It doesn’t matter whether the price of Bitcoin (or any other cryptocurrency) is rising or falling. The exchanges that execute the bulk of global crypto transactions are winning either way.

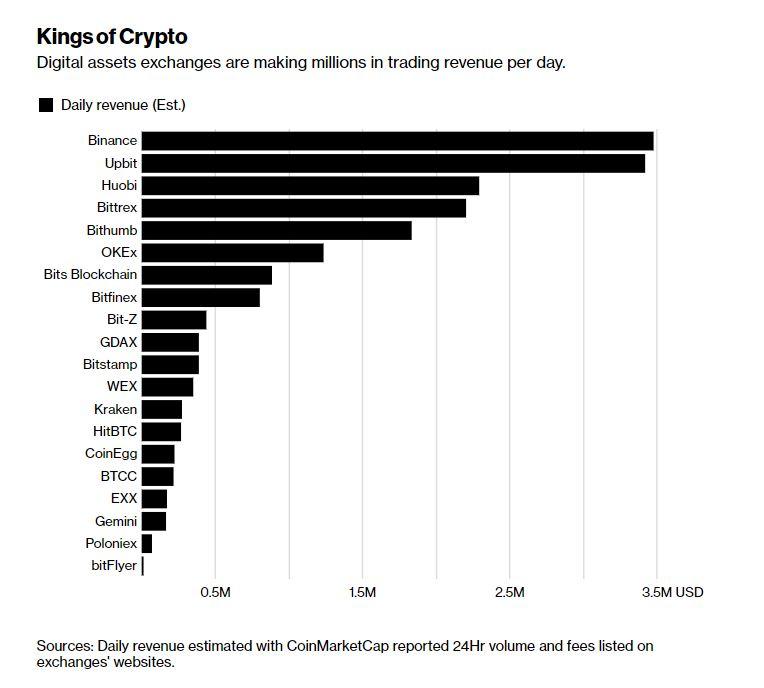

As Bloomberg points out, while investors have fixated on the massive price appreciation across cryptocurrency pairs, in reality, it’s the exchanges that are pulling in the real money. The largest exchanges are generating as much as $3 million a day in fees – an amount that could eventually reach more than $1 billion for the year.

And that’s using the lowest range of the fee scale…

“The exchanges and transaction processors are the biggest winners in the space because they’re allowing people to transact and participate in this burgeoning sector,” said Gil Luria, an equity analyst at D.A. Davidson & Co, who reviewed the methodology for the revenue estimates.

“There’s a big business there and it would not surprise me if they’re making hundreds of millions of dollars in revenue and possibly even billions a year.”

Tokyo-based Binance, which has a reputation for listing almost every ICO, and Hong Kong-based OKEx are handling the largest volume of trading, equal to about $1.7 billion daily. Based on fees of 0.2 percent, which are higher than OKEx’s 0.07 percent for the most active traders, Binance is probably bringing in the most cash. Binance, which first launched in July, has experienced growth that’s unprecedented, even for the world of cryptocurrencies.

Huobi, Bitfinex, Upbit and Bithumb, all of which are also based in Asia, are next in the rankings. These exchanges process between $600 million and $1.4 billion of trading volume and charge fees of 0.3 percent on average.

More than half of the crypto currency trading happens on Asia-based exchanges, according to data compiled by smart contract platform Aelf. “They don’t make users go through the know-your-customer process until withdrawal,” Slaughter said. “It’s a complicated process. You can lose customers in the two or four hours that it takes. In Binance, you can go from not having an account to having funds on an account in less than 20 minutes.”

Leave A Comment