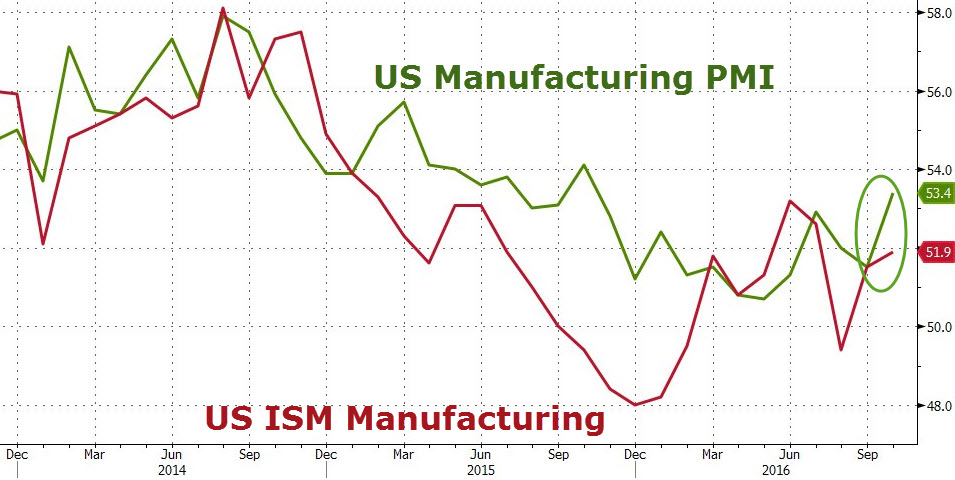

Despite a final October print for PMI at 53.4 (highest since Oct 2015), US manufacturers remain skeptical and, as Markit notes, “hiring is also being subdued partly by worries about escalating costs, with the October survey recording the largest monthly rise in factory prices for five years.” Following disappointments from regional Fed surveys (Dallas and Chicago notably), ISM Manufacturing rose to 51.9 (with prices paid rising and new orders tumbling).

Both ISM and Markit surveys of US manufacturing improved in October…

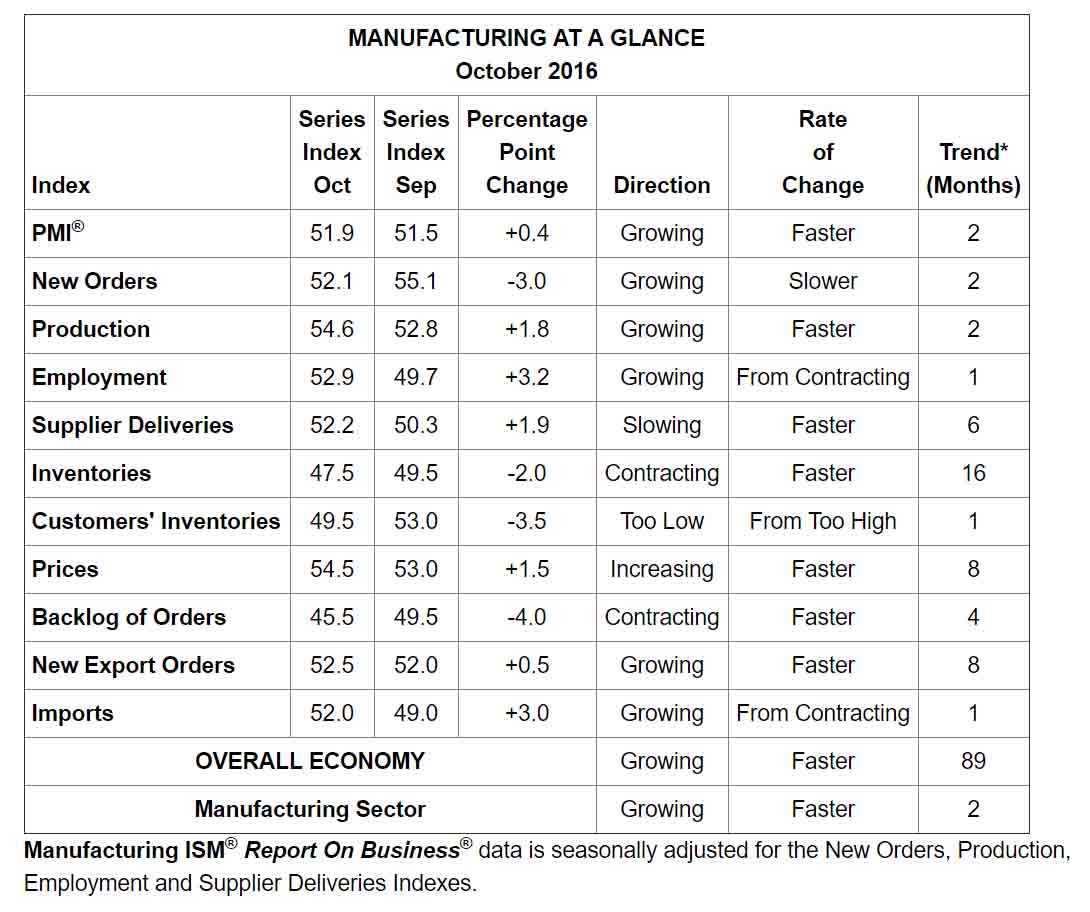

ISM Breakdown shows prices rising and orders falling (and a drop in inventories is not helpful for Q4 GDP). Overall, four components declined, among which New Orders, while 6 rebounded, including Prices, suggesting to potential stagflation should growth not follow:

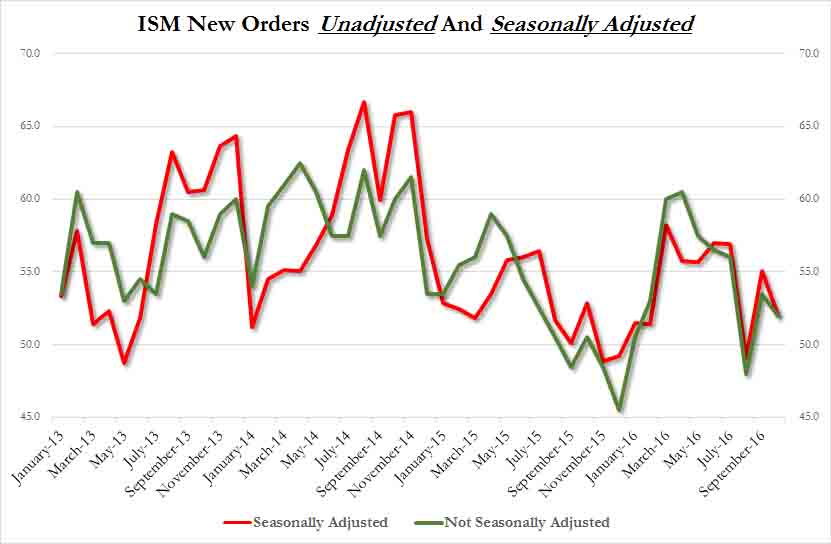

Asal, New Orders fail to show a sustained rebound.

Meanwhile Inflation fears soar:

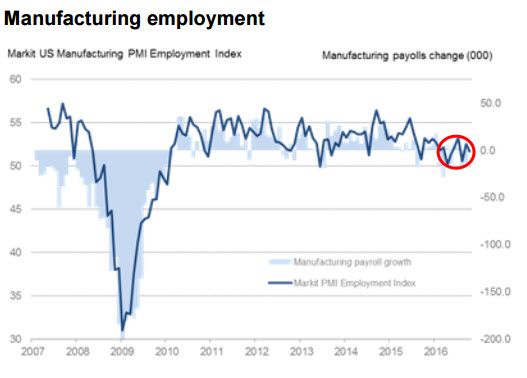

Amid reports of rising commodity prices, average input costs increased for the seventh month in a row. The rate of inflation was also the greatest recorded by the survey for two years, and encouraged companies to pass on these higher costs to clients in the form of increased output charges. The net result was a solid pace of charge inflation that was the strongest seen since November 2011.

And the rising costs of inflationary inputs is weighing on employment…

The ISM respondents were very cheerful, as usual:

Leave A Comment