In running through dividends by the numbers for March 2018, we found that a total of 92 U.S. firms declared that they would cut their dividends, the second highest figure ever reported for monthly data that goes back to January 2004, a period that encompasses the worst of both the Great Recession and the tax hike-motivated Great Dividend Raid.

Unfortunately, Standard & Poor’s market attributes DIVSTAT report, the source for that figure, doesn’t provide any detailed information on which U.S. firms cut their dividends.

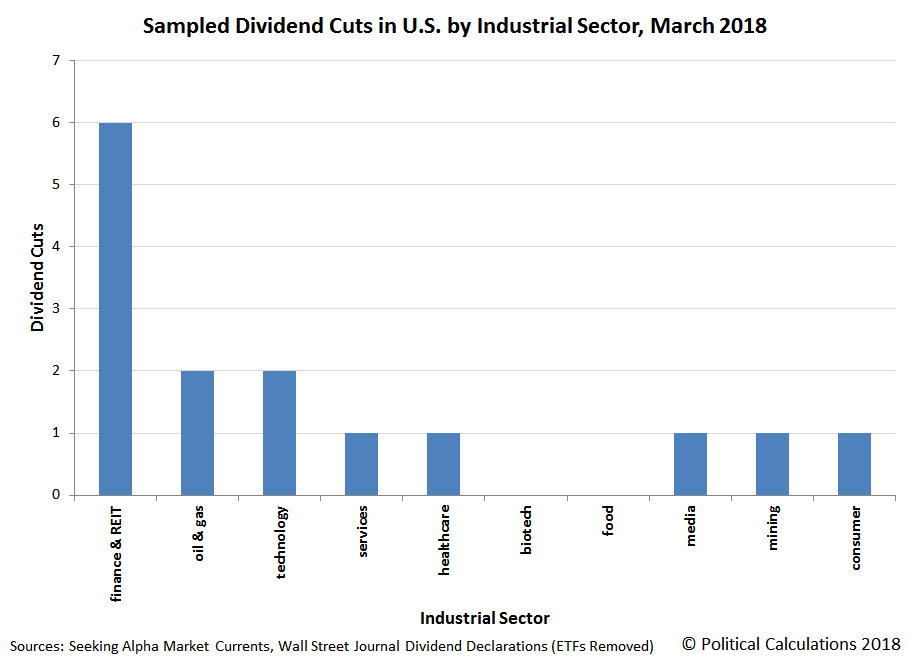

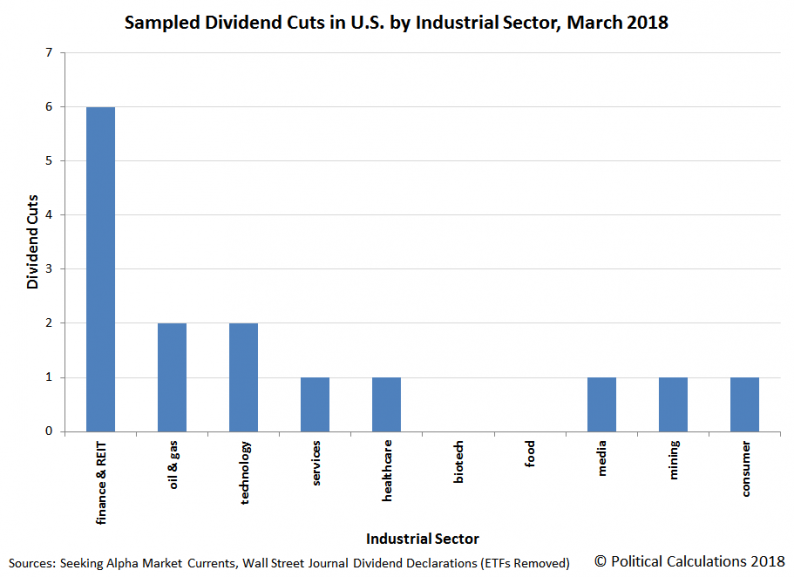

So to find out, we tapped our two near-real time sources for dividend cut declarations. The following chart reveals what we found:

In all, we were able to identify 15 U.S. firms that announced that they would be cutting their dividends in March 2018. Of these, 6 were financial industry firms or Real Estate Investment Trusts (REITs), where the U.S. Federal Reserve’s recent series of rate hikes has cut into their earnings, two were in the oil and gas industries, another two were technology-related firms, while we found one firm each in the services, health care, media, mining and consumer goods producing sectors. [In the chart above, we’ve also identified the biotech and the food industries, which were represented in 2018-Q1’s dividend cuts, but which had zero dividend cuts reported in March 2018.]

Those figures exclude Exchange Traded Funds (ETFs), which we omit because these funds often include holdings in companies that issue stock that announce their dividend policies independently, where including them would represent double counting. They also exclude foreign firms whose stocks trade on U.S. stock exchanges, preferred stock, and closed end funds. However, we find that adding all these other types of dividend-paying entities to our sampled total increases the total reported dividend cuts from all entities by 24, for an expanded total of 39 dividend cutting firms. At a minimum then, we’re still missing at least 53 U.S. dividend cutting firms.

Leave A Comment