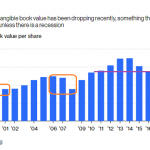

Even without the near constant whining about the overextended nature of valuations from Federal Reserve officials, there are growing signs that the top is in for equity benchmarks in the United States, especially technology stocks.Technology has been strong source of optimism behind rallies and was a bright spot during the last financial crisis, leading the way during the recovery. However, despite all the optimism surrounding tech, the sector may just be the canary in the coalmine bearish traders have been waiting for now that corporate earnings are expected to contract sharply during the second quarter. Considering the deep exposure of the Nasdaq Composite to the technology sector, any momentum lower is likely to drag on the index and be a leading indicator of any sustained downturn in equity valuations across the board, including other key benchmarks.

Stagnating Performance

Equities have gone from one of the most loved to loathed asset classes within a very short period of time. After in many ways mirroring the vast balance sheet expansion undertaken by the US Federal Reserve, the bull market in the Nasdaq Composite looks to have hit a potential snag.The favorable conditions and backdrop that enabled companies to borrow at exceptionally low interest rates while funding a record amount of share buybacks are rapidly disappearing.Now that financial conditions are once again tightening and the balance sheet is no longer being expanded, the backdrop has shifted towards much less favorable conditions for stocks.Rising borrowing costs will force component companies to engage in R&D spending alongside capital expenditures and investment to grow top and bottom line results in lieu of craft accounting to bolster results.

On the returns side, the index itself has not had a stunning performance over the last 52-weeks, falling -6.55% over the period.After breaking down the index by sector, a few clear trends begin to emerge. For one, the worst performer in the index has been the energy sector, thanks in large part to the enduring weakness in prices which has seen many companies declare bankruptcy as they seek to reorganize. However, energy is only a small component of the index at 0.63%.By comparison, technology comprises 41.94% of the total weight of the Nasdaq Composite index, making the sector a strong bellwether for the broader index.The single largest component however is Apple, which has tumbled -29.70% over the last year, weighing heavily on the performance of the broader benchmark.

Leave A Comment