WTI Crude Oil

The WTI market fell again during the session on Tuesday, as we broke below the $30 level. It now appears that the market is going to continue to go much lower, reaching towards the $28 level. That is an area that offered a significant amount of support previously. We ended up bouncing enough to go all the way to the $34 level last time we tested this region. That being said, we could get another bounce, but I think that will only incite more selling. I do not see this market rallying, at least not for any real length of time even though we get Crude Oil Inventories coming out of America today. Any rally at this point in time offers value in the US dollar.

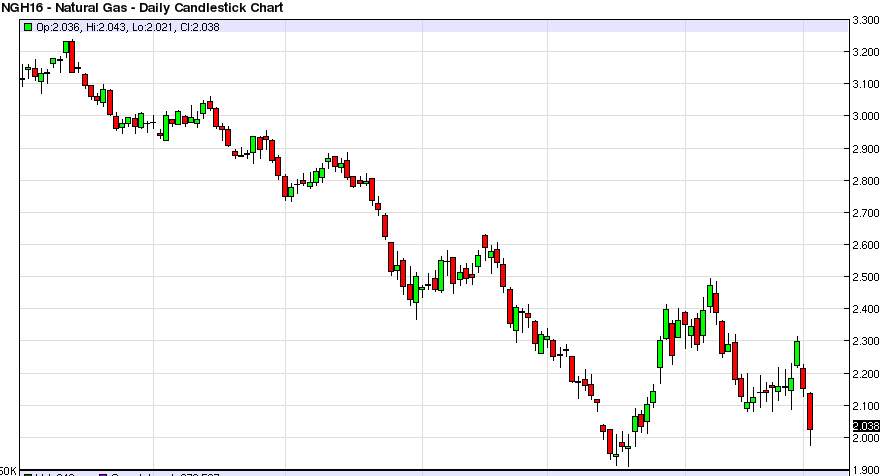

Natural Gas

The natural gas markets fell drastically as well, slicing through the $2 level. By doing so, it looks as if we are going to test the lows again, and it is probably only going to be a matter time before we break down below the $1.90 handle. If we do that, I would suspect that the market could go as low as $1.75 in the short-term, but God Himself only knows where the bottom is at this point.

Rallies will be used as selling opportunities on the first sign of exhaustion, and I have no scenario at this point below the $2.50 level that could even remotely suggests the idea of buying this particular commodity. The supply is simply far too strong for the demand, and that should continue to be the case going forward. The candle during the session on Tuesday was a very persuasive, and breaking below the $2.09 level was a significant move as it had been so supportive in the recent past. You also have to look at the fact that there was a gap during the month of December, but that was sliced through like it wasn’t even there.

Leave A Comment