No speculation as to whether FED will raise interest rates again later today (they are), but much surrounding the tone of the accompanying statement and press conference, and what Powell is likely to signal regarding the number of hikes moving forward. This is hugely important for stock investors as rising interest rates increases the cost of borrowing for companies thereby directly impacting earnings and share value.

Powell’s words will have an effect, not only on the USD but also on the broader market as this FOMC coincides with the anniversary of a 10 year bull run in stocks, indices at all-time highs and bond yields rising, so today words from Powell are likely to set in motion some major changes to the current market landscape, both in the US and in emerging markets.

However, a more dovish tone from Powell and the FED is also a possibility given the current trade tariff disputes and the negative effects these are likely to have on the US economy in 2019.

So a hugely important and significant FOMC, and one with some far-reaching consequences.

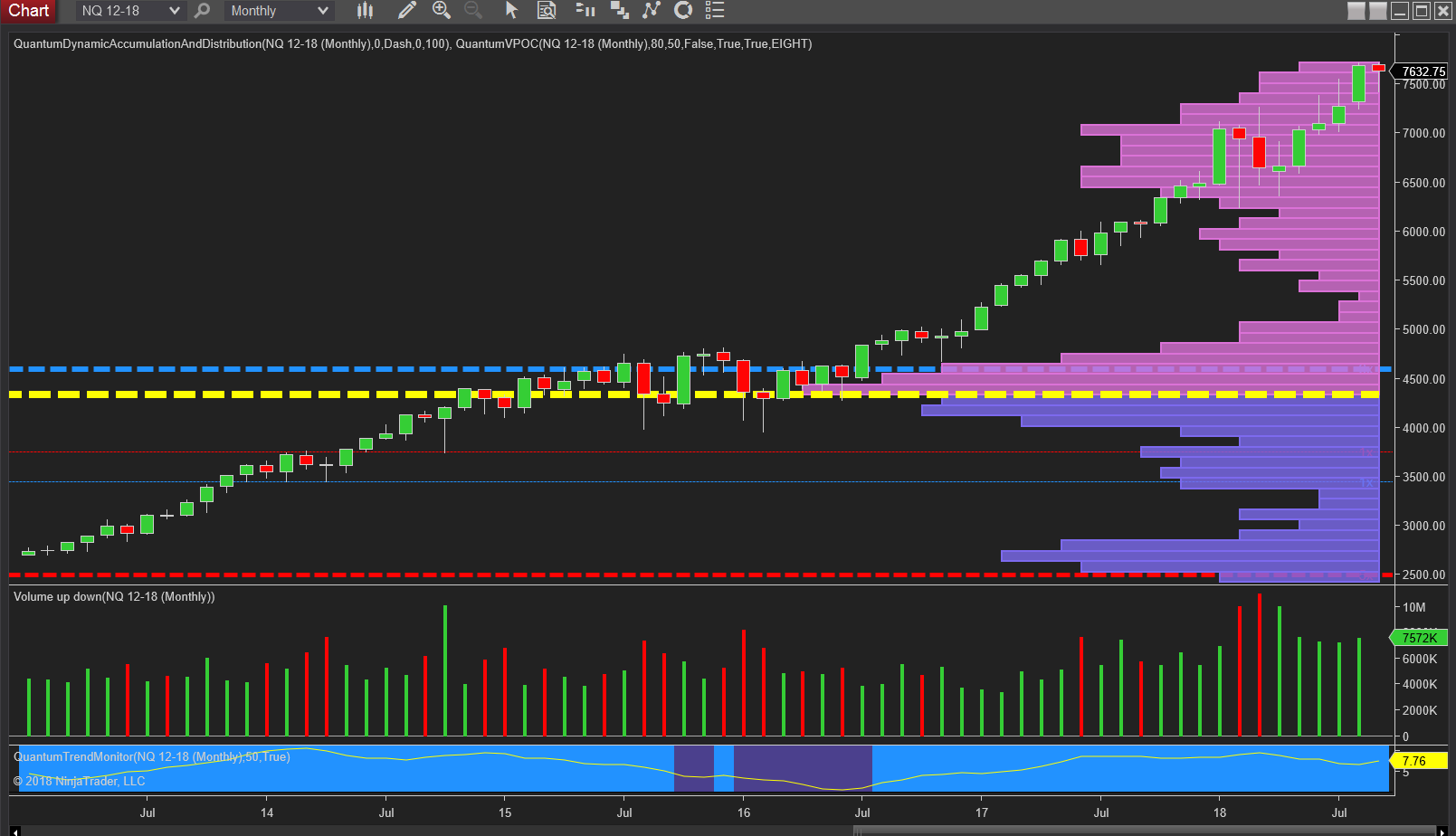

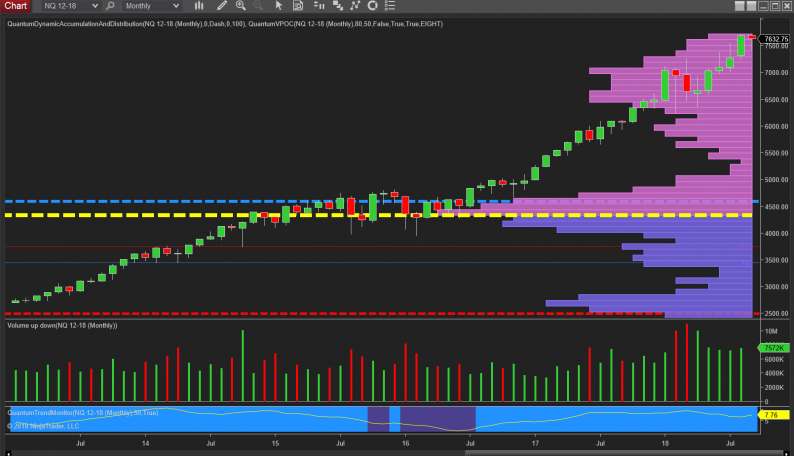

Meantime the indices continue to march higher with today’s price action on the NQ and ES reaching new highs of 7722 and 2947 respectively whilst the YM has yet to take out its all-time high of January 2018 of 26,616.

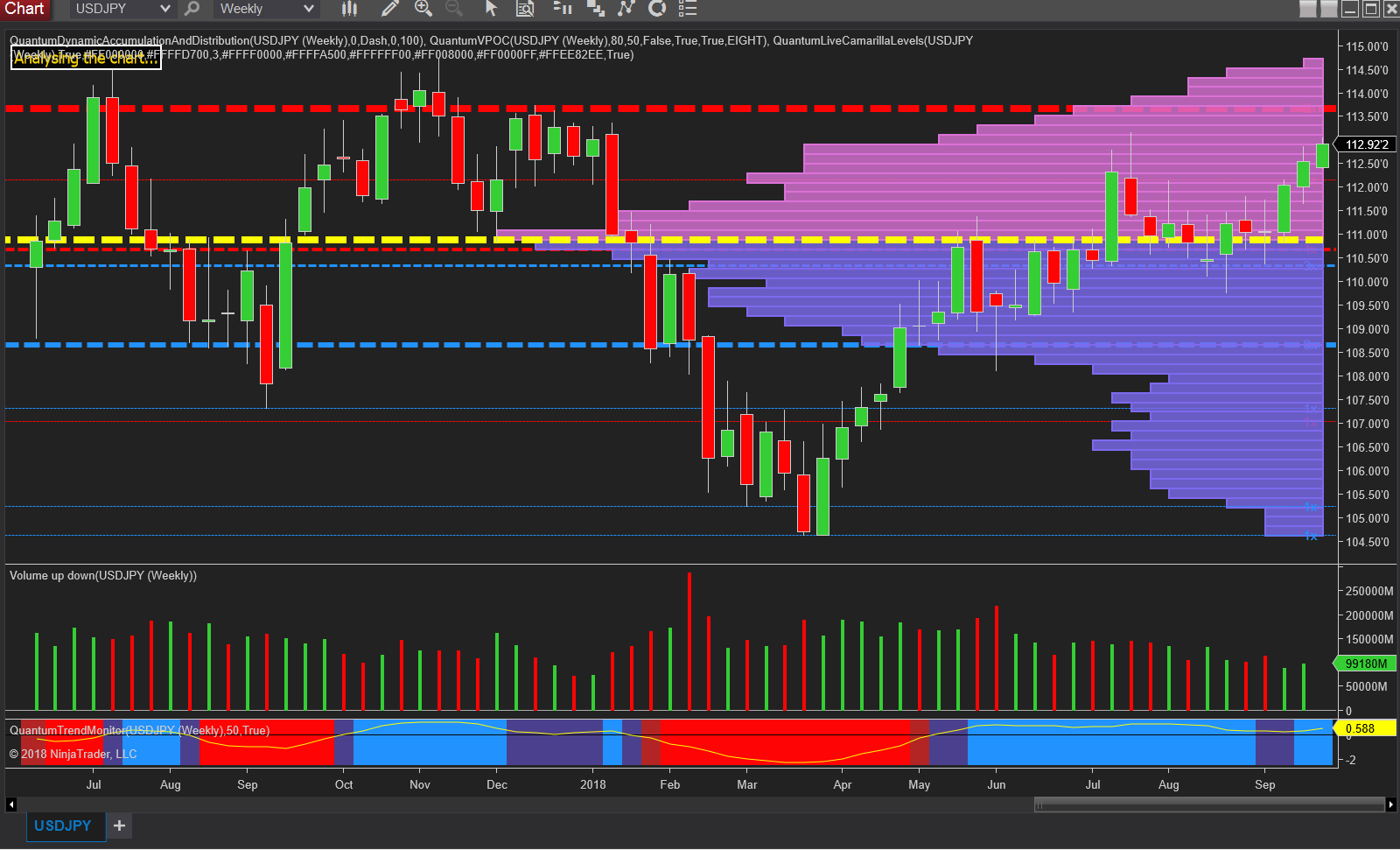

For forex traders, the pair to watch will be the USD/JPY where the volume of point of control in the 111 price region has provided the springboard for the recent move higher in the pair. However, what is also interesting is the vpoc is also sitting in this region on both the weekly and monthly charts so today’s decision will confirm the validity, or otherwise of the recent breakaway. To the upside 113.50 is the first serious level of resistance.

Leave A Comment