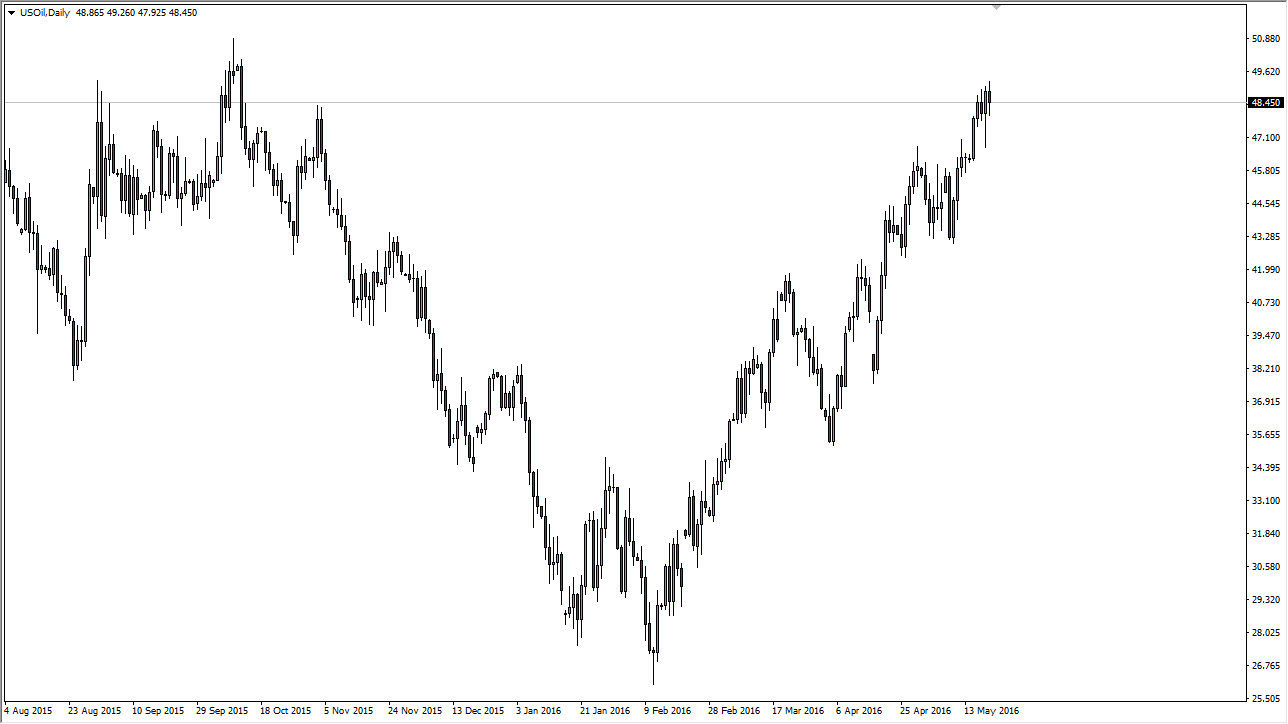

WTI Crude Oil

The WTI Crude Oil market initially fell during the course of the day on Friday but turned back around to form a hammer. This was preceded by a hammer on Thursday as well, so it looks like bullish pressure is starting to pick up. With this being the case, we could continue to test the $50 level, and eventually break out above it. I don’t think it’s going to be easy though, so more than likely any pullback should be a buying opportunity as it represents of value overall. Once we break above the $50 level, the market should be more or less in a “buy-and-hold” type of situation. As far selling is concerned, it’s all but impossible to do at the moment, and I of course will be waiting for a longer-term selling signal before I even think about doing it.

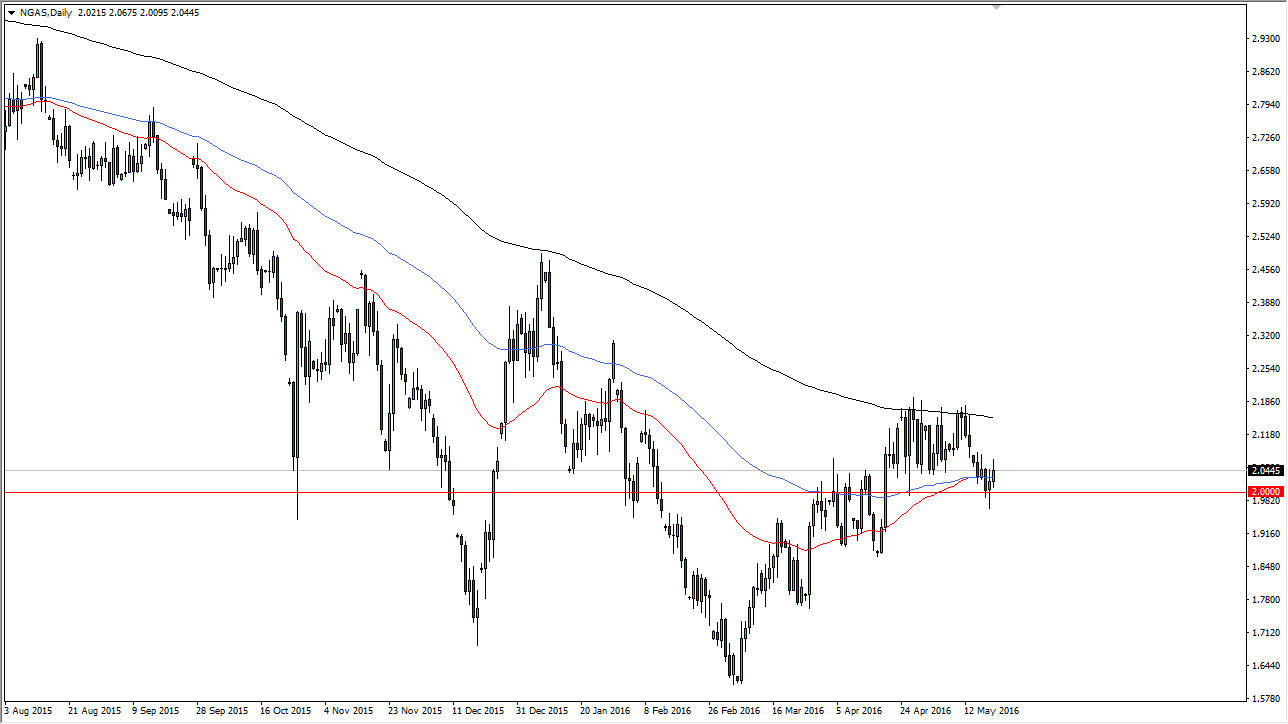

Natural Gas

Natural gas markets rose slightly during the course of the day on Friday, breaking the top of the hammer that formed on Thursday at the psychologically significant $2.00 level. The chart attached to this article has 3 moving averages on it, they 50 day exponential moving average, the 100 day exponential moving average, and then the 200 day exponential moving average. The red 50 day exponential moving average has started to try to cross above the 100 day glued exponential moving average. This is the first sign that perhaps the overall trend could be trying to change. However, we have the 200 day exponential moving average just above, and it should continue to act as dynamic resistance.

With this being the case, I think we are going to try to bounce from here, but is going to be a short-term trade at best. If we break below the $2.00 level, we could then continue falling and a long-term continuation of the negative trend should be in play.

Leave A Comment