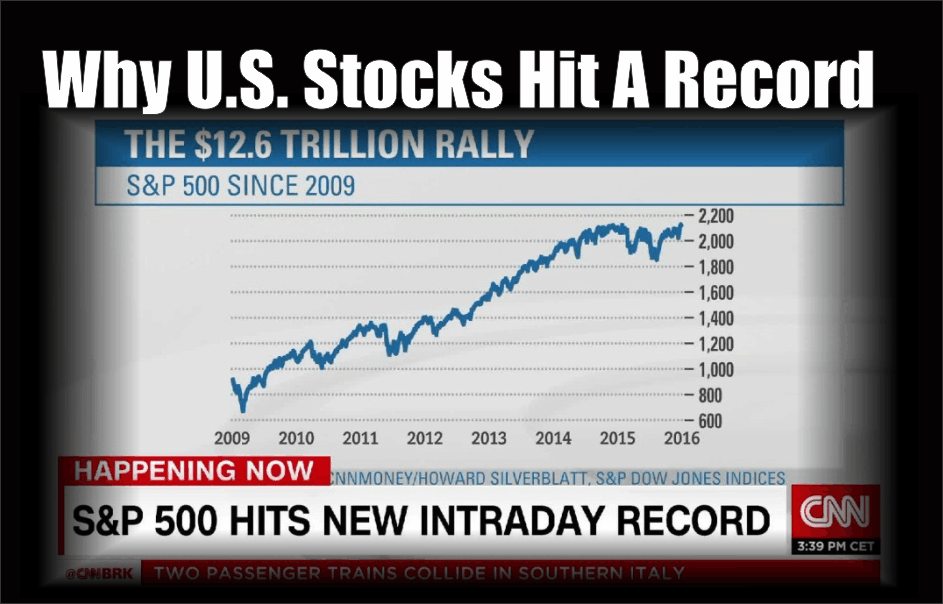

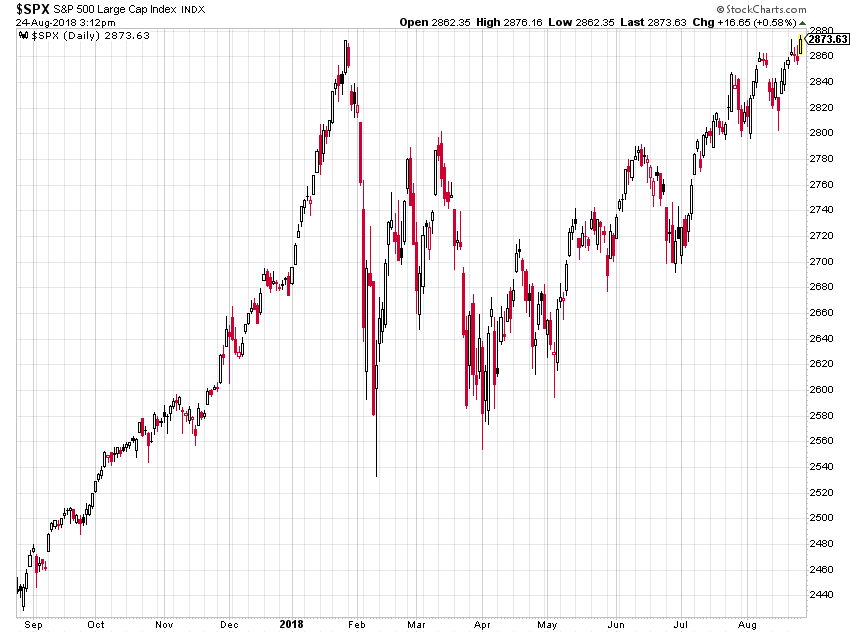

The S&P 500 hit an intraday record of 2,876.16 on Friday, surpassing its January 2018 peak that occurred before the violent 12% correction that ensued in February. The official reason for Friday’s bullish action was Fed Chairman Jerome Powell’s speech in which he outlined his expectations for gradual interest rate increases. Powell’s speech didn’t contain any new information, and that’s exactly why the market rallied – “no news is good news.”

Why has the S&P 500 been able to surpass its January high despite ultra-high stock valuations, trade wars, an unfolding emerging markets crisis, and more? This is not a popular explanation, but it is largely due to the fact that U.S. monetary conditions are still very loose despite the rate hikes of the past couple years. As I’ve discussed recently, record low interest rates are the primary reason for the U.S. stock market bubble. The chart below shows how U.S. interest rates (the Fed Funds Rate, 10-Year Treasury yields, and Aaa corporate bond yields) have been at record low levels for a record period of time since the 2008 financial crisis.

Low-interest rates contribute to the inflation of asset and credit bubbles in numerous ways:

The chart of real (inflation-adjusted) interest rates below confirms just how loose U.S. monetary policy has been since the Great Recession. In recent decades, the only time the U.S. has experienced negative real interest rates for a significant amount of time was during the mid-2000s housing bubble and during the current “Everything Bubble” period that started after 2009. (Note: “Everything Bubble” is a term that I’ve coined to describe a dangerous bubble that has been inflating across the globe in a wide variety of countries, industries, and assets – please visit my website to learn more.)

Leave A Comment