The Federal Reserve in early 2012 altered longstanding monetary policy. In January that year, the FOMC had voted to make explicit what everyone already knew, that it considered 2% inflation to be the definition of “stable” consumer prices, casting off one of the last vestiges of 1980’s era regimes where central bankers felt silence was the best course. It had been for some time one of Ben Bernanke’s goals, in order to, as he claimed, make the Fed more transparent and aligned with the procedures of other central banks around the world.

In its statement announcing the change, the Fed claimed:

Communicating this inflation goal clearly to the public helps keep longer-term inflation expectations firmly anchored, thereby fostering price stability and moderate long-term interest rates and enhancing the committee’s ability to promote maximum employment in the face of significant economic disturbance.

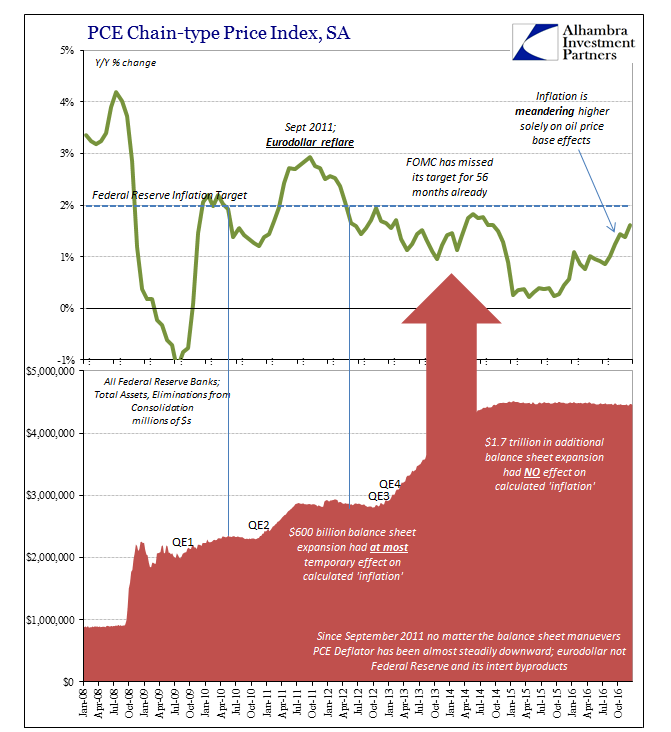

We cannot help but notice the irony of the timing, as the explicit 2% target lasted only three months more. The Fed still holds out 2% as its target, it’s just that inflation hasn’t been at that level at all (in terms of their preferred inflation index) in the almost five years since. The PCE Deflator remained less than 2% in December 2016, the 56th consecutive month where Federal Reserve monetary policy has failed to achieve its stated goal.

Inflation has been “better” of late, of course, from the perspective of monetary officials who despise actual stable prices. Modern monetary theory assumes it is far more preferable to have a little inflation than to risk having none; the latter condition, policymakers assume, leaves the economy no room for error, meaning the risk of deflation and depression too high. Empirical evidence over the last few years, nearly a decade now, shows clearly the fallacies in the argument.

The PCE Deflator was just 1.62% in December, even though oil prices were up between 40% and 50% last month. Oil prices are hot, the rest of the economy isn’t. The meandering of consumer prices indicates more purely the commodity difference rather than actual economic acceleration. The rest of the PCE report indicates just that, a clear lack of momentum.

Leave A Comment