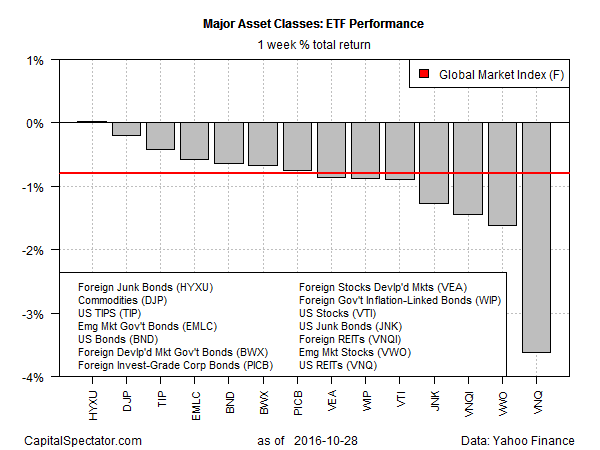

The major asset classes lost ground last week, with one exception: foreign high-yield bonds. Otherwise, red ink dominated the broad categories of global markets for the five trading days through Oct. 28, based on a set of proxy ETFs.

The only slice of markets that escaped (just barely) last week’s red-ink fest: the iShares International High Yield Bond ETF (HYXU), which posted a fractional gain of 0.02%.

The rest of the field fell, with US real estate investment trusts taking the biggest hit. Vanguard REIT (VNQ) tumbled a hefty 3.6%, pushing the fund to a five-month low.

The negative bias in last week’s trading weighed on an ETF-based version of the Global Markets Index (GMI.F). The investable, unmanaged benchmark that holds all the major asset classes in market-value weights lost 0.8% over the five trading days through Friday.

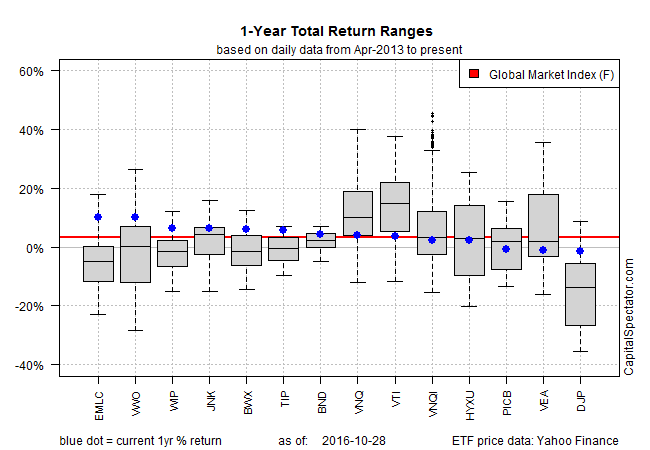

In the one-year column, the return profile still reflects an upside bias, with most asset classes posting gains.

The current top performer: emerging-market fixed income. Van Eck Vectors JP Morgan Emerging Market Local Bond (EMLC) is ahead by 10.1% in total return terms for the year through Oct. 28.

Meantime, commodities continue to languish as the biggest loser for one-year results. The iPath Bloomberg Commodity ETN (DJP) is off 2.3% for the trailing 12-month period. Note, however, that this modest setback is relatively light in comparison with recent history. As the chart below shows, DJP’s current one-year decline (blue dot at far right) is comfortably above the interquartile range of one-year losses since 2013 (gray box).

For context, keep in mind that GMI.F’s total return is a modest 3.2% for the trailing one-year period as of Oct. 28.

Leave A Comment