The world financial system is booby-trapped with unprecedented anomalies, deformations and contradictions. It’s not remotely stable or safe at any speed, and most certainly not at the rate at which today’s robo-machines and fast money traders pivot, whirl, reverse and retrace.

Indeed, every day there are new ructions in the casino that warn investors to get out of harm’s way with all deliberate speed. And last night’s eruption in the Japanese bond market was a doozy.

The government of what can only be described as an old age colony sinking into certain bankruptcy sold 30-year bonds at an all-time low of 47 basis points. Let me clear here that we are talking about a record low not just for Japan but for the history of mankind.

To be sure, loaning any government 30-year money at 47 basis points is inherently a foolhardy proposition, but its just plain bonkers when it comes to Japan.

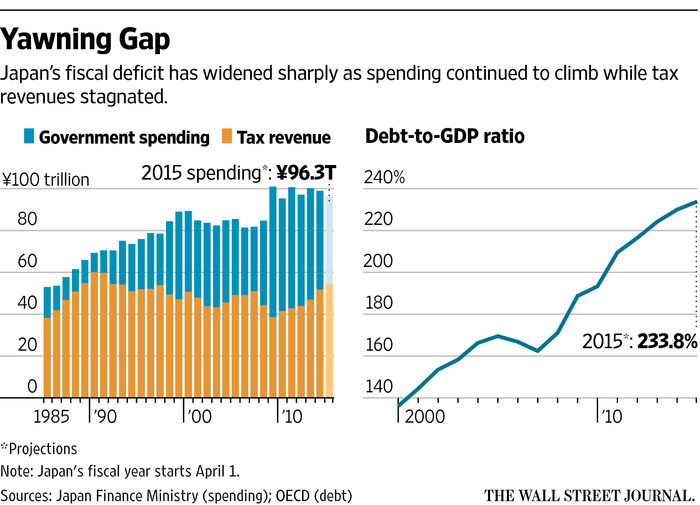

Here is its 30-year fiscal record in nutshell. Not withstanding years of chronic red ink and its recent 2014 consumption tax increase from 5% to 8%, Japan is still heading straight for fiscal oblivion. Last year (2015) it spent just under 100 trillion yen, but took in hardly 50 trillion yen of revenue, stacking the difference on its already debilitating mountain of public debt, which has now reached 240% of GDP.

That’s right. A government which is borrowing nearly 50 cents on every dollar of outlays should be paying a huge risk premium to even access the bond market. But a government with a 240% debt-to-GDP ratio peering into a demographic sinkhole would be hard pressed to borrow at any price at all on an honest free market.

The graphs below show what lies 30 years down its demographic sinkhole. To wit, Japan’s population will have declined by 30% to 90 million, while its working age population will have plummeted from 78 million to about 52 million or by 33%. Moreover, its labor force participation rate has been declining for years, but even if it were to stabilize at the current 60% level, it would still mean just 31 million workers.

Leave A Comment