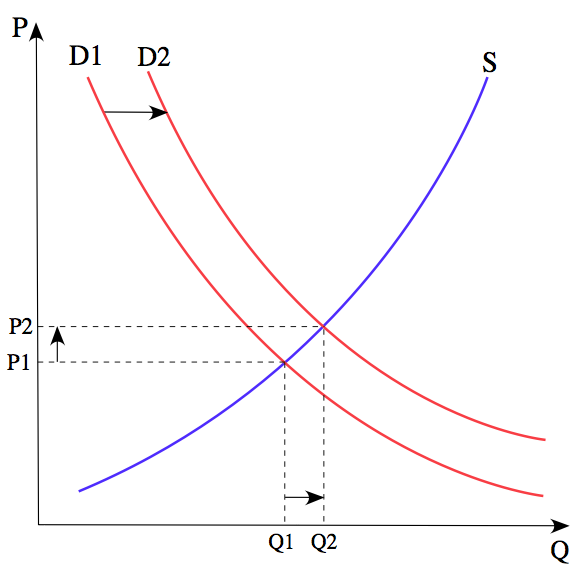

Economists have given us a model of how prices and quantities of goods are supposed to interact.

Unfortunately, this model is woefully inadequate. It sort of works, until it doesn’t. If there is too little a product, higher prices and substitution are supposed to fix the problem. If there is too much, prices are supposed to fall, causing the higher-priced producers to drop out of the system.

This model doesn’t work with oil. If prices drop, as they have done since mid-2014, businesses don’t drop out. They often try to pump more. The plan is to try to make up for inadequate prices by increasing the volume of extraction. Of course, this doesn’t fix the problem. The hidden assumption is, of course, that eventually oil prices will again rise. When this happens, the expectation is that oil businesses will be able to make adequate profits. It is hoped that the system can again continue as in the past, perhaps at a lower volume of oil extraction, but with higher oil prices.

I doubt that this is what really will happen. Let me explain some of the issues involved.

[1] The economy is really a much more interlinked system than Figure 1 makes it appear.

Supply and demand for oil, and for many other products, are interlinked. If there is too little oil, the theory is that oil prices should rise, to encourage more production. But if there is too little oil, some would-be workers will be without jobs. For example, truck drivers may be without jobs, if there is no fuel for the vehicles they drive. Furthermore, some goods will not be delivered to their desired locations, leading to a loss of even more jobs (both at the manufacturing end of the goods, and at the sales end).

Ultimately, a lack of oil can be expected to reduce the availability of jobs that pay well. Digging in the ground with a stick to grow food is a job that is always around, with or without supplemental energy, but it doesn’t pay well!

Thus, the lack of oil really has a two-way pull:

(a) Higher prices, because of the shortage of oil and the desired products it produces.

(b) Lower prices, because of a shortage of jobs that pay adequate wages and the “demand” (really affordability) that these jobs produce.

[2] There are other ways that the two-way pull on prices can be seen:

(a) Prices need to be high enough for oil producers, or they will eventually stop extracting and refining the oil, and,

(b) Prices cannot be too high for consumers, or they will stop buying products made with oil.

If we think about it, the prices of basic commodities, such as food and fuel cannot rise too high relative to the wages of ordinary (also called “non-elite”) workers, or the system will grind to a halt. For example, if non-elite workers are at one point spending half of their income on food, the price of food cannot double. If it does, these workers will have no money left to pay for housing, or for clothing and taxes.

[3] The upward pull on oil prices comes from a combination of three factors.

(a) Rising cost of production, because the cheapest-to-produce oil tends to be extracted first, leaving the more expensive-to-extract oil for later. (This pattern is also true for other types of resources.)

(b) If workers are becoming more productive, this growing productivity of workers is often reflected in higher wages for the workers. With these higher wages, workers can afford more goods made with oil, and that use oil in their operation. Thus, these higher wages lead to higher “demand” (really affordability) for oil.

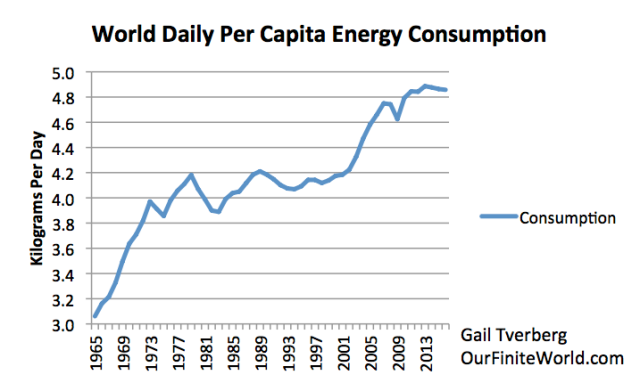

Recently, worker productivity has not been growing. One reason this is not surprising is because energy consumption per capita hit a peak in 2013. With less energy consumption per capita, it is likely that, on average, workers are not being given bigger and better “tools” (such as trucks, earth-moving equipment, and other machines) with which to leverage their labor. Such tools require the use of energy products, both when they are manufactured and when they are operated.

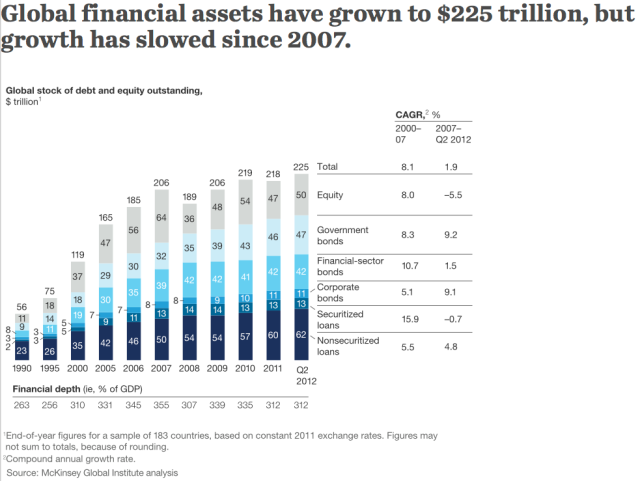

(c) Another “pull” on demand comes from increased investment. This investment can be debt-based or can reflect equity investment. It is these financial assets that allow new mines to be opened, and new factories to be built. Thus, wages of non-elite workers can grow. McKinsey Global Institute reports that growth in total “financial assets” has slowed since 2007.

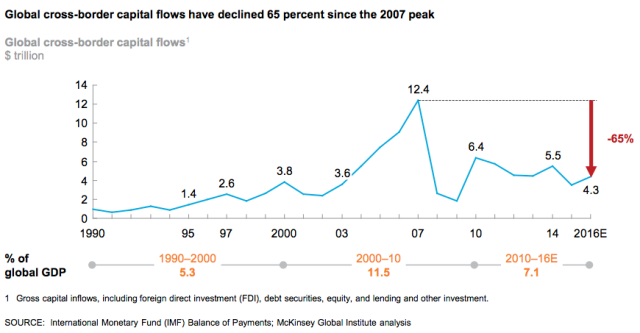

More recent data by McKinsey Global Institute shows that cross-border investment, in particular, has slowed since 2007.

This cross-border investment is especially helpful in encouraging exports, because it often puts into place new facilities that encourage extraction of minerals. Some minerals are available in only in a few places in the world; these minerals are often traded internationally.

[4] The downward pull on oil and other commodity prices comes from several sources.

(a) Oil exports are often essential to the countries where they are extracted because of the tax revenue and jobs that they produce. The actual cost of extraction may be quite low, making extraction feasible, even at very low prices. Because of the need for tax revenue and jobs, governments will often encourage production regardless of price, so that the country can maintain its place in the world export market until prices again rise.

Leave A Comment