In this time of great economic uncertainty, I am amazed at the indicators people look to for guidance on the future. When miners would take caged canaries down into the mine with them, these birds were a monitor of lethal gases building in the mines. The bird would die before any harm to the miners. They were “leading indicators” as we investors would say. In the coal mine we find ourselves in now, you hear little about leading indicators, however, and a constant babble about either coincident or lagging indicators. For instance, the mantra in market TV and press now is “wages are up” and “employment is OK.” But these are lagging indicators. It’s like taking a canary and an elephant down into the mine, carefully ignoring the canary and watching only the elephant as you are overcome with deadly gases. The miners (investors) will be dead by the time the elephant (everybody else) is overcome.

There is also a third type of indicator – Fed guidance. In 2007, Ben Bernanke told us we are not entering a recession and the housing market was just fine. The Fed is persistently a badly lagging indicator (to put it politely). Yet, all we hear and see is a steady drumbeat of wages, employment, consumer confidence, and Fed speak. We are all staring at the elephant in the coal mine – unless you search out the leading stuff.

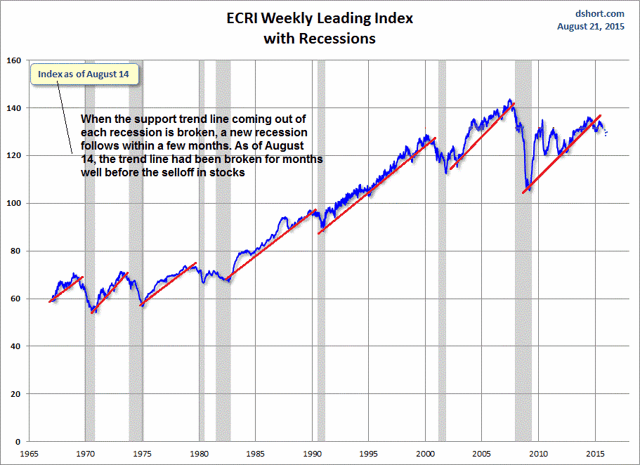

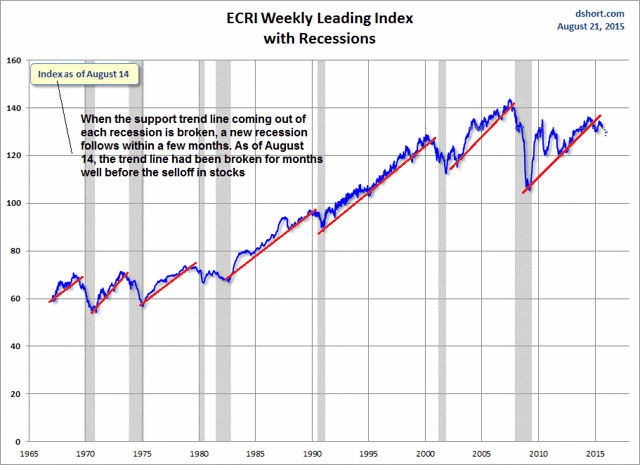

What should we be looking at? Well, there are a slew of leading economic indicators tabulated by the ECRI, and they are showing a downturn as they always do before recessions:

Here we see that this canary has been dead for quite a while. I’ve added the continued downturn of the data since this August 14 chart with blue dots. All you heard on CNBC on August 14 was wages, employment, and when the Fed was going to rein in the booming economy with rate hikes. I don’t think I saw this chart on CNBC back in mid-August, or ever for that matter.

As good as this ECRI chart is, I actually like keeping an eye on certain lead groups in the stock market as my canaries. There has been a train of lead and follow groups with a caboose, cars, and, and an engine pulling us into the mess we are approaching. Let’s first take a look at the caboose, the RLX index of large retailers, a reflection of the American consumer:

Leave A Comment