Some things go unnoticed. For example, the S&P 500 rallied 13% off its closing lows (1867) set in late August. Lost in the shuffle? The popular benchmark has yet to revisit its closing highs (2130) registered back in May.

In essence, the corrective activity that began in the springtime as a function of a faltering global economy, overvalued equities and weakening market internals has yet to run its course. What’s more, these factors that led to the August-September sell-off in risk assets are unlikely to dissipate quickly.

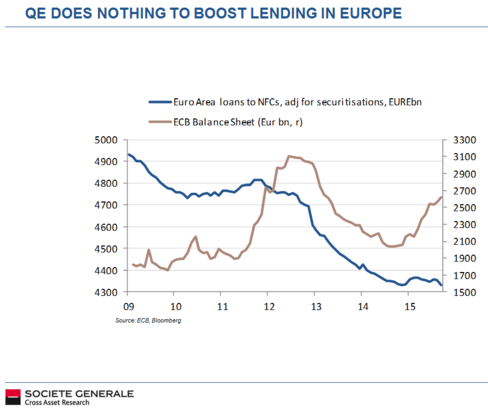

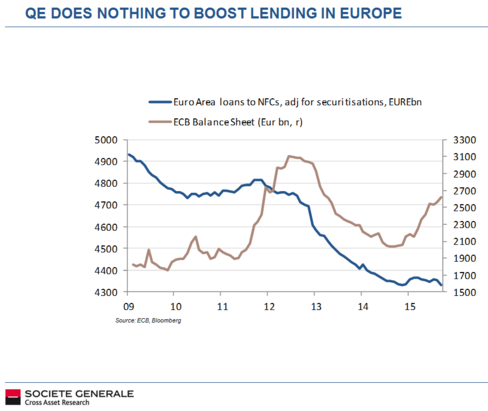

Let’s start with the macro-economic backdrop. Data show that quantitative easing (QE) in Europe is not stimulating borrowing activity the way that it stimulated borrowing activity in the United States. If European consumers and European businesses are fearful to take out loans – or if creditors are unwilling to extend credit – the euro-zone economy is unlikely to show improvement. Similarly, European stocks would not experience much of a boost from share buybacks.

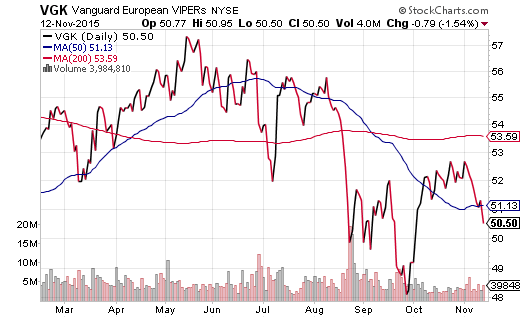

Not surprisingly, then, the Vanguard FTSE Europe ETF (VGK) failed to rise above its 200-day moving average; it never came close to recapturing its 52-week high. At this moment, the euro-zone proxy is still 12% below its high-water mark.

Europe is hardly the only canker sore on the world stage. Japan recently revised its economic growth projections lower. China is slowing dramatically. And nations that depend upon natural resources exports (e.g., Australia, Canada, Brazil, Chile, etc.) are witnessing yet another downturn in commodity prices. In fact, the PowerShares DB Commodity Tracking Index ETF (DBC) has plummeted back to levels not seen since the late August free-fall for U.S. stocks.

The bullish case for U.S. stocks continues to rely on the notion that the rest of the world does not matter. Ironically, the Federal Reserve did not raise borrowing costs in September and cast doubt on any rate hike this year when it stated that “…global economic and financial developments may restrain economic activity.” The central bank subsequently backtracked at its October meeting by removing its commentary on global issues altogether.

Leave A Comment