Business Investment “depends on the prospective yield of capital, and not merely on its current yield” – John Maynard Keynes

One of the many puzzles of the recovery since the 2008 crisis has been the corporate sector’s reluctance to add to a nation’s capital stock. Investment in new plant and equipment along with the construction of new productive facilities has lagged behind the experience of previous recoveries. Throughout the industrialized world, the rate of growth in fixed capital investment has been dismissal, resulting in below average rates of growth in national income. Hence, the general malaise we experience today.

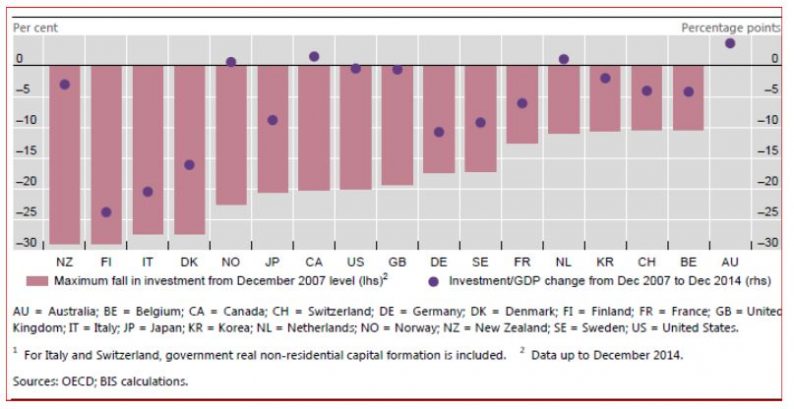

The accompanying Chart 1 measures the maximum fall in investment activity since 2007 as well as the decline in ratio of investment to growth in GDP in the industrialized world. The fall off in investment has been quite dramatic, especially in Japan, the US, and in Western Europe.

Chart 1 The Decline of Business Investment, Selected Countries , since 2007

Now, we are entering a period in which profit growth has not only slowed, but appears to be on the decline. As Chart 2 reveals US corporate profitability as a percent of GDP has slumped from 11% to 9% in less than five years. Forecasts for the 2016-17 anticipate a weak profit performance in response to the worldwide slowdown. To the extent that profits motivate corporations to expand their facilities, the absence of this important ingredient only adds to our concern for the future.

Chart 2 The Decline of Profits as a Percent of GDP, United States

Why Are We Puzzled?

This dramatic weakness in capital formation is worrisome given all the factors that one would expect would generate a flourish of new investment such as:

Unprecedented monetary stimuli in the form of zero interest rates and central banks’ purchases of domestic bonds( QEs);

A narrowing of corporate bond spreads, providing cheap credit for expansion;

Record levels of retained earnings and dividends ; both items provide businesses with the wherewithal to self-finance expansion;

Record levels of profit margins, again providing the corporate sector with ample encouragement to expand facilities and reach for new markets domestically and internationally.

Access to alternative, non- traditional bank lending sources (e.g. private equity) at competitive rates.

Leave A Comment