The FANG stocks have been taking quite a beating in recent weeks. So much so that just a handful of stocks are responsible for causing significant drops in major market indices.

What are the FANG stocks? That’s an acronym that traders uses as shorthand to specifically describe the following firms that, until 2018, had handsomely rewarded investors in recent years.

But a looser version of that acronym also ropes in some other big tech firms, including Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA), which have also been sucked into the “Tech Wreck” of 2018.

So why is such a small group of stocks having such a large effect on the world’s stock markets?

In a nutshell, the rapid growth of these firms in recent years has swelled their market capitalizations, where investors have bid up their stock prices as they’ve bought millions of their shares.

Meanwhile, the major stock market indices, like the S&P 500 and the Nasdaq 100, are made up of individual component stocks whose weighting within the indices are set according to their market capitalization.

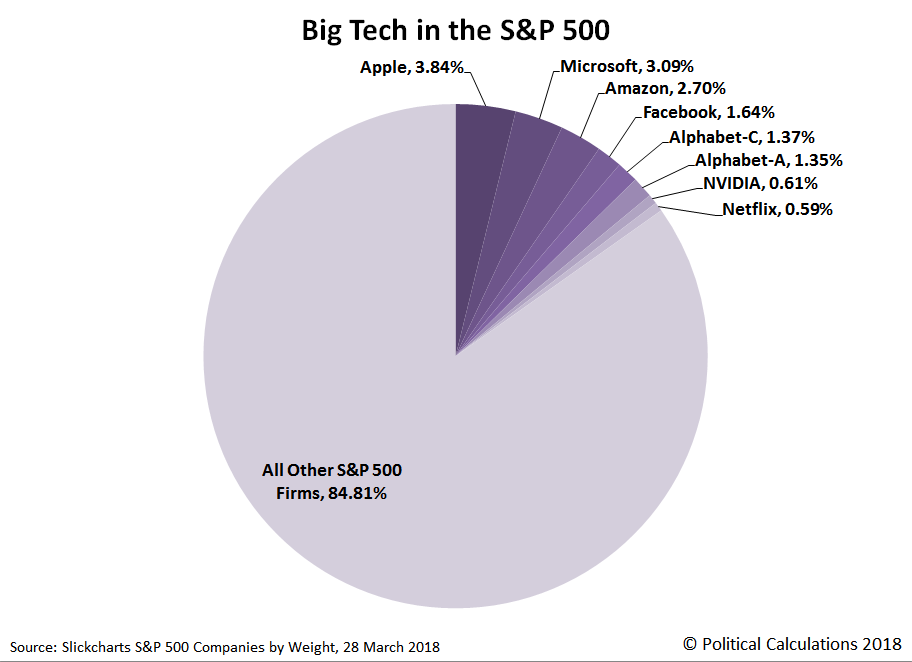

Consequently, as the market capitalizations of Big Tech stocks have grown, they have also grown to account for a much larger share of the value of these stock market indices. The following chart shows what that means for the S&P 500 (Index: INX):

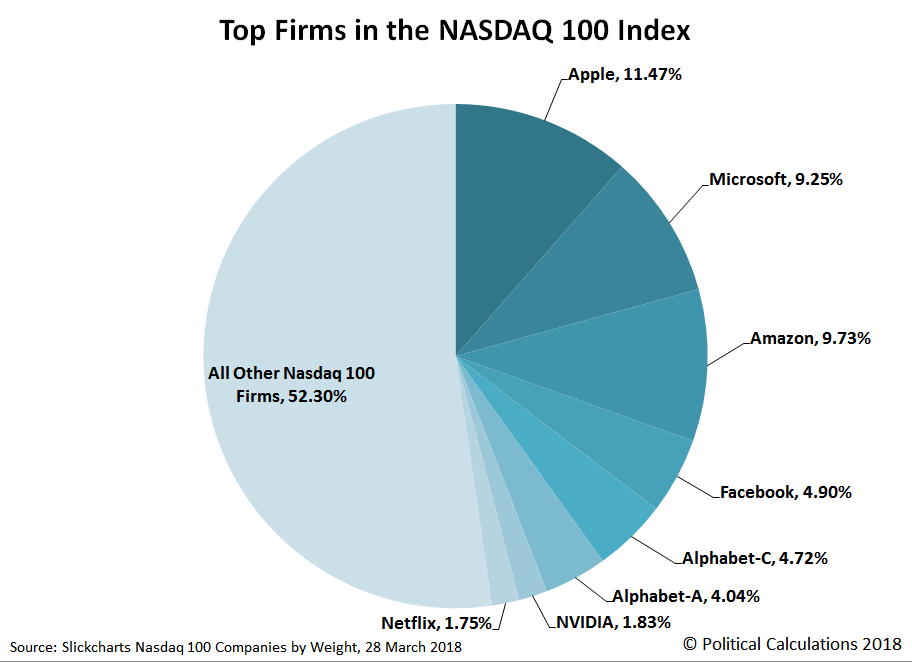

Together, the eight stocks that we’ve listed above account for over 15% of the entire value of the S&P 500 stock market index as of 28 March 2018. They hold a much larger share however of the Nasdaq 100 (Index: IXIC), which unlike the more diversified S&P 500, is predominantly composed of firms in the technology sector:

At nearly 48% of the Nasdaq 100’s value, even small changes in the share prices of these eight stocks can have a large impact on the value of the index. And that, for investors, is why bad news for Big Tech is bad for stocks, and why investors need to consider alternatives to holding large quantities of these companies’ stocks in their investment portfolios.

Leave A Comment