This is the last peak week of the Q3 earnings season, with over 700 companies set to report. One of the most anticipated names every quarter, Facebook, is scheduled to release results tonight after the closing bell. After mixed results from peers like Twitter and LinkedIn, the Estimize community has FB estimates that top those from the Street. Thus far the company has garnered nearly 500 estimates, surpassed only by Apple’s 1,183 contributions.

(Photo Credit: Jurgen Appelo)

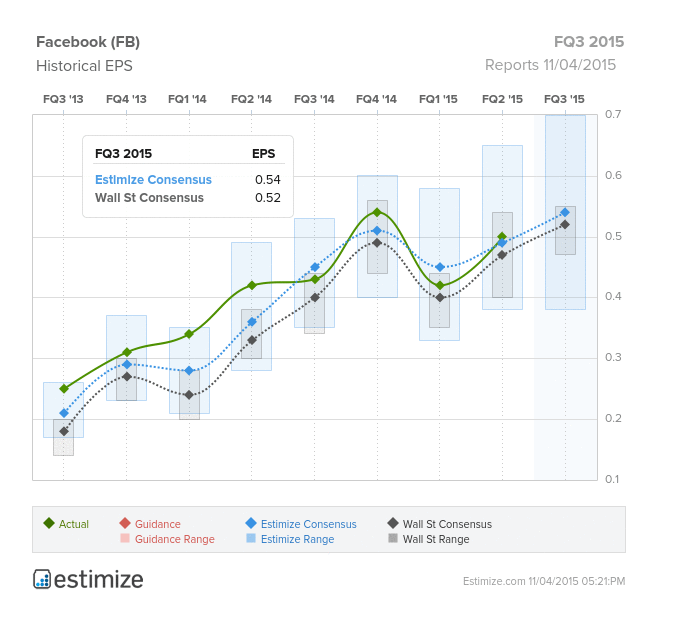

Currently Estimize is expecting EPS of $0.54, two cents higher than the Street’s consensus. Revenues are also slightly higher at $4.404B vs. Wall Street at $4.387. After missing EPS expectations in the first quarter of the year, the company came back in Q2, beating Estimize by a penny. Profit growth has been slipping every quarter since Q4 2014, but Q3 is slated to put up 26% growth, above Q2’s 19%. Revenues are still holding up nicely with expected growth of 37%.

Of course the most important metrics for the social media names are those that measure user growth and engagement. In the second quarter, the social media darling posted Monthly Active Users (MAUs) of 1.49B, an increase of 13% over Q1 and well ahead of competitors such as Twitter which only has 320M MAUs and LinkedIn with 400M members. Daily Active User (DAU) growth is actually outpacing MAUs with 17% growth in Q2, a good sign that users are on the platform more frequently. Mobile MAU and DAU growth is not so surprisingly surpassing desktop numbers.

With the US market saturated, Facebook has its eye on the emerging markets, especially India which has huge growth opportunities. Approximately 130 million people in India use Facebook, second to only to the US. Still, there are 1 billion people in India who are not connected to Internet, CEO Zuckerberg has made it his mission to get those people connected. Despite expanding geographically, the average revenue per user is lower in these regions.

Leave A Comment