Photo Credit: Mike Mozart

American Eagle Outfitters (AEO) Consumer Discretionary – Specialty Retail | Reports May 18, After Market Closes

Key Takeaways

Teen retailers may not be a thing of the past after all. During the fourth quarter both Abercrombie and American Eagle delivered robust turned back the clock with strong earnings and revenue growth. American Eagle kicks things off this week when they announce first quarter earnings this Wednesday, after the market closes. Early indications look as if the company will extend its current streak of growth.

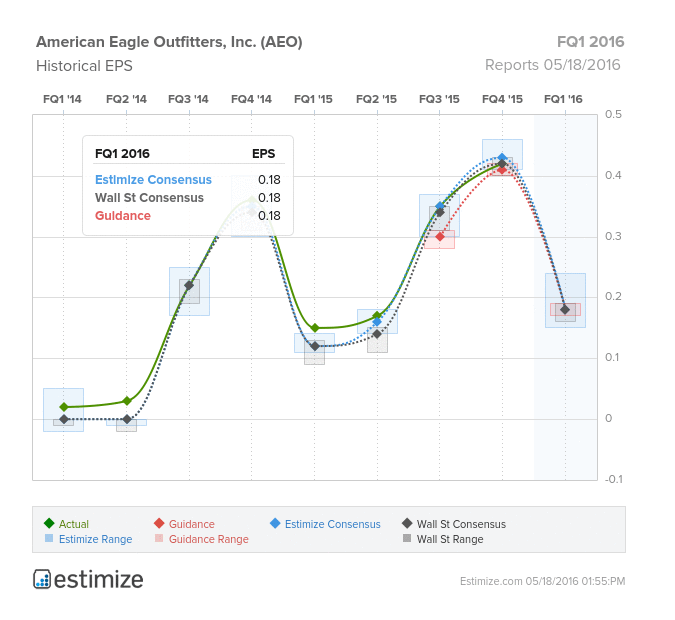

The Estimize consensus is calling for earnings of 18 cents per share on $730.07 million in revenue, right in line with Wall Street on the top and bottom line. Per share estimates have come down 9% in the past 3 months but still project a 21% increase from a year earlier. Revenue on the other hand is forecasted to increase 5% over the same time frame. On average the stock is a positive mover during earning season. In the 3 days leading up to its report, shares typically increase 3%. This should help reconcile some of the losses that shareholders have been seeing lately.

After a tough few years, American Eagle has finally started to turn things around. Last quarter saw strong growth across its key brands. Consolidated comparable sales grew 4% supported by a 26% increase in aerie brands and 3% growth in core AE products. Factory stores finally broke even, compared to a 9% contraction from Q4 2014. The company provided favorable guidance for the first quarter and fiscal year 2016. American Eagle portfolio of established brands should continue to reach its target customers, led by its Aerie Brand.

Leave A Comment