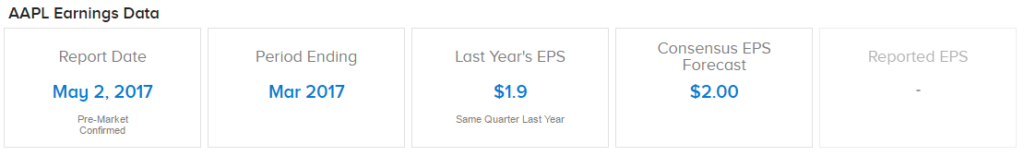

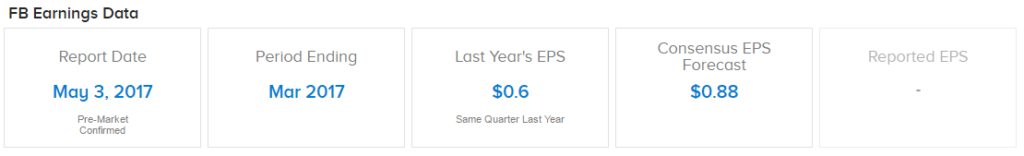

This is a big week for the market- as the earnings calendar shows, Apple (AAPL) releases its fiscal Q2 earnings report on May 2, followed by social media giant Facebook’s (FB) Q1 results on May 3.

Ahead of these all-important dates, we wanted to dive in and see what top analysts are predicting for these two tech giants:

Apple – all about the super cycle

Potential iPhone8 design

Consensus estimates for the stock come in at $2 EPS on revenue of $53 billion, with Needham’s Laura Martin forecasting iPhone unit sales of 53.35 million. But it’s not the numbers that have the market buzzing; it’s the earnings conference call Q&A. Investors want to know more about the upcoming iPhone x’s radical redesign (dubbed the iPhone 8) as well as recent rumors suggesting that the iPhone 8 will be delayed two months until October/ November due to complex hardware upgrades.

Indeed for five-star Piper Jaffray analyst Michael Olson, this quarter’s results may prove to be uneventful but ultimately “any unexpected ‘hiccups’ in results would likely be glossed over as investors focus on the upcoming iPhone launch.” He concludes: “We recommend owning AAPL due to the expectation for growing anticipation around iPhone 8 and a strong ongoing trajectory for services revenue.”

Olson reiterated his buy rating on the stock with a $155 price target (7.9% upside from the current share price of $143.65) on April 26. By clicking on the AAPL ticker on his TipRanks profile page, we can see that he has a very impressive AAPL track record of 100% success rate and 11.7% average return.

Top Credit Suisse analyst Kulbinder Garcha is even more confident in his forecast of a major iPhone 8 super cycle. His price target of $170-176 price target gives Apple a whopping value of close to $1 trillion. According to Garcha, “Over the course of the next year, we continue to believe that an iPhone 8 super cycle (starting with 3 models, one of which will be OLED [display]) should drive up replacement rates and drive new customers.”

Leave A Comment