Photo Credit: DrivingtheNortheast

Pandora Media, Inc. (P) Information Technology – Internet, Software & Services | Reports February 11, After Market Closes

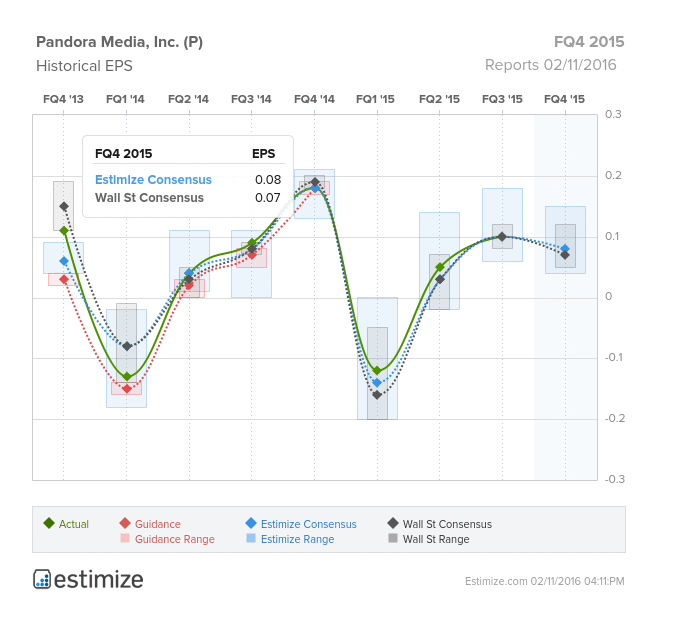

Pandora is scheduled to report fourth quarter earnings after the bell on February 11. Shares of the internet radio company has been in a freefall since the company reported third quarter earnings in October. Concerns over slowing growth, coupled with macroeconomic volatility have contributed to share prices falling over 33% in the past three months. The upcoming fourth quarter earnings will shed some light on whether Pandora can compete in a crowded streaming music market. The Estimize consensus is calling for EPS of $0.08 and revenue of 332.29 million, right in line with Wall Street’s estimates. Compared to Q4 2014, this represents a projected YoY contraction in EPS of55%. The Estimize community is bearish on Pandora’s profitability, cutting EPS estimates 36% in the past three months.

In a crowded music streaming industry, Pandora’s fourth quarter earnings are expected to underwhelm. The emergence and growth of Apple Music and Spotify have taken the industry by storm, leaving Pandora on the sidelines. Apple and Spotify has threatened Pandora’s conversions rate, place downward pressure the number free users converting to paid users. With active paid users growing at a slower pace, Pandora has made heavy investments in international expansion, new acquisitions, and improved marketing initiatives to revitalize growth. So far, Pandora has failed to expand outside of the United States, while both Apple and Spotify have a strong presence in almost 100 countries. The company will focus on signing costly direct licensing deals with record labels to stimulate global growth.

On the bright side, Pandora has improved its monetization model to drive revenue growth. This quarter, Pandora is expected to see improvements in ad RPM (revenue per 1000 listeners) compared to Q3 2015. Local ad revenue, which grew 52% YoY in the prior quarter, looks to carry over into the company’s fourth quarter earnings. Pandora is also expanding outside of its traditional services in an effort to generate long term growth. Automobiles is the firm’s fastest growing segment, as auto manufacturers continue to integrate Pandora’s technology. Moreover, the internet radio company’s acquisition of TicketFly has the chance to cushion potential losses. In the meantime, investments into costly label deals, currency headwinds and higher royalty fees will put downward pressure on Pandora’s margins.

Leave A Comment