Do you hear the military march? The world’s largest economies are flexing their muscles and preparing for war. Will gold win the trade conflict between the United States and China?

So It Begins

Trade war. This topic dominated the recent days. Last week, President Trump announced plans for tariffs on about $60 billion of Chinese imports. In response, Liu He, China’s vice-prime minister, told Steven Mnuchin, U.S. Treasury Secretary, that China is ready to defend its interests. Indeed, on Friday the country announced plans to impose tariffs on about $3 billion of U.S. imports. So are we at war?

Markets Believe So

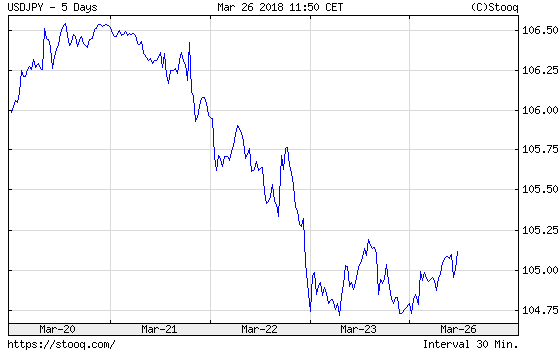

Investors worry that we are. As one can see in the chart below, the U.S. dollar plunged against the Japanese yen to the lowest level in 16 months.

Chart 1: USD/JPY exchange rate over the last five days.

The trade dispute has also shaken the stock markets. The S&P 500 Index fell like a stone at the end of last week, as the chart below shows. As investors turned on the “risk off” mode, they escaped into safe assets, such as the Japanese yen – and gold. The price of the yellow metal hit a 5-week high on Friday, almost reaching $1,350.

Chart 2: Gold prices (yellow line, left axis, London P.M. Fix, in $) and the S&P 500 Index (green line, right axis) in 2018.

But Are We Really at War?

The narrative about a trade war and the end of the liberal world order is really scary. No wonder that the media like it so much. There is something in it, that’s for sure. But let’s step back and take a look at cold facts.

First, Trump has signed a memorandum so far. It opened a 30-day consultation period to discuss tariffs and gave the Treasury Department 60 days to develop investment restrictions to prevent Chinese companies from purchasing U.S. companies with sensitive technologies. During that waiting period, Trump’s proposal may be watered down. The upcoming days may also create space for negotiations – investors shouldn’t forget that Trump is a great negotiator and some of his craziest initiatives may be just a way to increase his leverage in negotiations. The bluster is often more impressive than the following action.

Leave A Comment