In the past four days, stocks have peaked in the morning and then fallen in the afternoon, sometimes into the negatives. I think there is a technical battle between those who want the market to retest the recent trough and those who want the market to make new highs. On Thursday, the S&P 500 was up about 1% in the morning, but closed up only 0.10%. The Dow was up 0.66% as it was led higher by United Technologies, which was up 3.3%, and Caterpillar, which was up 2.3%.

10 Year Bond Yield Should Fall

The 10 year bond yield was down 3.3 basis points to 2.917% just after I said it was bound to fall in the next month. I won’t claim victory after one day of action because the call is for a decline of about 20 basis points from the peak of 2.95%. I don’t think there will be major problem if the 10 year hits 3%, but so many people are afraid of this occurring that it could be a self-fulfilling prophecy. That’s a technically driven call because there’s no fundamental reason why anything crazy should happen based on a few basis points of movement.

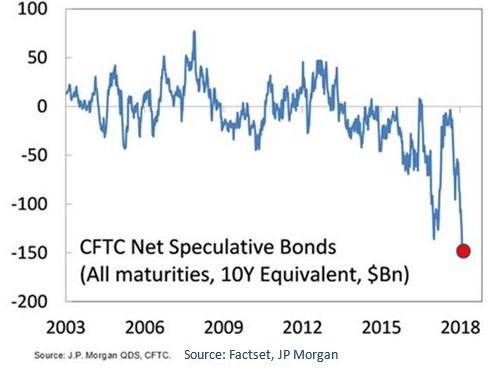

As you can see from the chart below, the CFTC net speculative position in bonds is at an all-time low. This should cause a panic buying in the 10 year bond just like there was panic buying in the VIX when the short VIX trade unwound. The same thing happened in oil as the price fell sharply a couple weeks ago. There are fundamental reasons for all the trades (long oil, short VIX, short treasuries) to continue, but corrections occur to keep everyone from getting too aggressive.

10 Year Yield Versus S&P 500 Firms’ Yields

The chart below provides another bit of context into the TINA trade. Personally, I don’t think the TINA trade is the main reason for the bull market because bond investors and stock investors have different risk preferences. I would argue that only the utilities, telecom, and consumer staples sectors are affected by changes in yields. Some stocks with high dividends trade like bonds, but most don’t. As you can see from the chart below, the percentage of companies with a yield higher than the 10 year treasury is about 20%. This is down from the peak of about 60%. The chart supports my theory that low yields don’t push many investors into stocks because it shows there were barely any stocks with a yield above the 10 year in the 1990’s, yet the stock market was the most expensive ever in that period.

Leave A Comment