One of the uses of the most bullish and bearish stock lists is to gauge the health of a rally. What I like to see is a lot of leading stocks in the bullish list that matches the length of the run. We’ve had a rally that lasted three weeks and is now taking a bit of a breather so let’s see what the three week lists tell us.

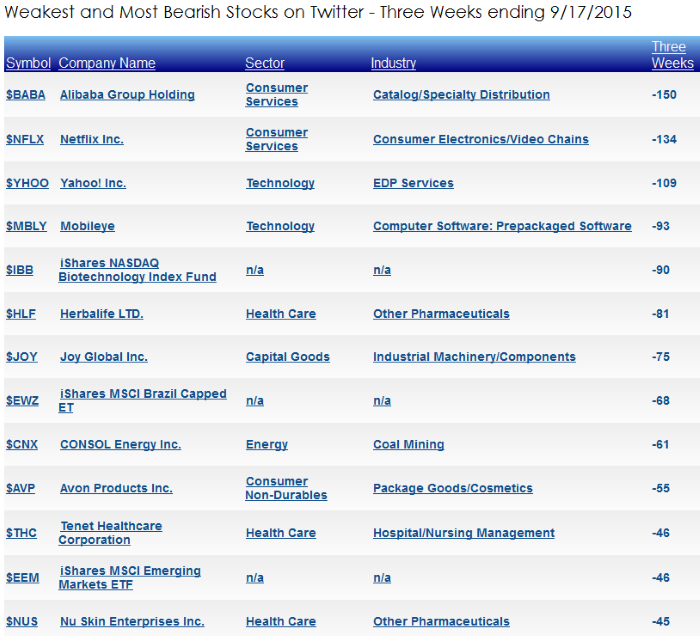

First let’s look at the most bearish list. Alibaba (BABA), Netflix (NFLX), Yahoo (YHOO), Mobileye (MBLY), Biotech (IBB) lead the list of bearish stocks during a three week rally. If the current rally is the resumption of the uptrend I wouldn’t expect to see so many popular stocks leading the list. Nor would I want to see FedEx (FDX) on the bearish list.

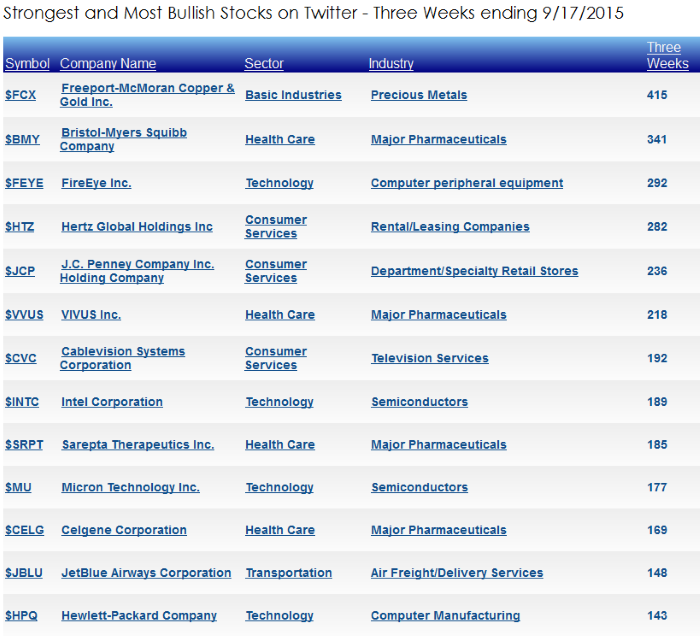

Looking at the bullish list doesn’t motivate me much. Do you see a large number of stocks that excite you? Is this the list of stocks you want to rely on to lead the market higher? Where is Google (GOOGL), Nike (NKE), Goldman Sachs (GS), Facebook (FB), Salesforce (CRM), Netflix (NFLX), Cisco (CSCO), Skyworks (SWKS)? The only hope I see is some of the pharma stocks have a biotech component. With the list littered with beaten down stocks like Freeport MacMoRan (FCX), Intel (INTC), and Alcoa (AA) this looks more like value buying which means there’s probably more work to be done on the downside before we get a sustained move higher.

Conclusion

A lot of leading stocks have been bearish during a three week rally. At the same time the bullish list is missing a lot of leaders. At the moment they don’t inspire confidence. Keep an eye on the one month bullish list (and shorter time frames too) going forward. What we want to see is the momentum stocks leading again. Until then I’d expect more weakness than strength.

Leave A Comment