Written by QuandaryFX

There’s change afoot in the gold market…the spot price has rallied by over 15% since the year began… the first upswing in a very long time. It is my belief that we will see this upswing continue strongly over the next year. I do not base this belief on subjective analysis or any intangible intellect which only I possess, but rather on the cold, hard facts of numbers. To help you see things the way I see them, let’s begin our story by looking at…manufacturing.

…Very few will make the connection between gold and manufacturing. In fact, it sounds absurd, doesn’t it? One of the largest commodity markets in the world being driven by the ebbs and flows in the United States’ business cycle as measured by the strength of producers. When you dig into the numbers, though, production is a very logical base of analysis for examining gold.

The price of gold is driven by a whole lot of things.

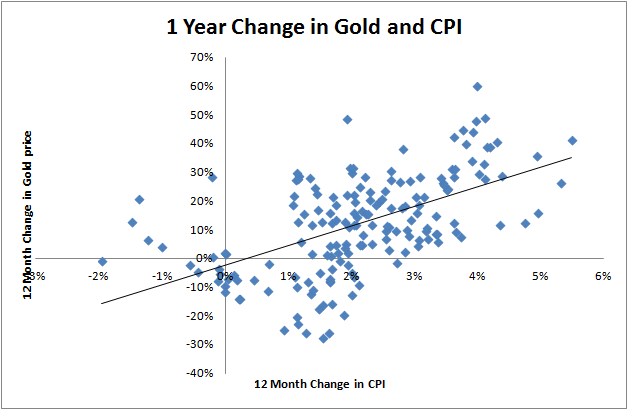

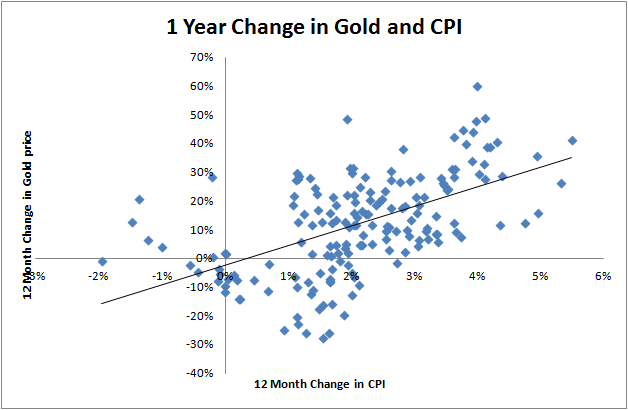

As you can see in the chart above, there is a direct correlation between changes in inflation as measured by the CPI and changes in gold. In other words, if there’s high inflation over a period of time, gold will more than likely increase over that same period of time. But what drives inflation? If we can predict changes in inflation, does this mean we can predict changes in gold? Yes.

Leave A Comment