The most prevalent view regarding future oil supply, as well as total energy supply, seems to be fairly closely related to that expressed by Peak Oilers. Future fossil fuel supply is assumed to be determined by the resources in the ground and the technology available for extraction. Prices are assumed to rise as fossil fuels are depleted, allowing more expensive technology for extraction. Substitutes are assumed to become possible, as costs rise.

Those with the most optimistic views about the amount of resources in the ground become especially concerned about climate change. The view seems to be that it is up to humans to decide how much energy resources we will use. We can easily cut back, if we want to.

The problem with this approach is the world economy is much more interconnected than most analysts have ever understood. It is also much more dependent on growing energy supply than most have understood. Surprisingly, we humans aren’t really in charge; the laws of physics ultimately determine what happens.

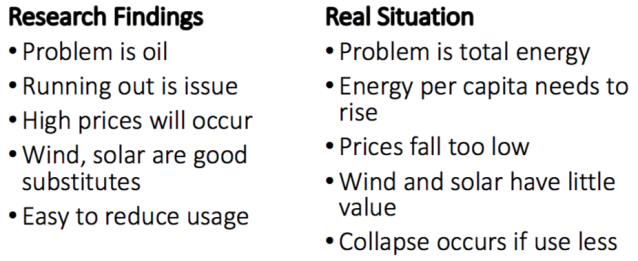

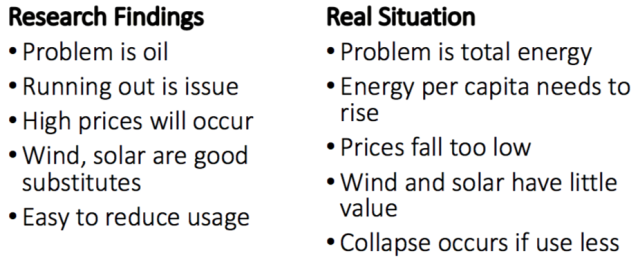

In my view, Peak Oilers were correct about energy supplies eventually becoming a problem. What they were wrong about is the way the problem can be expected to play out. Major differences between my view and the standard view are summarized on Figure 1.

Figure 1. Prepared by Author.

Let me explain some of the issues involved.

[1] Modeling is a lot more difficult than it looks.

Let’s take one common model of the part of the earth where we live, a street map:

Figure 2. Source: Edrawsoft.com

If we want to scale the model up to cover the whole world, we need to add a whole new dimension. In other words, we need to make a globe.

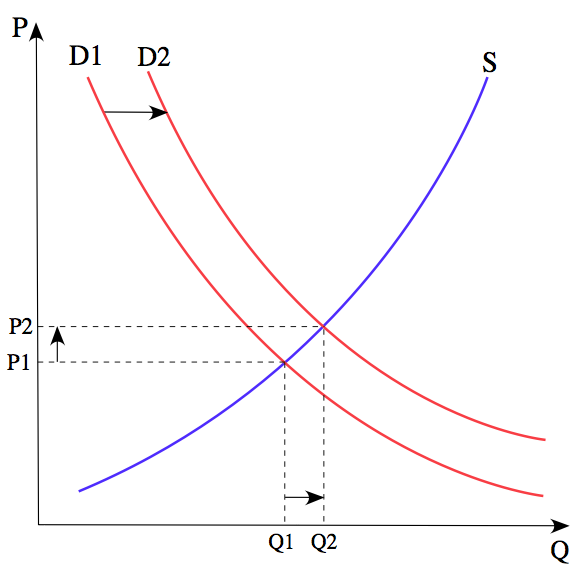

The same problem occurs with what seem to be simple economic models, like supply and demand:

Figure 3. From Wikipedia: The price P of a product is determined by a balance between production at each price (supply S) and the desires of those with purchasing power at each price (demand D). The diagram shows a positive shift in demand from D1 to D2, resulting in an increase in price (P) and quantity sold (Q) of the product.

If we are trying to model the situation a long way from limits (running out, or whatever the real limit is) then this model is perhaps “good enough.”

But if energy is the item that is in scarce supply as we approach limits, it can affect both quantity and price. Lack of energy supply at an inexpensive enough price can reduce both the quantity of the goods produced and the wages of workers. For example, distributors of goods in the United States may choose to buy imported goods from China or India to work around the problem of too high a cost of production (including energy costs).

The resulting competition with low-wage countries reduces the wages of many workers, especially those with low skill levels and those just finishing their educations. With such low wages, workers cannot afford to buy as many cars, motorcycles, and other goods that use energy products. The lack of demand from these workers indirectly brings down the prices of commodities of all kinds, including oil. In fact, prices can fall below the cost of production for extended periods. This has happened since 2014 for many energy products, including oil.

The model by the economists isn’t right. It doesn’t have enough dimensions to it. Peak Oil researchers did not understand that economists had put together a badly incomplete model. Their model only represents simple cases away from energy limits. Their model doesn’t explain what we should expect near energy limits.

[2] Simple two-dimensional models can work for some purposes, but not for others.

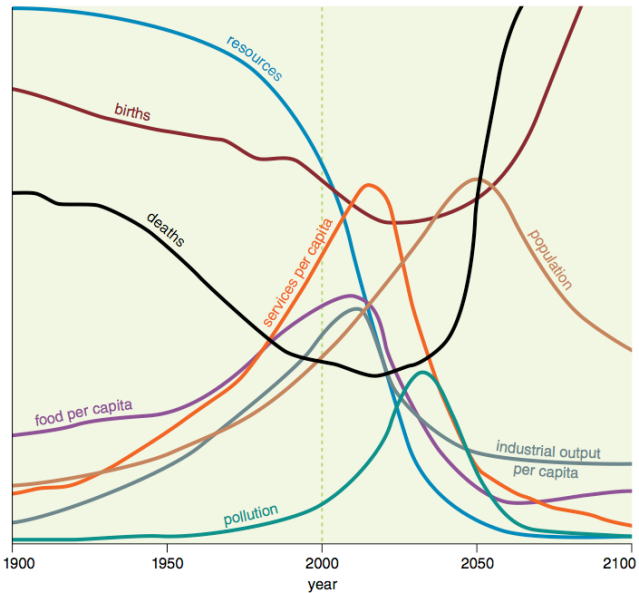

One thing that has been confusing to Peak Oil researchers is the base model in the 1972 book The Limits to Growth seems to present a fairly accurate timeline regarding when energy limits might hit. The indications are that the limits will happen about now.

The model reflects a simple, quantity-based approach that does not consider problems such as how debt might be repaid with interest if the economy is shrinking, or how pension payments would fare in a shrinking economy. The model is based on the assumption that our problem is only inadequate supply, not economic problems that indirectly result from short supply.

Figure 4. Base scenario from 1972 Limits to Growth, printed using today’s graphics by Charles Hall and John Day in “Revisiting Limits to Growth After Peak Oil” http://www.esf.edu/efb/hall/2009-05Hall0327.pdf

The thing that is easy to miss is the fact that this model is too simple to show how the limits will hit. For example, will the limits apply to oil or all fuels combined? What will be the impact on wage disparity? How will the impact on wage disparity affect demand for goods and services? Will the economy start growing too slowly and fail for that reason?

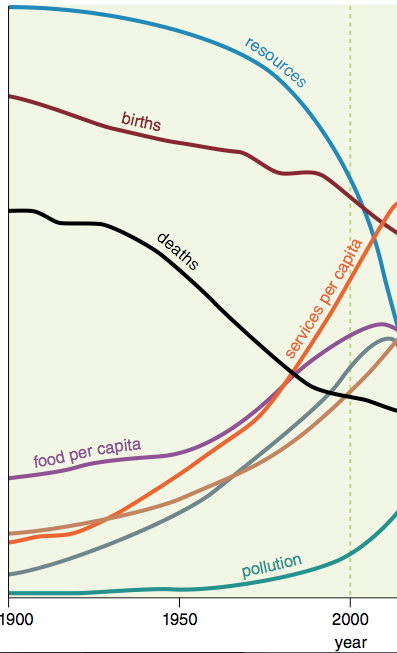

The authors of The Limits to Growth wisely pointed out that their models could not be relied on to show what would happen after collapse, but this warning seems to have been missed by many readers. I have suggested that it might have been better if the model had been truncated at an earlier date, to emphasize how limited the model’s predictive abilities really are because of its omission of a financial system that includes debt, wages, and prices.

Figure 5. Limits to Growth forecast, truncated shortly after production turns down since modeled amounts are unreliable after that date.

[3] Energy is a critical need for the economy. Many prior economies collapsed when energy consumption stopped rising sufficiently rapidly.

Much research has been done on the huge number of historical economies that have collapsed. Peter Turchin and Sergey Nefedov examined eight agricultural economies that collapsed. This is a chart I prepared, explaining the approximate timing of the eight collapses, and the population growth pattern that seemed to occur.

Figure 6. Chart by author based on Turchin and Nefedov’s Secular Cycles.

According to Turchin and Nefedov, when a new resource became available (for example, land available after cutting down trees, or a new discovery of improved food yields because of irrigation), the population grew rapidly until the population reached the carrying capacity of the land with the new resource. The carrying capacity would reflect the energy resources that were easily available: land for farming and biomass that could be harvested and burned.

As limits were reached, population growth tended to plateau. The plateau would tend to come when the area could only support its existing population, without adding some sort of complexity to try to produce more goods and services using the existing energy resources. Joseph Tainter, in The Collapse of Complex Societies, tells us that by adding complexity (including improved technology, larger businesses and expanded government functions), it was possible to increase the output of the economy over what initially seemed to be available. There are at least two reasons why using technology to work around natural limits doesn’t work for very long, however:

Leave A Comment