According to the Energy Information Administration’s Monthly Energy Review database, world field production of crude oil in September was up 1.5 million barrels a day over the previous year. More than all of that came from a 440,000 b/d increase in the U.S., 550,000 b/d from Saudi Arabia, and 900,000 b/d from Iraq. If it had not been for the increased oil production from these three countries, world oil production would actually have been down almost 400,000 b/d over the last year.

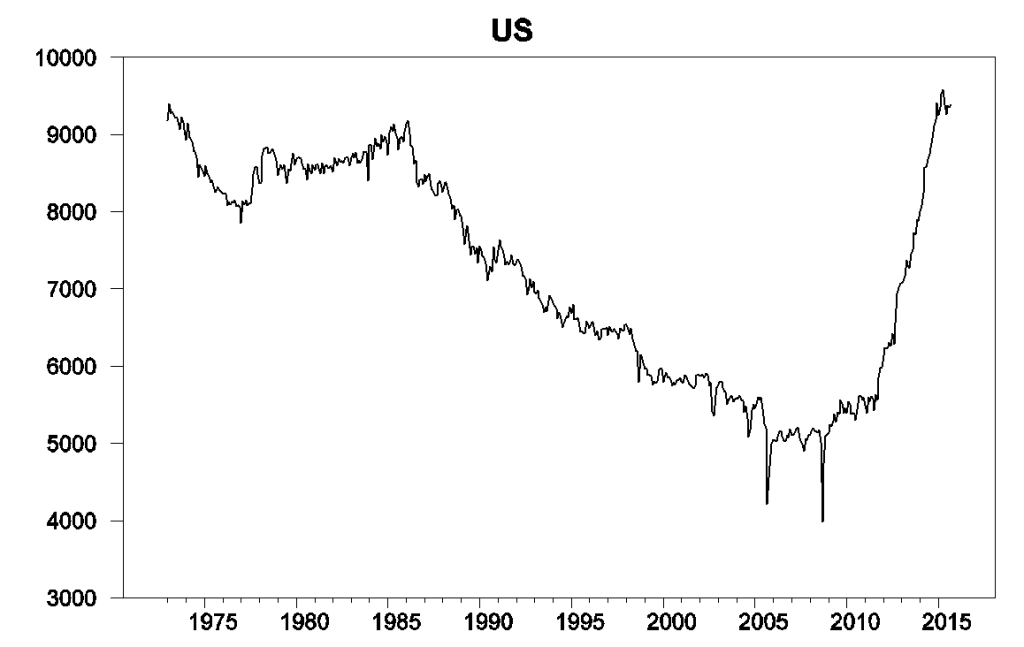

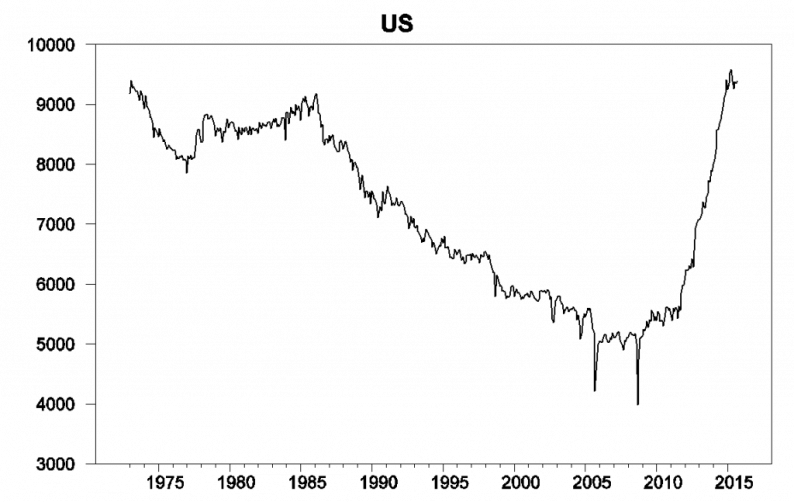

Monthly U.S. field production of crude oil, thousands of barrels per day, Jan 1973 to Sept 2015. Data source: Monthly Energy Review database.

But the U.S. situation will be very different in 2016. The number of active U.S. oil rigs today is about a third of the levels reached in 2014. JODI’s separate database estimates that U.S. oil production was already down year-over-year by October 2015. And the EIA’s drilling productivity modelestimates that production from the U.S. counties associated with the tight oil boom will have fallen another 500,000 b/d from the September values by the end of next month.

Number of active oil rigs in counties associated with the Permian, Eagle Ford, Bakken, and Niobrara plays, monthly Jan 2007 to Dec 2015. Data source: EIA’s drilling productivity model.

Actual or expected average daily production (in million barrels per day) from counties associated with the Permian, Eagle Ford, Bakken, and Niobrara plays, monthly Jan 2007 to Feb 2015. Data source: EIA’s drilling productivity model.

Still, it is hard to see prices increasing until U.S. inventories begin to come down.

U.S. commercial crude oil inventories. Source: EIA.

The much-discussed increase from Saudi Arabia only puts the kingdom’s oil production back to where it had been in August 2013.

Monthly Saudi Arabian field production of crude oil, thousands of barrels per day, Jan 1973 to Sept 2015. Data source:Monthly Energy Review database.

Leave A Comment