The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen. When Mohamed El-Erian wrote in what was I guess an oped in the Financial Times on Monday that bond investors were “distracted”, it was his subtle way of attacking them as wrong.

In that way, we are truly back to late 2013 and early 2014 all over again. But back then the Fed’s positivity side, thus bad for bonds, had a whole lot more going for it (even if it was in total still a thin catalog). Recovery at that point was at least plausible under the undetermined guidance of QE3 (and 4), whereas today not even Fed officials talk that way or even bring themselves to mention QE.

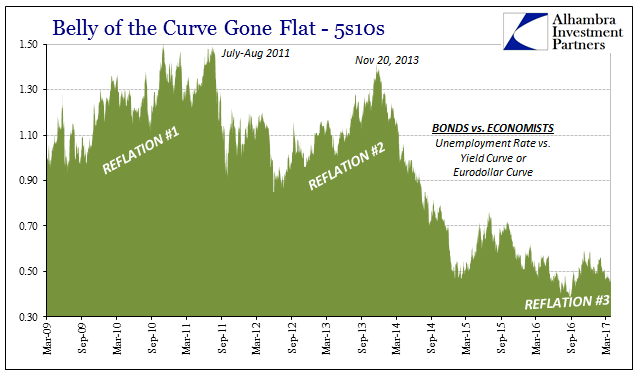

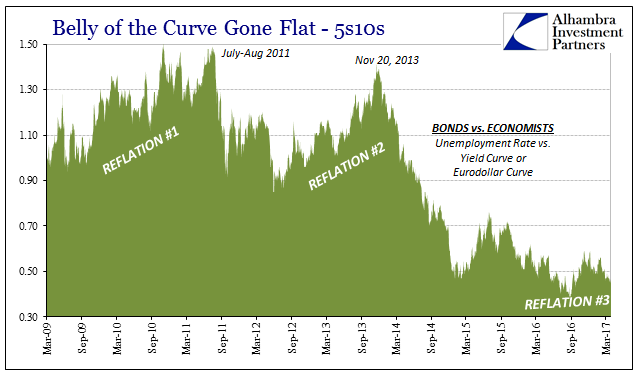

This isn’t to say that the bond market or eurodollar futures have everything right, far from it. As I argued earlier this week, these very markets were way off at several points and for several years. Treasuries as well as eurodollar futures were firmly within the camp of higher interest rates and monetary policy support until 2011. In other words, bond investors then were wrong, and even though it took several years to fully appreciate the implications of the con job that was QE, the bond market and eurodollar futures curve have been far more right than wrong since then (the noted exception being late 2013).

On its own, that doesn’t mean bond investors are now infallible and that treasury yields and the eurodollar curve together make up the definitive guide to the universe. Everything is about probabilities and really a spectrum of them, which means in simple terms the bond market deserves the benefit of the doubt where clearly economists and policymakers do not. Therefore, if there is a disagreement all over again between bonds and economists, particularly in similar fashion to 2014 and 2015, it does not make much sense to follow the latter particularly as interpretations on that side continue to rely upon the so far unreliable unemployment rate view of the economy.

Leave A Comment