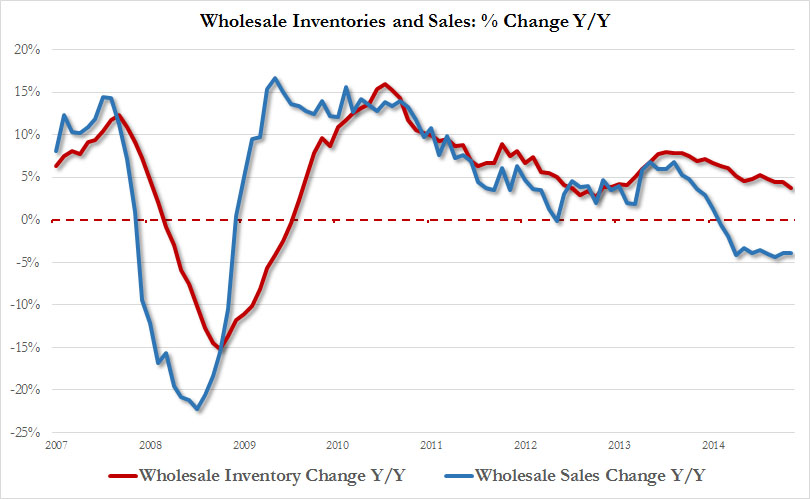

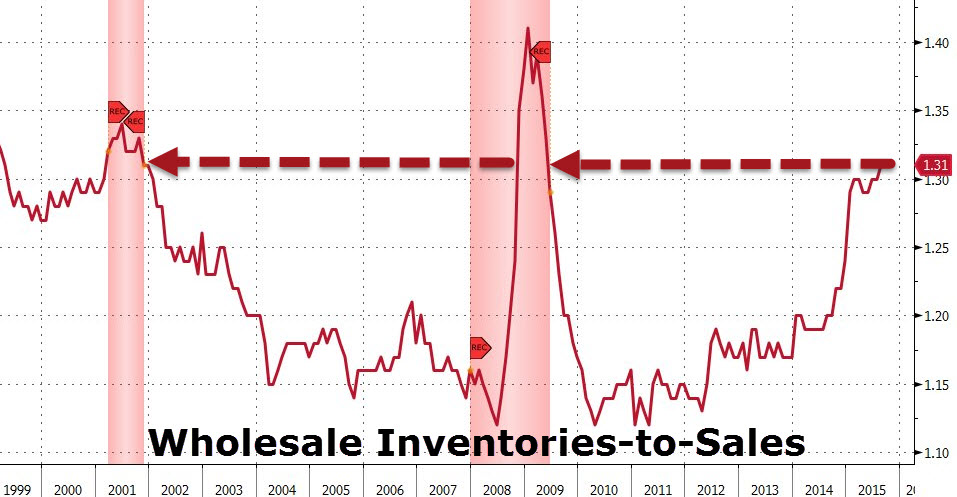

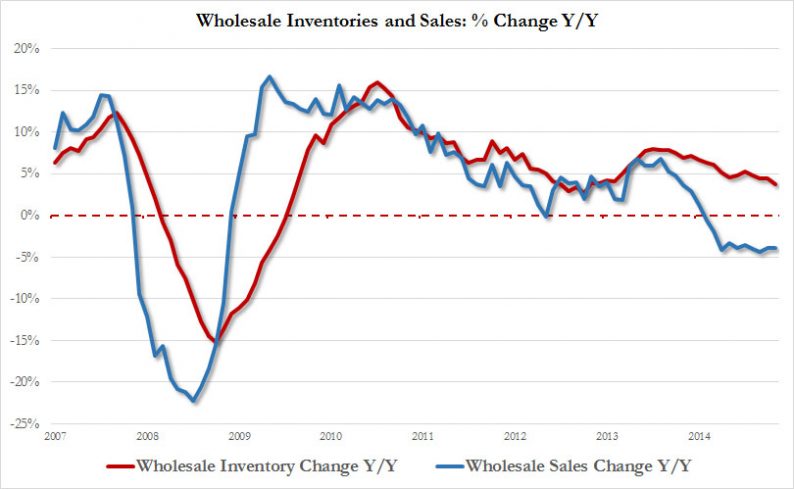

Q4 GDP expectations are off to a bad start as October wholesale inventories dropped 0.1%(missing expectations of a 0.2% rise and well down from the September surge of 0.5%). Wholesale inventories rose only 3.7% YoY, the lowest since Sept 2013 but sales have now been negative YoY since December. This leaves the crucial inventories-to-sales ratio at 1.31 – post-crisis highs, and deep in recession territory.

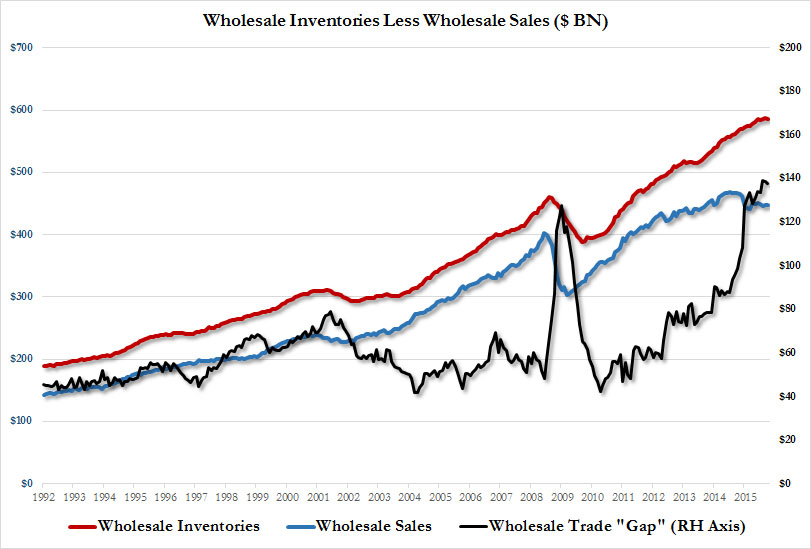

Leaving the absolute level of inventories over sales just shy of all-time record highs..

and the inventories to sales ratio at cycle highs…

Time for a Fed rate-hike!?

Charts: Bloomberg

Leave A Comment