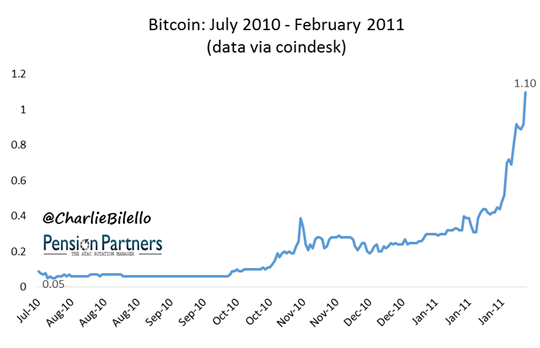

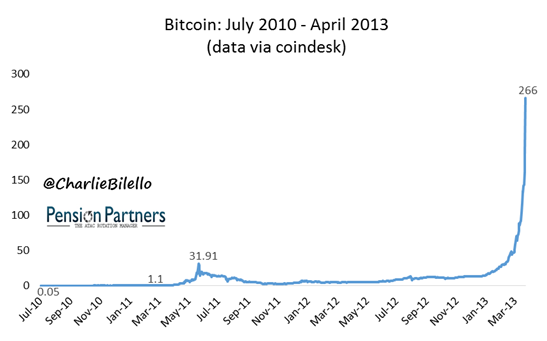

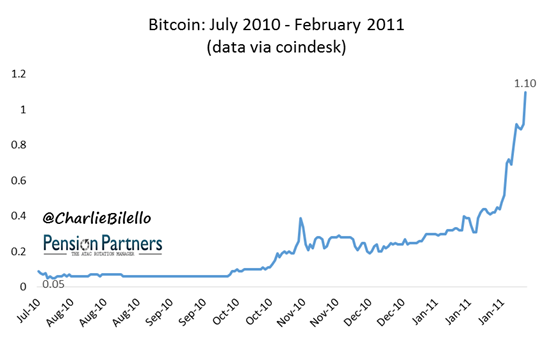

In July 2010, Bitcoin was trading at 5 cents. By February 2011 it was trading at $1.10. That’s a 2,100% return in 7 months. This is what the chart looked like at the time.

What’s the first word that comes to mind? Bubble.

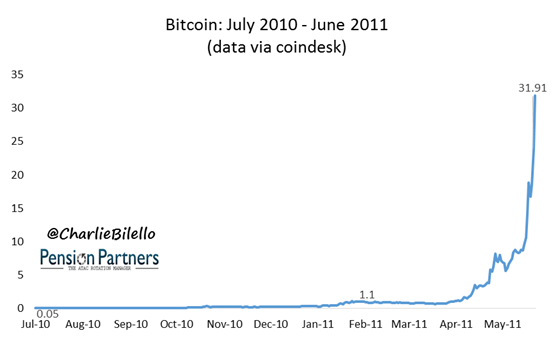

Indeed, and over the next two months that bubble would burst, as Bitcoin declined nearly 50% to a low of 56 cents. And then, this happened: Bitcoin came right back, advancing another 2,801% above its February 2011 peak to $31.91 by June 2011.

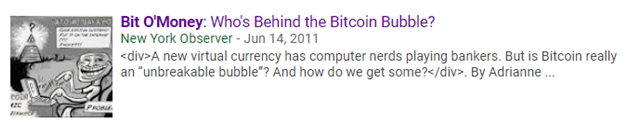

What does that chart look like to you? An even bigger bubble, and by this point the media was starting taking notice.

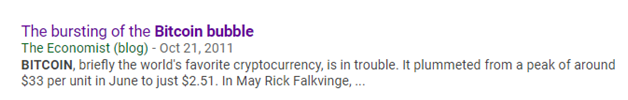

Bitcoin would crash 94% from its peak in June 2011 and the Economist did a postmortem: “the currency’s rise was the result of a speculative bubble.”

And then, this happened: Bitcoin recovered its 94% loss and advanced another 734% above its June 2011 peak to reach a new high of $266 in April 2013.

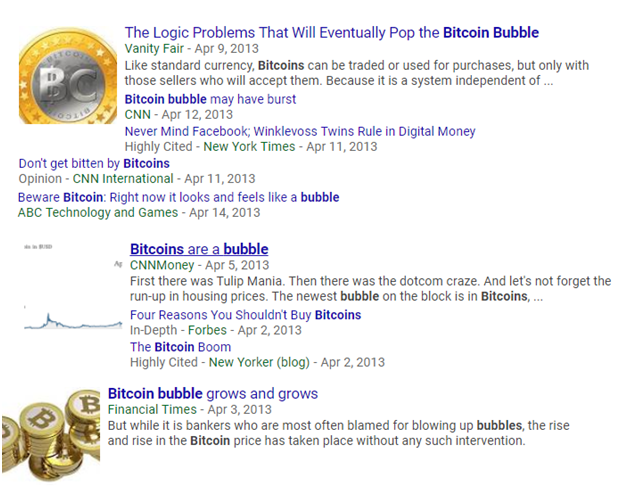

What does that chart look like to you? A colossal bubble, and by this point the mainstream media was having a field day pointing it out.

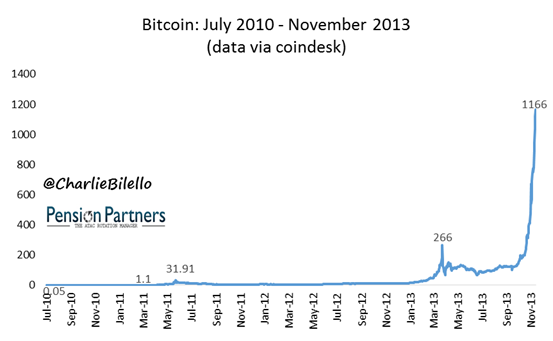

Bitcoin would crash 76% from its April 2011 peak to a low of $63 in July 2013. Here’s a headline at the time from The Atlantic:

The article goes on to explain the recent decline as the result of a “speculative bubble,” saying “it’s not clear why anybody would want Bitcoins.”

And then, of course, this happened: Bitcoin recovered its 76% loss and advanced another 734% above its April 2013 peak to reach a new high of $1,166 in November 2013.

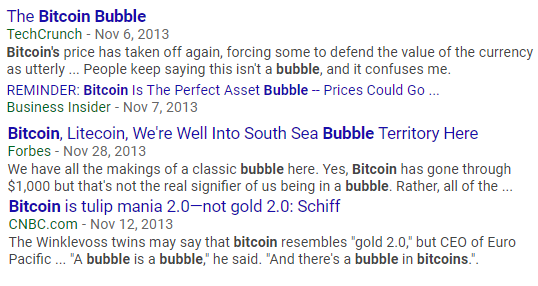

What does that chart look like? The biggest bubble in human history, and the media was all over it.

Bitcoin would crash 85% from that peak to a low of $170 in January 2015. The “bubble/Ponzi scheme” seemed to have burst once and for all.

Leave A Comment