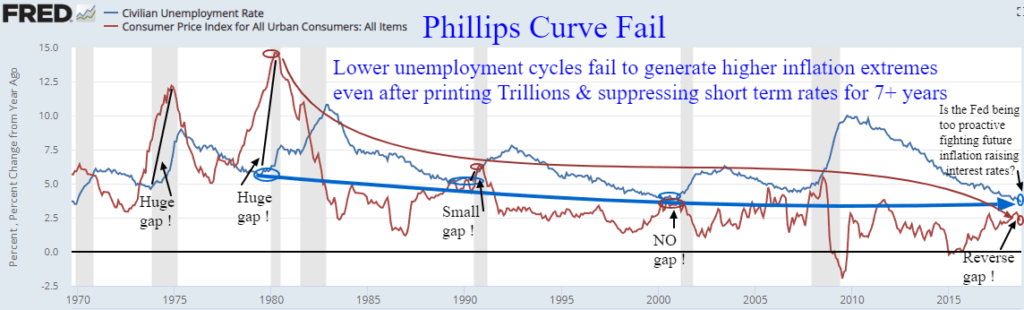

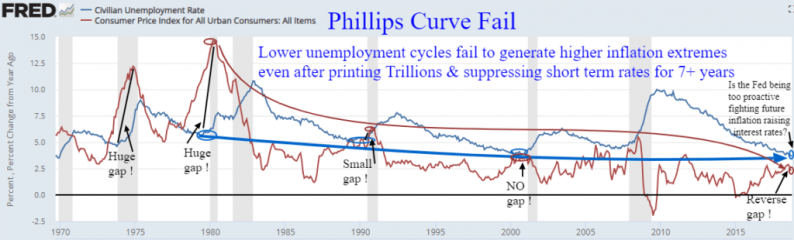

Our October report reviewed the limitations of the Phillips Curve in forecasting inflation as it relates to unemployment. Essentially economists interpretation of Phillips posit that lower unemployment equates to higher inflation. This view was created in the 1970’s post Gold/Currency Standard during the inflationary Baby Boom employment surge. Should the overall CPI rise above 4 to 5% or the venerable Core PCE inflation rate relied upon by the Fed rise above 2.5%, then the Fed can justify a faster pace of rate hikes in a quest for a neutral rate of interest called R* where GDP growth and inflation are in equilibrium.

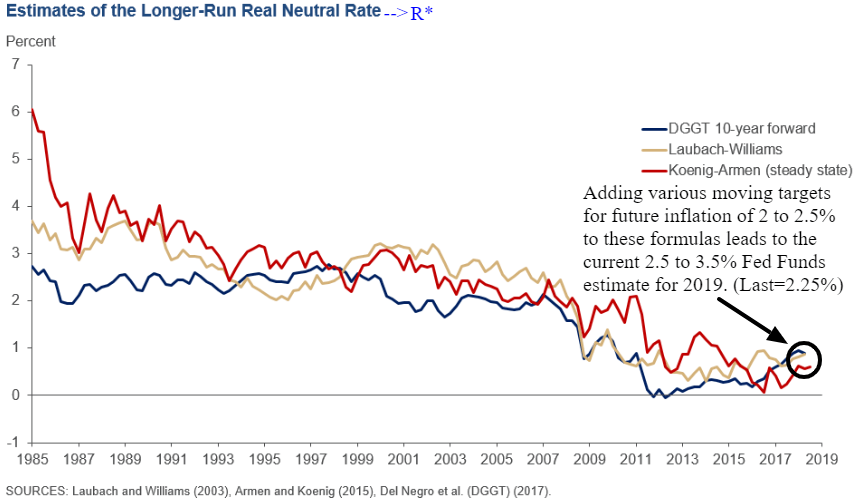

When the economy accelerates our central bankers at the Fed use the crutch of the Phillips Curve to make assumptions about inflation and a natural Fed Funds rate. Of course, there is nothing natural about it as it’s a construct from the economic tower of Babel. This natural or neutral rate known as R* (neutral interest Rate) was first promulgated by Swedish economist Wicksell of the Austrian School. R* is the magical neutral interest rate where GDP and inflation are stable. Calculating this neutral rate is a chimerical cosmic variance as certain as the perturbations of alternate universes. Leading economists use different metrics and hidden future assumptions in their R* forecasts. Federal Open Market Committee (FOMC) have submitted their targets for R* at between 2.5% and 3.5% in 2019. This is not a well-defined formula and Chair Powell’s hints that the upper end may be needed has cast a cloud over investors.

Non-consensus formulas for R* neutral interest rates and vague assumptions of future inflation provide plenty of latitude to pursue higher rates for anterior motives. Current and former Fed Chairs Powell and Yellen have recently implied that various inflation measures are not that important when they are low, as long as the GDP is above trend and the job market is tight. The Fed controls short-term rates and kept it near zero for years while printing Trillions of dollars above trend without a hint of inflation. Now that we finally have signs of lifting all economic boats, the Fed has predetermined they will keep raising rates until they help induce signals of a recession. Raising rates and the cost of capital in a strong economy with major shortages of labor and material is understandable. Being inflexible enough to pause when those material prices are falling and inflation proxies are low is myopic.

Leave A Comment