All of the major currencies sold-off against the U.S. dollar today but the Canadian dollar was unusually resilient in the face of sharply lower oil prices and reports of significant gaps between the U.S. and Canada from Canadian NAFTA negotiator Verheul.

The only explanation is the prospect of stronger Canadian GDP tomorrow. Retail sales and trade activity improved significantly in the month of January, pointing to a faster growth. If GDP surprises to the upside, the best currency pair to trade could be EUR/CAD because Eurozone data has weak and the ECB has been slow to adjust their forward guidance.

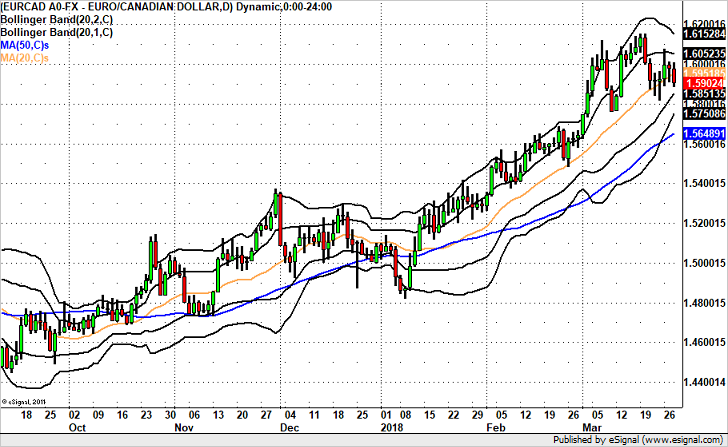

Technically, EUR/CAD has fallen back below the 20-day SMA and is now poised for a move down to the March low of 1.5760.

Leave A Comment