Yum! Brands’ China division’s Q4 2015 performance showed signs of recovery.

This recovery is in time for Yum! Brands’ planned China spin-off by the end of this year.

The China division spin-off, revenue recovery and Yum’s financial engineering among other things will help Yum! stock in the short-term.

On 3 February 2016, Yum! Brands (YUM) reported an increase in adjusted earnings which topped analyst expectations but the company missed on its top-line estimates.Yum! Brands reported $3.95 billion in revenue compared to analyst expectations of $4.02 billion in revenues. But China was the main highlight of the quarter. This is because, apart from showing strong signs of recovery, Yum! Brands’ China division offers a lucrative opportunity due to the potential arbitrage opportunity from its spin-off at the end of 2016. That’s the reason I am advocating not to bet against Yum! Brands in 2016. The company has a few tricks up its sleeve, one of which is the Yum! China spin-off. Further, there’s a $6.2 billion shareholder repurchase program.

Q4 2015 China Highlights

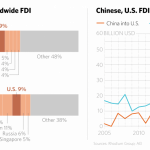

Yum! Brands’ China division continued being the company’s key growth area: 83% of international expansion occurred in emerging markets. New global restaurants totaled to 1,160, including 384 stores or ~33% of Yum’s new global restaurants in China.

Yum! Brands’ China division started showing signs of a recovery: China system sales increased 7%, driven by 7% unit growth and 2% same-store sales growth. Restaurant margins increased 4.3% to 11.4%. Operating profit margins increased 207%.

Full Year China Highlights

Emerging markets are Yum! Brands’ strength: At the end of 2015 new global restaurants totaled to 2,365, including 743 in China, with 351 KFC stores and 355 Pizza Hut stores. 80% of international expansion occurred in emerging markets.

Yum! Brands’ China Division system sales increased 2%, driven by 7% unit growth and partially offset by a 4% same-store sales decline. Restaurant margins increased 1.1 percentage points to 15.9%. Operating profits increased 8%.

Leave A Comment