In recent days, the British pound declined quite sharply against the greenback, which caused several negative developments. Will currency bears be strong enough to trigger further deterioration in the coming week?

EUR/USD – Double Bottom or Further Declines?

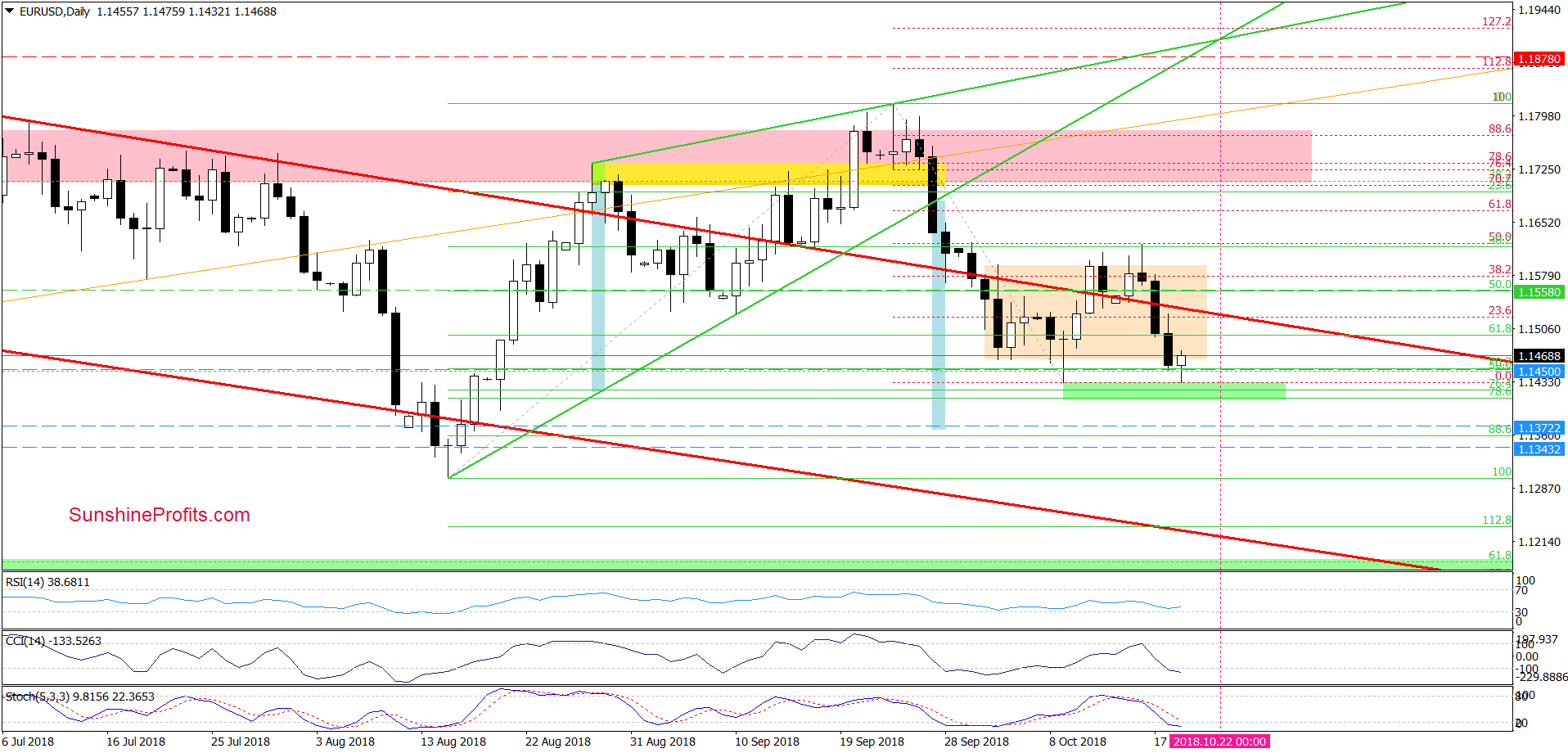

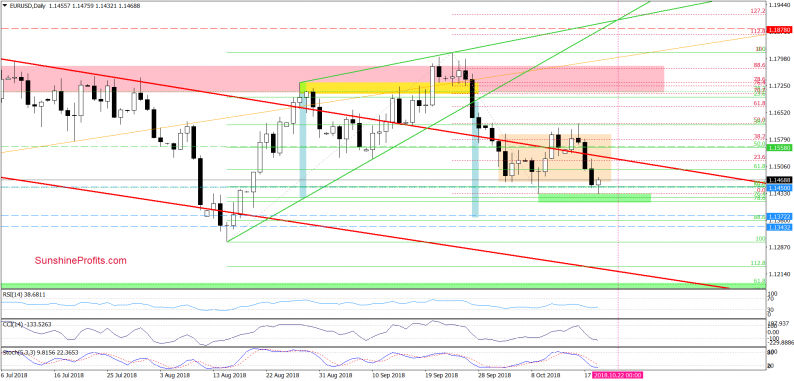

On Wednesday, EUR/USD closed the day well below the red line (the upper border of the red declining trend channel). Yesterday, we noticed a small rebound, which looked like nothing more than a verification of the earlier breakdown.

Additionally, the sell signals generated by the indicators were in play, supporting another move to the downside. Therefore, we wrote in our yesterday’s alert that “(…) if the pair declines from this area, we’ll see a test of the lower border of the consolidation or even the last week’s low in the following days.”

Looking at the daily chart, we see that currency bears took EUR/USD lower (as we had expected), which resulted in a daily closure under the lower line of the consolidation. Earlier today, the pair moved even lower and re-tested the last week’s low and the green support zone, making our short position more profitable (as a reminder, we opened it when EUR/USD was trading at around 1.1558).

Despite this deterioration, the combination of supports encouraged currency bulls to act, which caused a small rebound and a comeback to the lower line of the consolidation. Such price action looks like a verification of the earlier breakdown, which in combination with the sell signals generated by the daily indicators suggests that another attempt to move lower is just around the corner.

Therefore, if the exchange rate extends losses from current levels, we’ll see a drop to (at least) 1.1372, where the size of the downward move will correspond to the height of the green rising wedge.

GBP/USD – Breakdown and Its Consequences

Leave A Comment