Value investing may not be a victim of the grim reaper, but the strategy’s certainly giving a convincing impression of a cadaver.

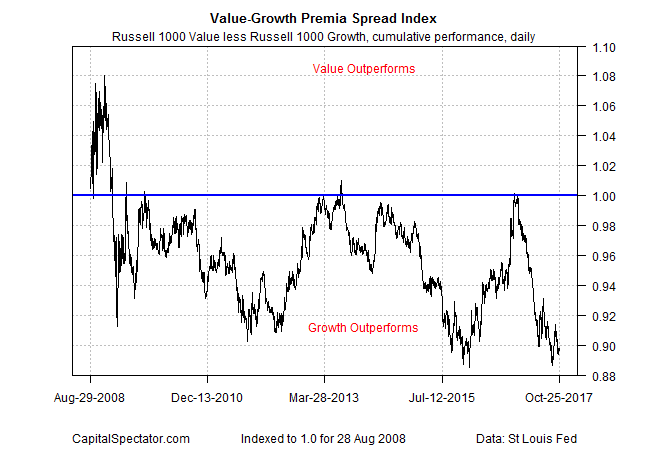

Jocelin Reed at AJO, a value-oriented investment shop in Philadelphia, points out in a recent note that buying big-cap US stocks that fall into the value bucket – priced at relatively low valuations – has been a dog relative to growth companies since the 2008 financial crisis roiled the global economy:

Growth stocks have outperformed value stocks for over a decade (Russell 1000 Value versus Russell 1000 Growth). That’s the longest period since the Russell Indexes started measuring!

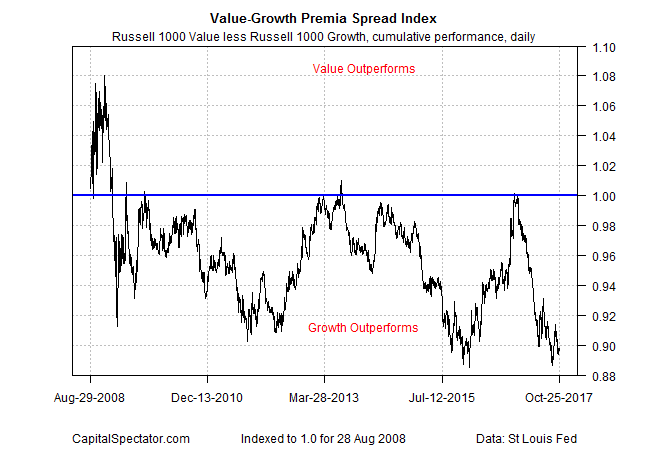

A single chart tells value’s woeful tale. Using a starting point at the end of Aug. 2008, on the eve of the Lehman Bros. collapse that let loose the dogs of economic and market meltdown, value has been underwater relative to growth for all but a small fraction of the time.

Nine years and counting is taxing even the most patient of Ben Graham’s disciples,inspiring some pundits to wonder if the value strategy has finally met its match for all of eternity. Unlikely, but the case for arguing otherwise has obvious appeal these days.

There are several theories circulating for why value’s fallen out of favor for so long, but the main question that mystifies the crowd: When will the drought end? No one knows, of course, but after such a long run of underperformance one is tempted to think that the end is near.

As with so many other strategies that wax and wane through time, when the last believer throws in the towel that’s usually a sign that a revival is close. No one will ring a bell at such moments, but David Einhorn’s latest commentary may signal that value’s collapse for this cycle is complete. As CNBC reports this week:

Hedge fund manager David Einhorn, who’s become a billionaire by effectively identifying undervalued and overvalued stocks, is struggling right now and questioning whether the classic investing principles that made him will ever work again.

“The market remains very challenging for value investing strategies, as growth stocks have continued to outperform value stocks. The persistence of this dynamic leads to questions regarding whether value investing is a viable strategy,” Einhorn wrote in an investor letter Tuesday obtained by CNBC.

Leave A Comment