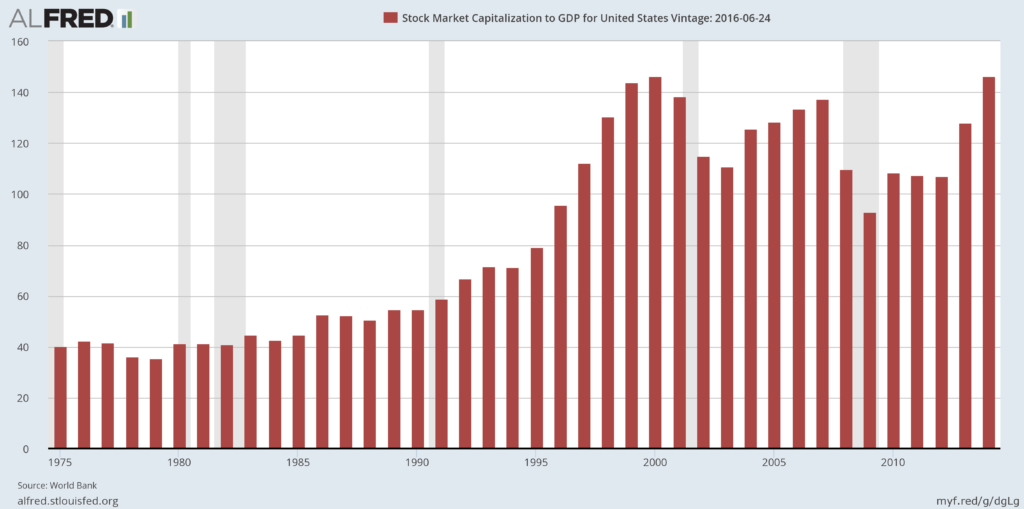

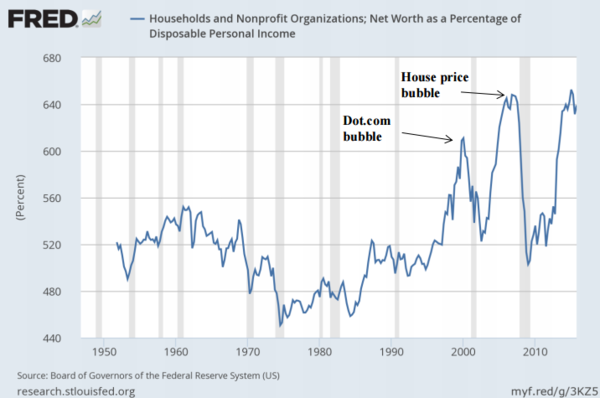

The Fed minutes were released yesterday and there’s one sentence everyone is talking about: “Some participants viewed equity prices as quite high relative to standard valuation measures.” By “quite high” I imagine they are referring to the fact that even by their own measures the broad stock market is now more expensive than it was at the height of the dotcom mania. The Fed stopped updating the series below in 2014, when valuations first surpassed the 2000 peak but it’s not hard to imagine what it might look like today with the stock market 15% higher and GDP just 7% higher.

Beyond stocks they also noted, “It was observed that prices of other risk assets, such as emerging market stocks, high-yield corporate bonds, and commercial real estate, had also risen significantly in recent months.” And this is as close as they will ever come to acknowledging the “everything bubble” their former colleagues are more willing to discuss candidly.

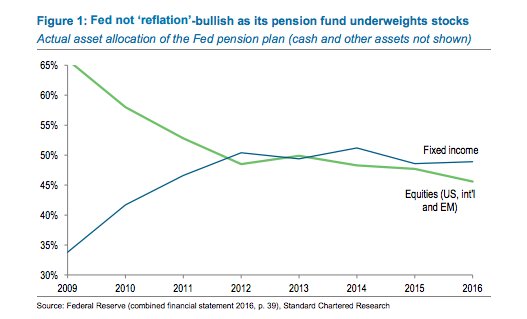

It’s important to note, however, that not only is the Fed talking about elevated valuations of risk assets they are also putting their money where their mouths are. The Fed’s pension fund has now taken its equity allocation to its greatest underweighting of the current cycle. Note that it was massively overweight at the 2009 low. Nice trade, gang. I guess we’ll soon find out how prescient their latest move proves to be.

The reason for the contrarian conservatism in the investment portfolio could be that the Fed appreciates the demographics headwinds facing financial assets over the coming decade. Or it could simply be that, better than anyone else, they understand what Stan Druckenmiller recently elucidated: “Earnings don’t move the overall market; it’s the Federal Reserve Board… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

Leave A Comment