Though Turkey’s financial markets have been struggling since the start of this year, the country’s currency and government bonds have been in an all-out freefall in the past week. A political clash with the United States caused the lira to lose approximately one-third of its value against the U.S. dollar in the last week alone. In an attempt to stem the lira’s plunge this year, Turkey’s central bank has hiked interest rates quite dramatically, which is a move that earned approval from many mainstream economists and analysts. Unfortunately, I believe that Turkey’s aggressive recent interest rates hikes are going to pop the country’s dangerous credit bubble that I warned about in Forbes in 2014.

The chart below shows the Turkish lira’s recent plunge against the U.S. dollar:

Source: XE.com

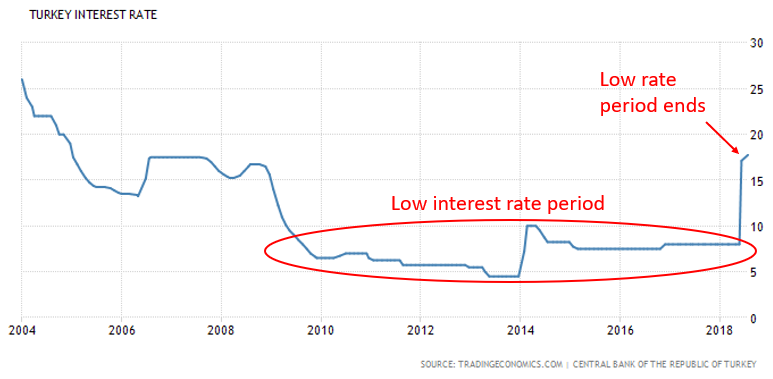

As I explained in my original bubble warning, Turkey has been experiencing a powerful economic boom since the early-2000s thanks to ultra-low interest rates and the resultant rapid credit growth. The chart below shows how Turkey’s benchmark interest rate kept falling from the early-2000s until the mid-2010s. Extremely loose global monetary conditions after the Global Financial Crisis led to a “tsunami of liquidity” that flowed into emerging economies such as Turkey, which caused interest rates to fall well below normal historic levels. Now that the U.S. and other countries have been ending their QE programs and raising interest rates, emerging market currencies and bonds have been taking it on the chin.

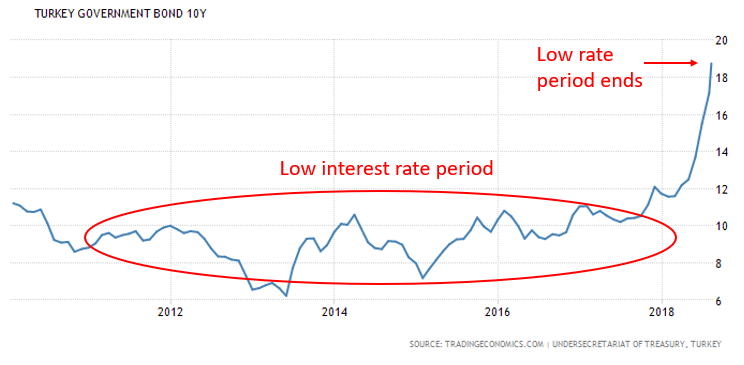

The chart below shows Turkish 10-year government bond yields, which have surged recently:

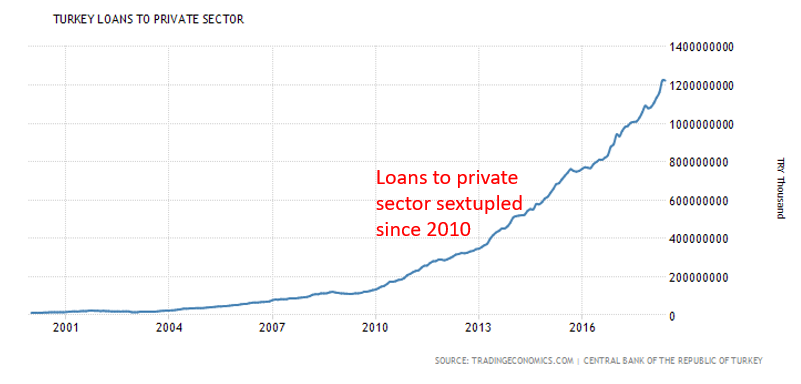

Unusually low interest rates have encouraged a credit boom in which loans to the private sector have sextupled since 2010:

Consumer credit has increased fivefold since 2010:

Leave A Comment