On the blogosphere, there is an interesting debate about whether, when the next recession arrives, interests rates will be high enough that the normal approach of cutting the target federal funds rate will be sufficient.

In chronological order David Reifschneider, Jared Bernstein, Paul Krugman and Dean Baker contribute their thoughts (and in the case of Reifschneider extensive calculations and new research).

In an influential (pdf warning) paper , Reifschneider cautiously comes close to concluding that, given current Fed policy and in particular the 2% inflation target, the safe short term interest rate will probably rise enough before the next business cycle peak that cutting it will be enough.

Jared Bernstein thinks very highly of the paper, but is not convinced by the conclusion.

“I am not much comforted. There are a lot of “ifs” in Reifschneider’s story (all of which he is totally straight up about).”

if [skip] if [skip] if the QE and guidance have the positive growth and jobs impacts the model says they do; if people’s expectations are truly moved by the forward guidance, which implies future Fed officials will maintain the program. Then sure, sounds good.

Importantly, Bernstein is not convinced that Fed forward guidance actually guides expectations.

I think I will just quote (his explanation is better than my effort)

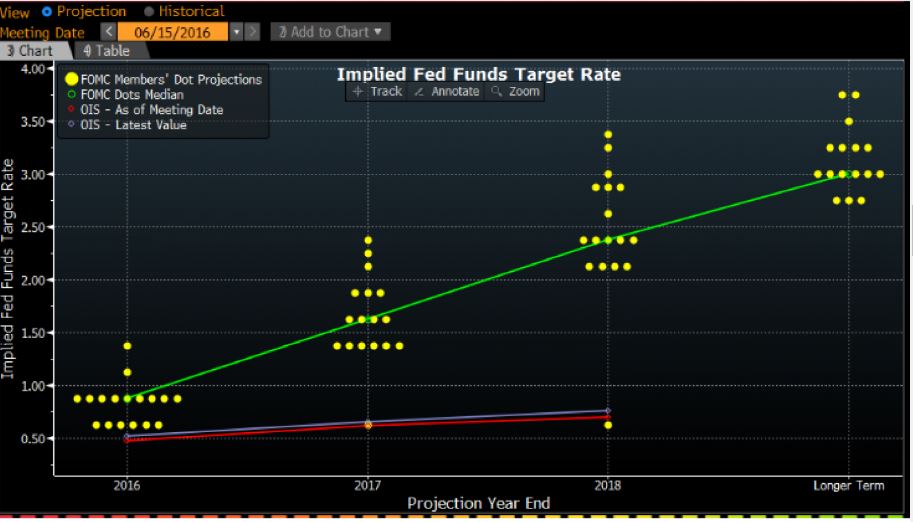

But I’m skeptical. The figure below, from Bloomberg News, shows a real problem for “if” No. 1. It draws a line through the “dot plots”: the Fed’s own predictions about where rates will go. The 3 percent at the end of the figure is the perch Reifschneider assumes they’ll get to before the next downturn.

The other lines at the bottom of the figure are the problem. They show market expectations of the funds rate and the fact that they’re so low creates a double problem for the Fed. First, if the markets are right, the limited firepower problem will be acute. Second, credibility. Remember, forward guidance works through market participants altering their expectations. At this point, the markets don’t believe the Fed’s projections.

Leave A Comment