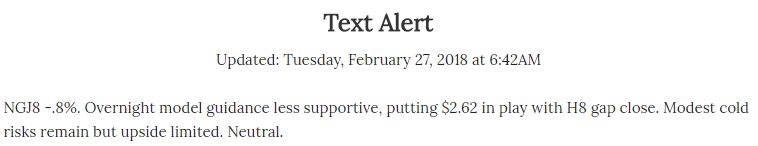

The April natural gas contract took over as the prompt month contract today, and despite early morning declines prices were able to bounce through the day and pulled back only slightly into the settle.

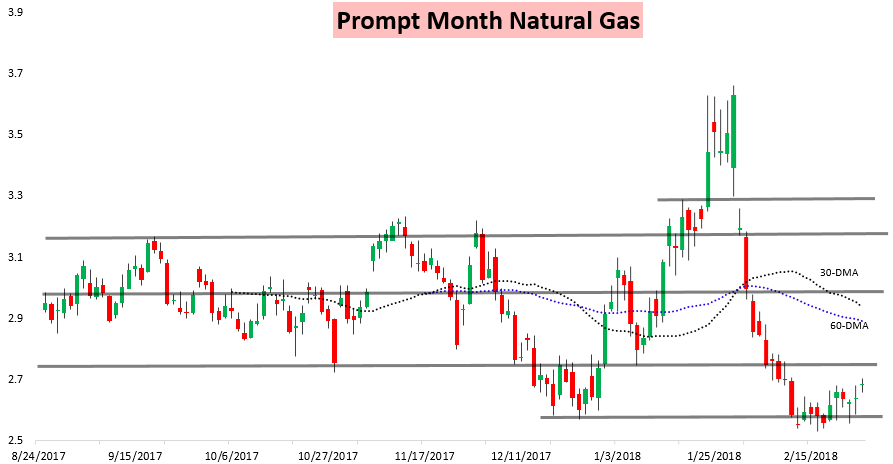

Prices initially bounced just above the $2.62 level we had been watching this morning.

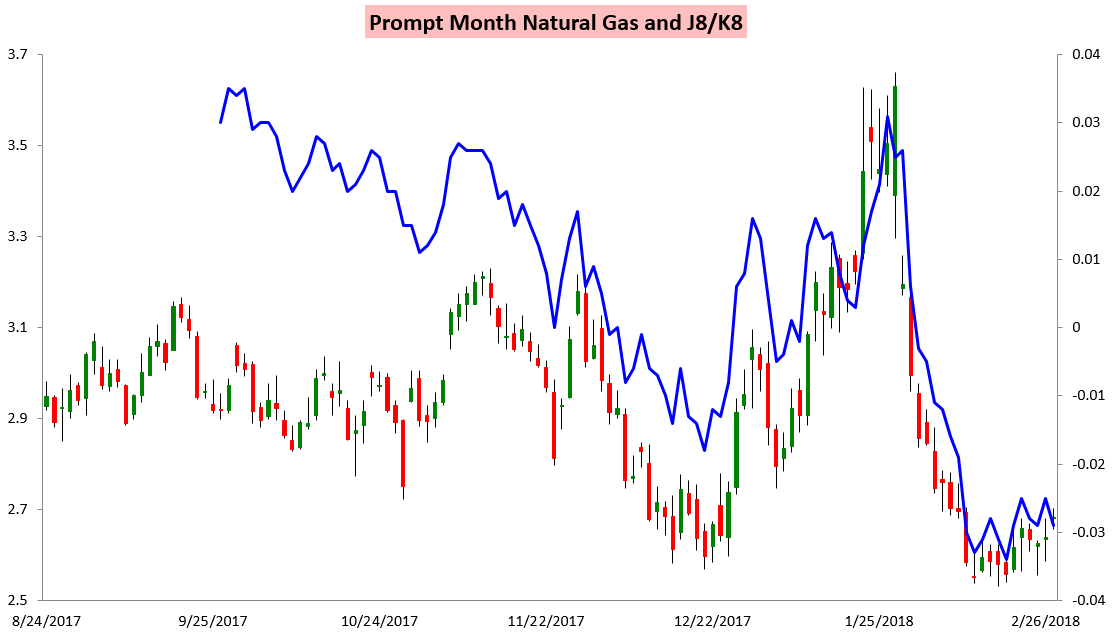

After that test, though, we saw a back-led rally mid-morning, with the prompt month April contract actually continuing to lag into the settle.

The result was a sizable tick lower in the J/K spread despite a firm prompt month.

In this morning’s Morning Update for clients we described this dynamic in advance. Weather was a bit less impressive today, leading J/K to tick in, yet we continued to see tightness in the natural gas market that kept our sentiment from turning bearish in the decline, and we just instead saw limited upside above the $2.7 level the April contract bounced off.

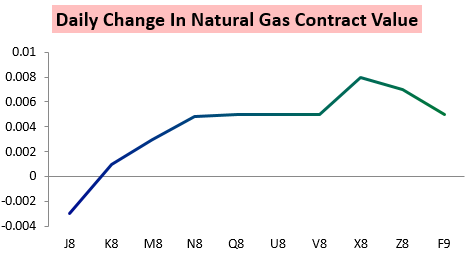

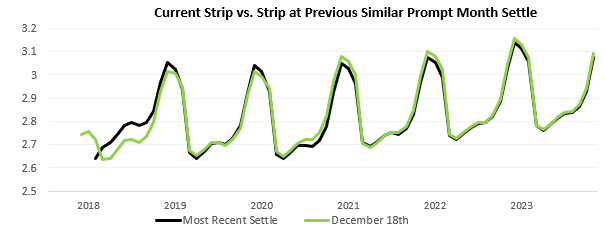

We also made note of it in our Seasonal Trader Report, where we looked at how the natural gas strip differed from the last time the April contract traded at similar levels back on December 18th.

This report provides both a 5-month GWDD forecast and seasonal forecast analysis, and combines that with our understanding of the natural gas strip and latest balance dynamics, allowing us to identify opportunities all along the strip. It also builds off of our Notes of the Day, like our Note from last Friday which alerted that we saw the tight balance continuing.

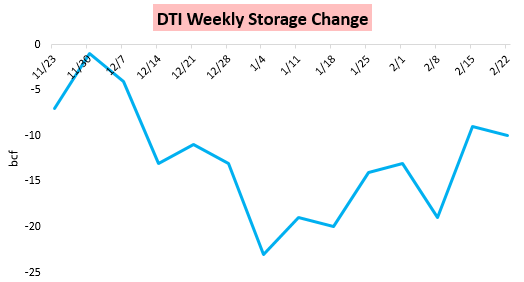

The focus on balance likely continues into tomorrow as well as traders position for Thursday’s EIA print. Already Dominion (DTI) has announced a modest-sized withdrawal of 10 bcf for the week ending February 22nd.

This has us expecting a modest withdrawal from the East Region, even though other regions may not see withdrawals that are all that large due to relatively widespread warmth.

Leave A Comment