The U.S. may not be in an official technical recession yet (and it won’t be until the NBER retroactively opines at some point in the next few years) but what about a half-recession? After all, nobody debates any more that the U.S. manufacturing sector is now contracting and it is only the services sector which is, at best, still growing (just ignore the last few Service ISM and PMI reports confirming that the manufacturing recession is rapidly spilling over).

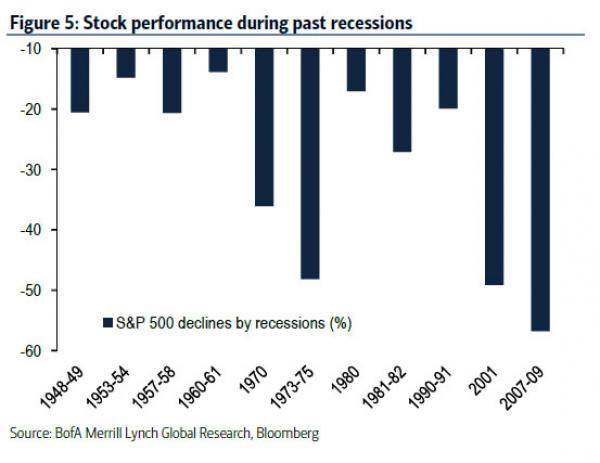

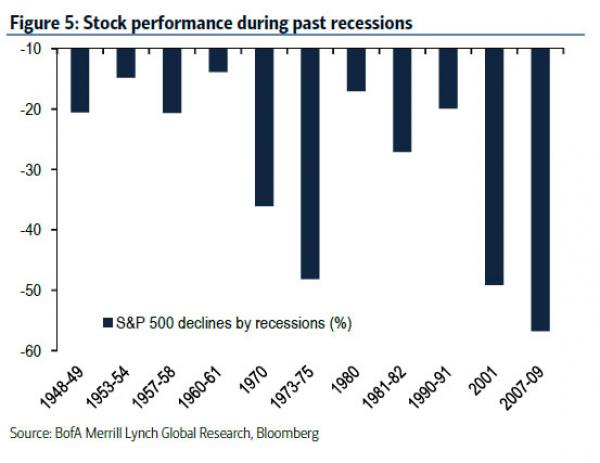

Well, according to stocks, a half-recession is precisely where the US was as of roughly noon yesterday, when the S&P touched an intraday low of 1812. This represents a 15% drop from the all time high close of 2,131 last summer. It also represents half the post-World War II average peak to trough decline around recession, which amounts to roughly 30% as shown in the chart below.

So, according to stocks, the US is already “half-pregnant” with a recession; in fact all that would take is another 15% drop in the S&P for the market to suffer the average decline observed during the past 11 US recessions.

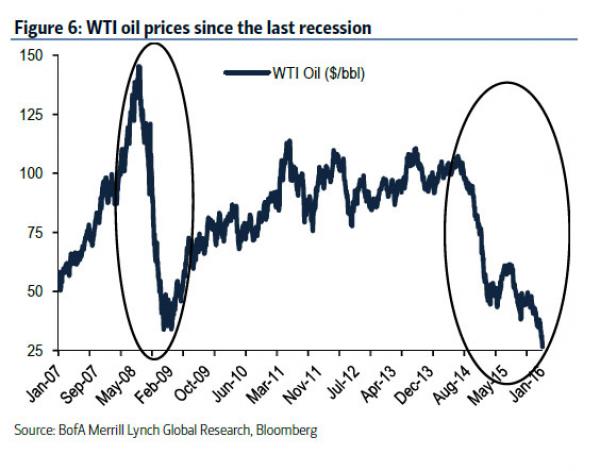

One place where there is no doubt about the state, if not so much of the US, then certainly of the global economy, is oil. According to Bank of America, at yesterday’s intra-day low of $26.19 crude oil had declined 76% since the peak in the summer of 2014. That drop nearly matches the 77% peak-trough decline during the financial crisis in 2008, which for all intents and purposes was a global depression, swept under the rug only thanks to two things: i) the Fed’s dramatic emergency response, ZIRP and QE, and ii) China’s historic releveraging crusade, which has seen its total debt quadruple and is currently at 300% of GDP. Don’t expect either the Fed or China to be able to unleash any remotely comparable response the next time there is a “Lehman-like” event.

So where are we now? Well, according to securities markets, anywhere between a US half-recession and a full-blown global depression. And while the markets’ discounting ability has been severely compromised after 7 years of central planning, we can’t help but wonder just what happens to the global economy when whatever it is that oil, and now stocks, are seeing is finally unleashed outside of comfortable confines of capital markets.

Leave A Comment