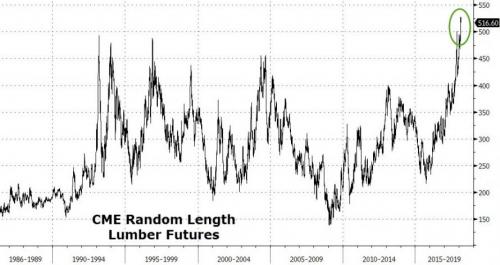

As we’ve repeatedly pointed out, home prices in the US have been climbing at a blistering pace (and, more importantly, much faster than wages) thanks to a shortage of supply. But builders trying to alleviate that shortage are struggling under some of the most adverse market conditions in more than a decade: To wit, a lumber shortage has pushed prices to their highest levels since the financial crisis as wildfires and a blossoming trade spat between the US and Canada have choked off some supplies.

As a result, homebuilders are being forced to pass on thousands of dollars in additional costs to the buyers, perhaps one reason why new- and pending home sales have fallen recently.

Lumber prices started climbing last year thanks to wildfires destroying prime forest land along the Pacific Northwest, as well as a worsening trade spat over softwood lumber that dates back to the Obama administration. While US media was preoccupied with the California wildfires, Canada’s Pacific coast saw its worst wildfires on record, too. Furthermore, Trump last year slapped tariffs on most types of lumber, with the highest rate at 24%, one of several protectionist moves against its northern neighbor.

Material prices now rival labor shortages as builders’ main concerns, a National Association of Home Builders survey showed in January. Prices for common building varieties like spruce and southern pine are at or near records, according to price-tracking publication Random Lengths.

Like all commodity producers and distributors, lumber suppliers have been struggling with higher transportation costs due to a shortage of drivers and, for major freight railroads, a shortage of cars and routes.

Some lumber wholesalers, as well as market analysts, have described the situation as a supply-side “crisis.”

“We are in a lumber supply crisis,” said Stinson Dean, a broker in Kansas City, Mo., who ships wood from sawmills to lumber yards, in a note to clients. “None of us have experienced a market like this.”

Forestry company Canfor Corp. CFPZF -0.30% said lumber shipments fell almost 10% in the final quarter of 2017, partly due to bad weather in western Canada. The transportation bottlenecks have caused weeks of delays, frustrating customers already paying record prices.

“People are screaming for their wood,” said Russell Taylor, managing director for Canada at analysis firm Forest Economic Advisors LLC.

Franklin Building Supply in Boise, Idaho, ran out of a type of lumber used in walls, flooring and roofs one day in February for the first time in years. Rick Lierz, who runs the supplier, said one shipment of wood he was waiting for was stuck on a railcar just 20 miles away.

His employees drove to local Home Depot Inc. stores to buy the lumber needed to fill orders to local builders due that day. Home Depot recently told investors that rising lumber sales and prices contributed to higher earnings in the fourth quarter of 2017.

“The cardinal rule when you’re a supplier is you don’t run out of what you need to supply,” Mr. Lierz said. “It’s like an ice cream shop running out of chocolate.”

Leave A Comment