All eight indexes on our world watch list have posted gains for 2017 through August 28. The top performer thus far is Hong Kong’s Hang Seng with a gain of 26.65%, followed closely by India’s BSE SENSEX at 19.25%. In third is our own S&P 500 with 9.17%.

The Last Four Weeks

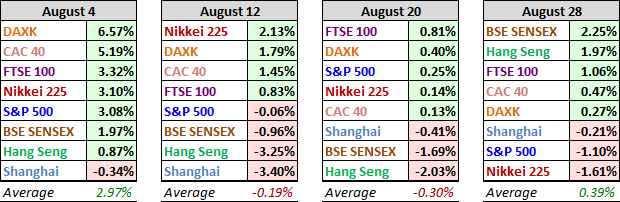

The tables below provide a concise overview of performance comparisons over the last four weeks for these eight major indexes. We’ve also included the average for each week so that we can evaluate the performance of a specific index relative to the overall mean and better understand weekly volatility. The colors for each index name help us visualize the comparative performance over time.

2017 YTD Performance

Here is an overlay of the eight illustrating their comparative performance thus far in 2017.

Here is a table of the 2017 performance, sorted from high to low, along with the most recent highs for the eight indexes. All eight indexes have posted gains for 2017 and top performer thus far is Hong Kong’s Hang Seng. In last is Tokyo’s Nikkei 225 at 1.46%.

Bear Market Perspective

The column chart is sorted by the least to worst declines from previous peaks as of the week’s end. All eight watch list indexes had dropped into bear territory (a 20% decline). As of the latest close, one index is in the bear zone, unchanged from the previous week.

A Longer Perspective

The chart below illustrates the comparative performance of World Markets since March 9, 2009. The start date is arbitrary: The S&P 500, CAC 40 and BSE SENSEX hit their lows on March 9th, the Nikkei 225 on March 10th, the DAXK on March 6th, the FTSE on March 3rd, the Shanghai Composite on November 4, 2008, and the Hang Seng even earlier on October 27, 2008. However, by aligning on the same day and using a log scale vertical axis, we get an excellent visualization of the relative performance. We’ve indexed each of the eight to 800 on the March 9th start date. The callout in the upper left corner shows the percent change from the start date to the latest weekly close.

Leave A Comment