Foreigners. They are always plotting. This time, they hit Turkey. And gold at the same time. Will Erdogan save the country and support the yellow metal?

They May Have Their Dollars, but We Have Our People

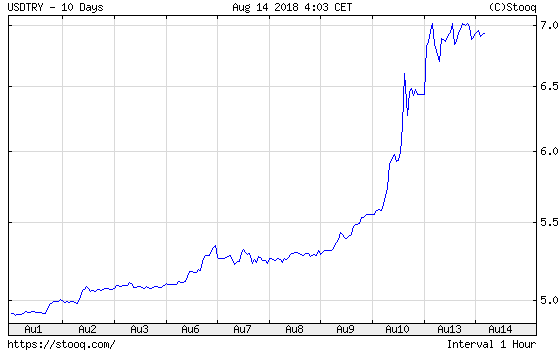

Following sharp losses last week, the Turkish lira plunged about 10% on Monday, as one can see in the chart below. The move came after President Erdogan reiterated his opposition to raising interest rates and said the lira’s recent free-fall was the result of a foreign plot. So, contrary to the market’s hopes for an interest rate hike, Turkey’s central bank announced a cut in reserve requirements ratios for banks.

Chart 1: USD/TRY exchange rate from August 1 to August 14, 2018.

Some analysts hope that Erdogan will change his stance. But why would he? After all, as he said last week, “they may have their dollars, but we have our people, our god.” He later said that Turkey faced an economic war and he blamed a foreign plot for the plunge in the domestic currency. Oh, yes, always these damned foreigners!

Gold Sinks below $1,200

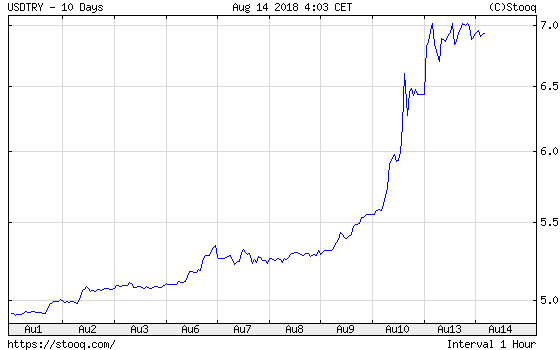

Actually, gold dropped below $1,200 on Monday, as one can see in the chart below. Our Readers should not be surprised, as we have been warning for some time that the current macroeconomic environment is rather bearish for gold and that we, thus, see more downside than upside risks for the yellow metal.

Chart 2: Gold prices (London P.M. Fix) from August 10 to August 13, 2018.

The Fed tightens its monetary policy, while inflation remains under control. Real interest rates have been rising, creating downside risks. The traditional strong negative correlation between real rates and gold prices will come back one day, pushing the yellow metal down.

However, the blow did not come from the yields. This time the U.S. dollar has been the villain. As the chart below shows, the greenback has recently appreciated not only against the Turkish lira but also against the euro.

Leave A Comment