Watching stock prices drop quickly can be terrifying. In late January, every big decline in stock prices was greeted with lots of media coverage, cable news networks rolling out their “market in turmoil” graphics, and an army of perma-bears promoting their forecasting abilities.

The internal angst we feel as markets decline could also be a result of experiencing large declines in the dollar value of our portfolios. “Jake” from the economicpic blog has a great post about how the recent stock market decline could have been the largest portfolio dollar decline many investors have experienced.

Because of the terrifying nature of market declines, one of the valuable services an adviser should provide is help in selecting an asset allocation that suits their client’s investment objective and risk preferences. This process starts by understanding two aspects of risk – Risk Tolerance and Risk Capacity. Michael Kitces has a great article discussing those aspects and how they should interact in selecting an appropriate asset allocation.

I want to dig a little deeper into Risk Capacity to show that investors shouldn’t be too afraid of a quick stock market decline.

Life Cycle of Capital

The first step in understanding how much an investor might be affected by a stock market decline is to understand who might be most at risk.

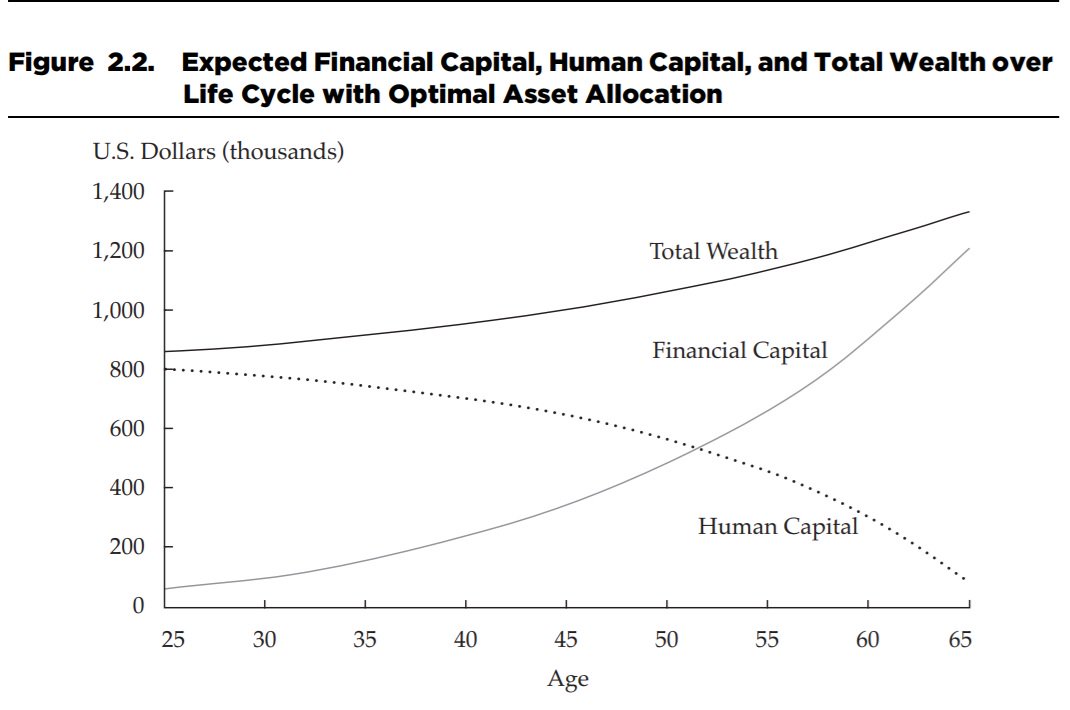

A young investor with not much in retirement savings could be just as wealthy as an investor with a large retirement account at the end of their working career. To help understand why, study the following chart from the CFA Institute, Lifetime of Financial Advice: Human Capital, Asset Allocation, and Insurance:

The graph above shows that at a young age an investor’s wealth is largely made-up of the present value of future savings (Human Capital) and typically not much in retirement savings (Financial Capital). As the investor ages their Human Capital is converted to Financial Capital through ongoing savings and investing.

Leave A Comment