from the St Louis Fed

— this post authored by Juan M. Sanchez and Hee Sung Kim

The U.S. inflation rate has been below the Fed’s 2 percent inflation target since 2012. In this article, we revisit the merits of some of the most common explanations for the current low inflation rate.

While a moderate inflation rate can be beneficial for the economy, there are several reasons to be concerned about very low inflation. First, an inflation rate lower than the 2 percent target for a long period of time may signal that the monetary authority does not have inflation under control or that its commitment to the target is not that strong. Second, very low inflation is typically associated with an increased probability of falling into deflation, in which prices and wages are declining on average. Deflation, in turn, is a phenomenon associated with weak economic conditions.

The prime example of the aforementioned concerns is Japan. Since the late 1990s, Japan has experienced a long period of low inflation that is associated with a secular stagnation. In past years, low inflation in the U.S. triggered concern that the country may be heading to a Japanese-style low inflation trap.[1]

Because inflation cannot be measured by an increase in the price of one product or service, or even several products or services, there are many different indexes to measure inflation, each index signaling different information about inflation. The Federal Open Market Committee (FOMC), the Fed’s main monetary policymaking body, prefers to look at personal consumption expenditures (PCE) because, among other reasons, the PCE price index covers a wide range of household spending.

Figure 1

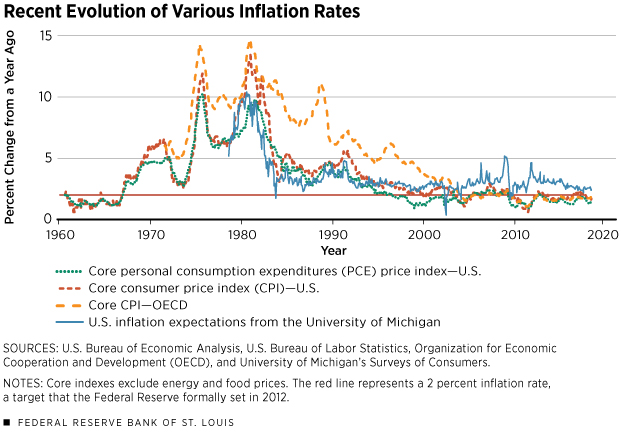

Figure 1 displays the recent evolution of the core PCE and core consumer price indexes (CPI) for the U.S. since the 1960s. Both indexes are seasonally adjusted and are computed as a year-over-year percentage change. It is also important to note that these indexes are “core” indexes, which exclude food and energy items that fluctuate dramatically. Looking at core indexes, rather than focusing on a short episode of spikes in inflation, helps to observe the inflation trend.[2] The PCE inflation in November 2017 is 1.5 percent, well below the inflation target of 2 percent.

Low inflation not only is a phenomenon observed in the United States, but also has been a concern around the world. Figure 1 includes the average core CPI for countries in the Organization for Economic Cooperation and Development (OECD). While the average inflation rate in OECD countries has historically been higher than the inflation rate in the U.S., inflation in these two areas has been sluggish in recent years, with CPI in OECD countries hitting 1.9 percent in October 2017 and CPI in the U.S. hitting 1.7 percent in November 2017.

Finally, Figure 1 also includes inflation expectations from the University of Michigan’s Surveys of Consumers. It shows that expectations have also been on a declining trend since 2011 but remain above the target, at 2.5 percent in November 2017.

Technological Progress

Alan Greenspan, then chairman of the Federal Reserve, stated in testimony before the U.S. Congress in 2005: “The past decade of low inflation and solid economic growth in the United States and in many other countries around the world … is attributable to the remarkable confluence of innovations that spawned new computer, telecommunication, and networking technologies, which, especially in the United States, have elevated the growth of productivity, suppressed unit labor costs, and helped to contain inflationary pressures.”

His idea, echoing the voices of many other economists, is that technological advancement has brought down the price of goods that use new technologies intensively. Indeed, innovation of smart electronic gadgets like smartphones has reduced the demand for various other gadgets, exemplified by the fact that the smartphones today can provide better cameras than professional equipment a decade ago. According to the U.S. Bureau of Labor Statistics, prices of general tuition and medical care have risen 29 percent and 25 percent, respectively, while prices of television and photographic equipment have decreased 73 percent and 24 percent, respectively, since 2010.

Leave A Comment