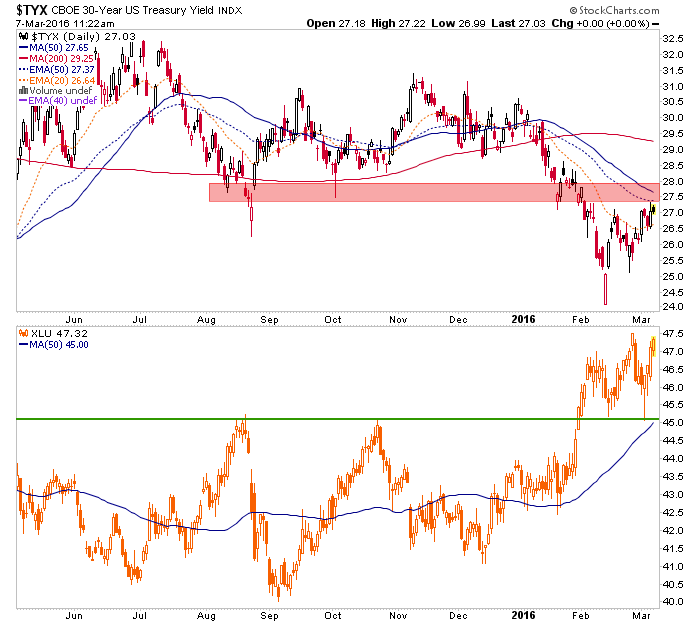

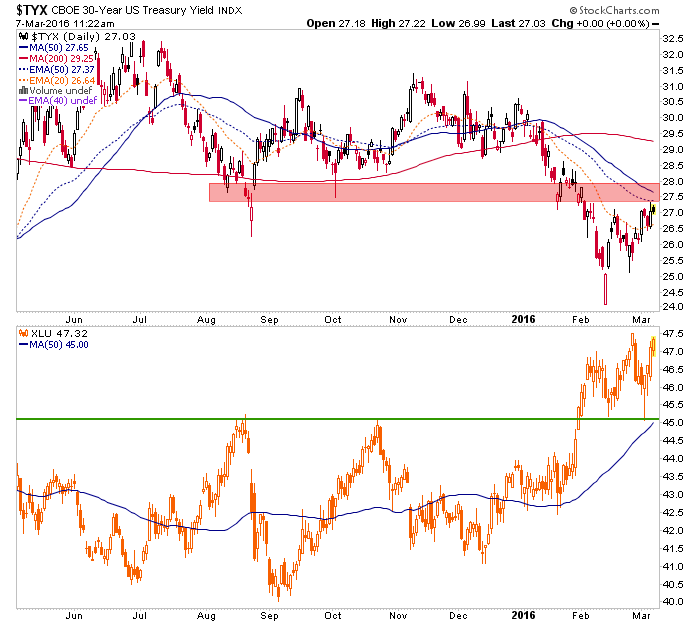

I own Thing 2 (XLU) from an NFTRH+ update, but took profit (and dividends) on its running mate, TLT. TLT is the ‘long bond’ iShares and it is roughly inverse to the 30 year yield, Thing 1 on the chart below. The point is that the Utes are not going to go up with the yield also rising forever because the Utes go with the bond itself, not the yield.

While the yield looks sneaky bullish short-term, if XLU is right then yields will soon top out and TLT or TIP (which I also profit took and dividend took) could be a good trade again.

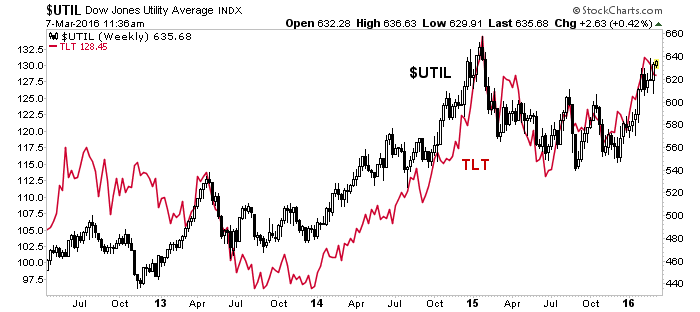

For reference, here is UTIL and TLT by a weekly view we use in NFTRH…

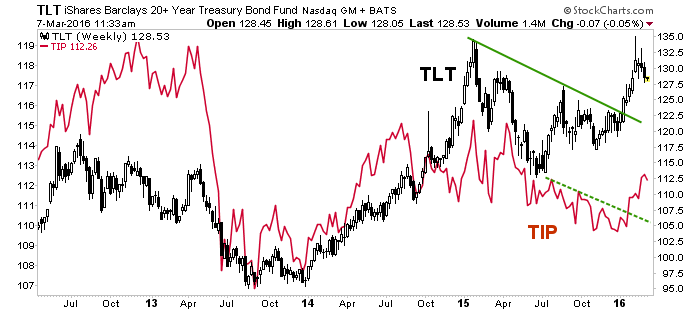

And here is TIP and TLT…

Leave A Comment