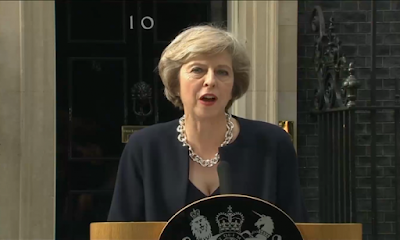

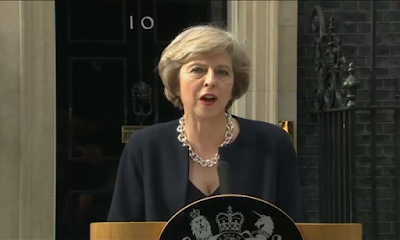

After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new government are particularly relevant. First, May demonstrates strategic prowess by putting those like Johnson and Davis, who campaigned for Brexit, to lead the negotiations with the EU, while putting Tories who favored remaining in the EU in the internal ministries.

The second element that is important is that May represents a different wing of the Tory Party than Cameron and Osborne. Not to put too fine a point on it, but she, at least part of her cabinet, are more interested in social justice. That was what her first speech was emphasized, not Brexit. She has expressed concern about executive pay and is sympathetic to having workers represented on corporate boards.

Today’s focus though is not on Brexit per se, but the Bank of England meeting. The surveys show divided markets.Many of those who don’t think the BOE cuts rates, look for a move next month. The mixed view in the market warns of the risk of volatile market response no matter the decision. The Times and City AM run their own shadow MPC exercises, and both favored a rate cut today.

In addition to the price of money, i.e., interest rates, there is some focus on the potential for a new asset purchase plan. If QE is ventured, there is some thought that the BOE would focus the operation on corporate bonds.The BOJ and now the ECB, are buying corporate bonds, it is not completely unprecedented for the BOE in the sense that previously they bought a few billion pounds of commercial paper.

Estimates suggest that the UK corporate bond market is roughly GBP435 bln. Most of the corporate bonds, however, would likely not be included for reasons ranging from rating (below investment grade), the issuer (non-UK domiciled business),sector (banks bonds), and technical reasons (e.g., maturity). Still, when these allowances are made, there may be more than GBP125 bln to “pick from”. Even a small program might be sufficient to revive the UK corporate bond issuance market, which has slowed to about GBP900 mln this year compared with GBP1.6 bln in the same period a year ago.

Leave A Comment