Written by Brad Parkes

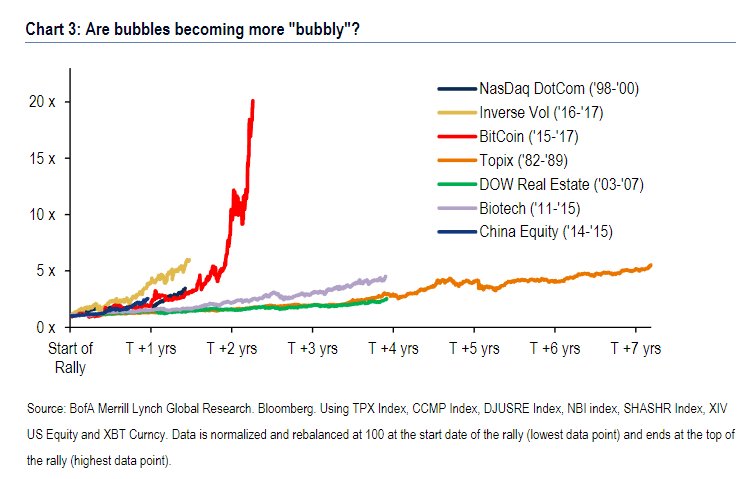

Let me walk you through my Bitcoin crash logic. I promise it has nothing to do with this chart.

Please share this article – Go to very top of page, right hand side, for social media buttons.

Nor does it have anything to do with a MMA fighter demanding payment in Bitcoin (remember Giselle with Euros or Bette Midler with Dotcom shares? sorry cannot find a link to the Midler demand).

Nor does it have to do with serial bubble identifier Robert Shiller announcing BTC is a bubble.

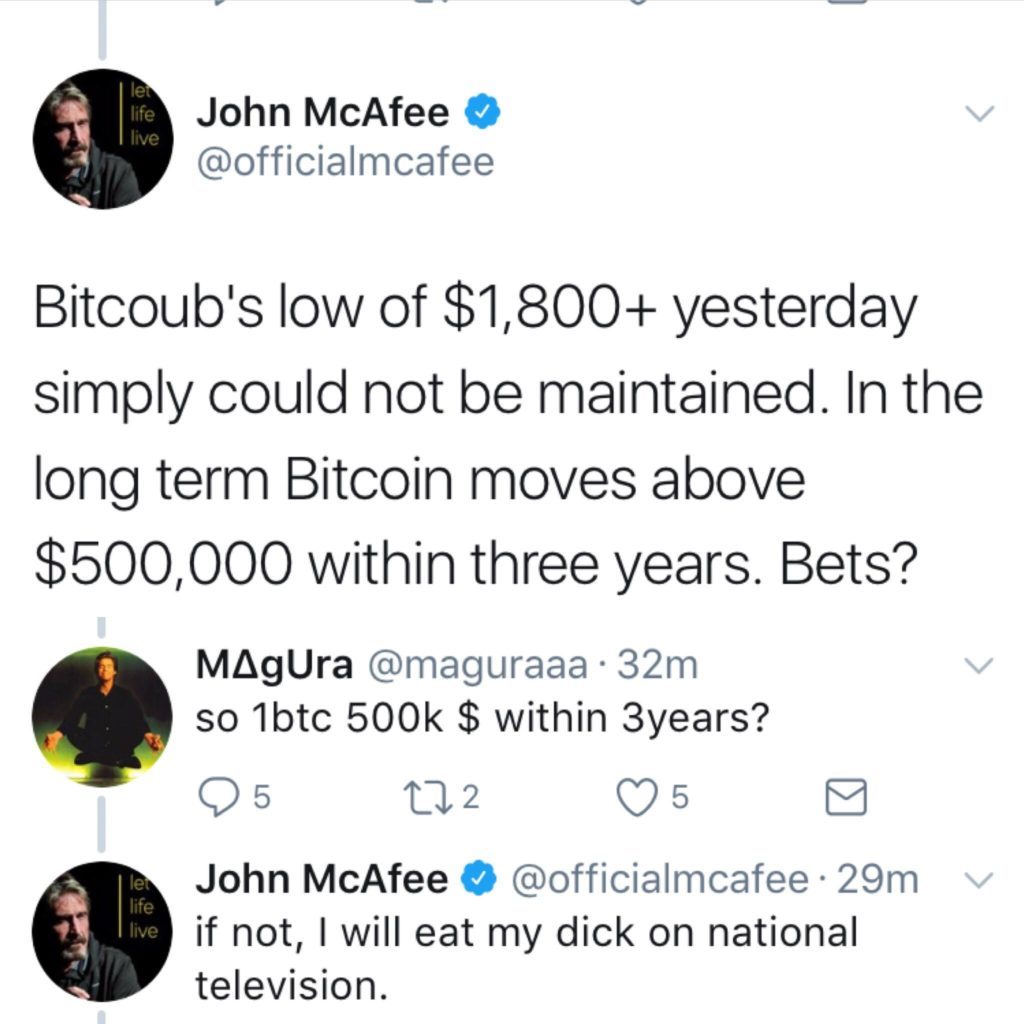

Nor does it have anything to do with crazy predictions:

It has to do with physics. Hear me out.

Proof

How is a new unit of Bitcoin (BTC) created?

It is mined.

How do you mine?

You use electricity.

Electricity has a cost of $X/unit and the BTC sells for $Y/unit.

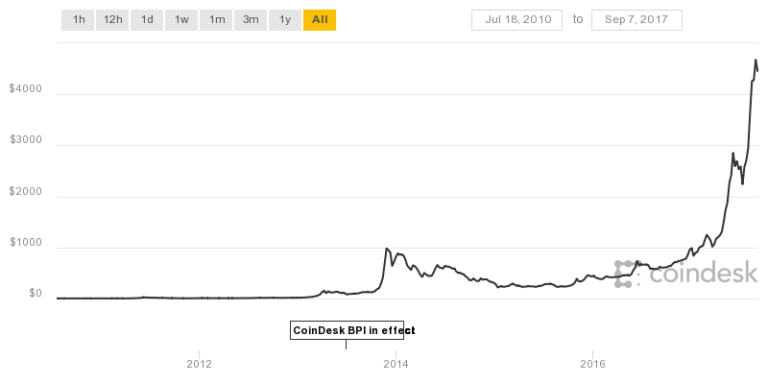

Y has been increasing relentlessly (see below chart).

This means that $Y/unit>>>$X/unit and $Y/unit continues to increase faster than $X/unit.

This means you can convert energy into a good that buys an increasing amount of energy.

So…

If you create more Y, you can buy more and more X with each new unit of Y.

This violates the conservation of energy.

Energy is being turned into an item that allows you to buy more energy which can be turned into a good that buys even more energy. This is perpetual motion.

Marginal cost of Mining

According to this article:

“Let’s try the low end, with 0.1 watts per Gh/s, which we might assume a top-of-the-line ASIC mining units burns. The entire Bitcoin network would then consume 835.4 kilowatts, or 7.31 gigawatt-hours per year. That is the same yearly consumption as 674.5 average American homes.”

There are 1,000,000 kilowatts per gigawatt.

According to the EIA the average cost of a kilowatt-hour in the United States is 13.22 cents.

And this site says there are 16.366 million Bitcoins in existence.

Leave A Comment