In his inimitable manner, Abraham Gulowitz unleashes 18 new pages of “all the charts you can eat” to expose the ugly reality of what is going on everywhere.

Trust Busters…

Market participants had penciled in stronger economies for 2016 and even a series of rate hikes by the Fed. Feeble world growth signals, the fallout from crashing oil and a weaker China plus tumultuous markets have combined to seriously dent expectations and encourage a serious reassessment of economic and financial prospects. Global equity prices have slumped by double digits so far this year and risk aversion has spread rapidly through the credit markets.

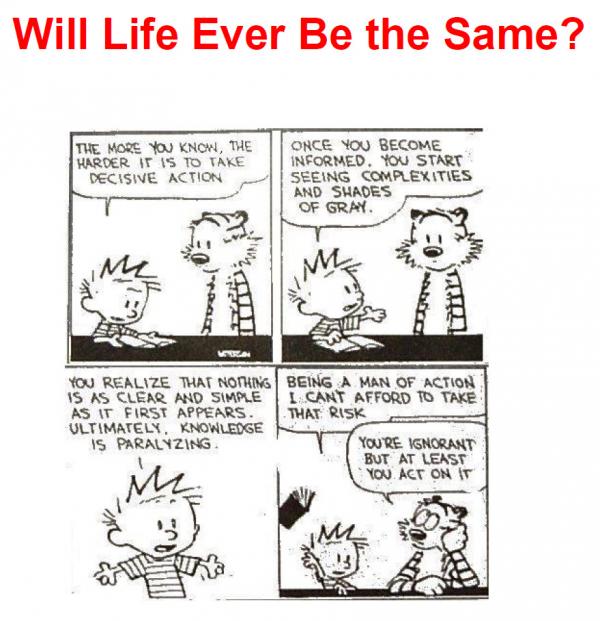

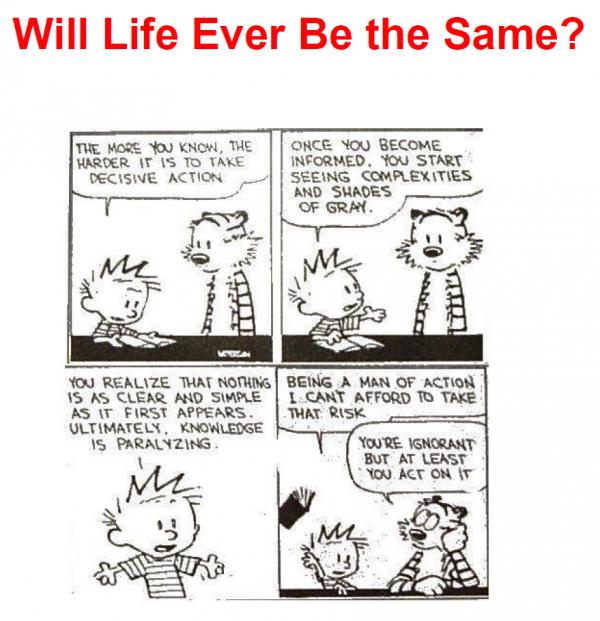

Reliable indicators of previous recessions have started to flash danger signals. We highlight several of these stats in this issue, and though specific explanations can be found to excuse each of these data readings, the abundance of warning indications cannot be dismissed. Both corporations and central bankers have queued up to warn about increased downside risks to the business and financial outlook, while at the same time seeking to reassure that renewed downturns are still likely to be avoided. But the risks have already increased that financial market conditions may yet feed through to the real business economy.

The greatest disappointment has to be the meager results emanating out of the massive and unprecedented easing around the globe. There is now little confidence in even the drastic measures that have been undertaken by central banks.

The experiments with negative interest rates conducted by a number of central banks trying to ward off deflation – – Switzerland, the eurozone and Denmark among them – – and now Japan, have yet to provide definitive conclusions. It does demonstrate, however, that too many economies are still struggling to grab onto sustainable growth paths with positive pricing power.

Engines of Growth are Sputtering…

Intense and confusing stress signals emanating from around the globe but particularly from China, the commodity markets, high yield and key emerging markets have confounded investors and contributed to intermittent bouts of severe volatility. Despite extensive and massive easing, most of the global economy still faces woefully inadequate growth prospects and difficult policy options.

The U.S. stands alone in the shift in monetary policy and the improvement in job markets.

Very obvious financial vulnerabilities and serious geopolitical concerns are aggravating the uncertainty. And let’s not forget that many of the challenges are not fleeting, and many cannot be resolved easily or quickly…

Leave A Comment