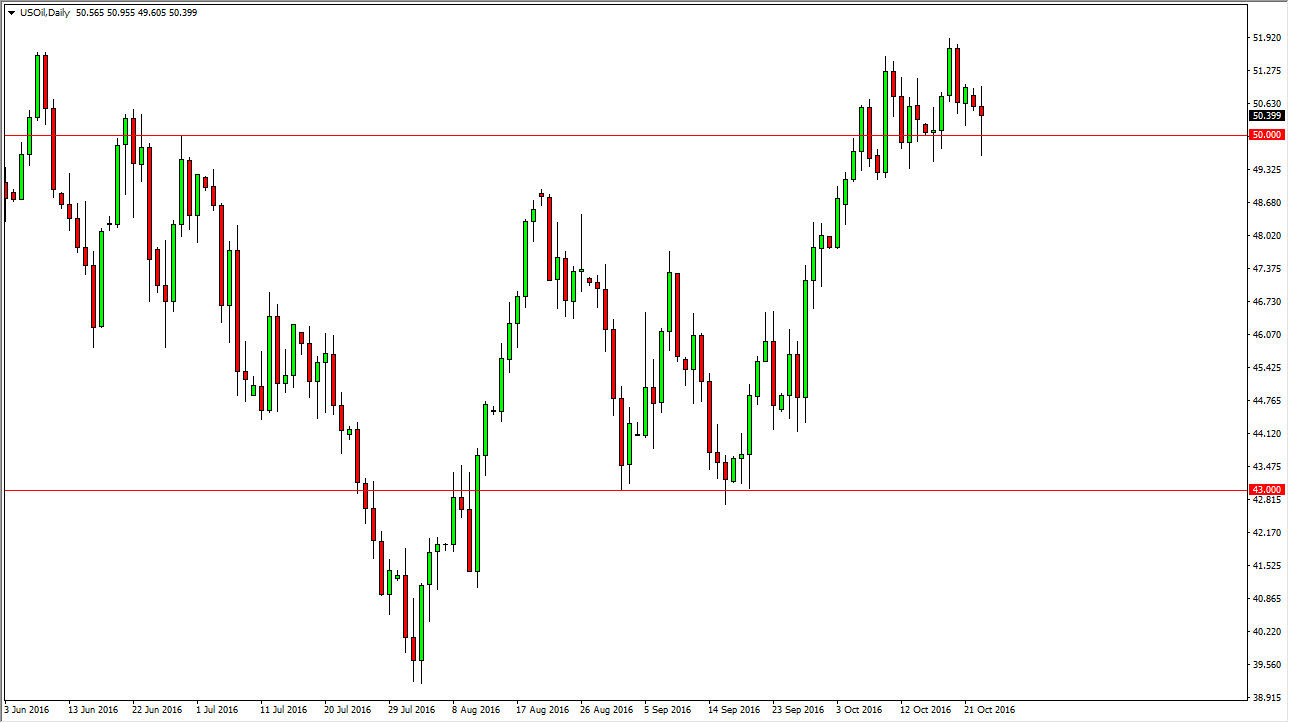

WTI Crude Oil

The WTI Crude Oil market went back and forth during the course of the day on Monday, as we have found more than enough support below the $50 level to keep this market somewhat afloat. If we break above the top of the candle I think we will continue to grind higher, perhaps reaching towards the $52 level. Pullbacks continue to offer buying opportunities as long as we stay above the $49 level below, and as long as we can stay above there I think that the buyers will be encouraged as the market continus to try to show strength. However, we have seen quite a bit of volatility lately, see you have to keep in mind that the market continues to show just how uncertainty there is.

?

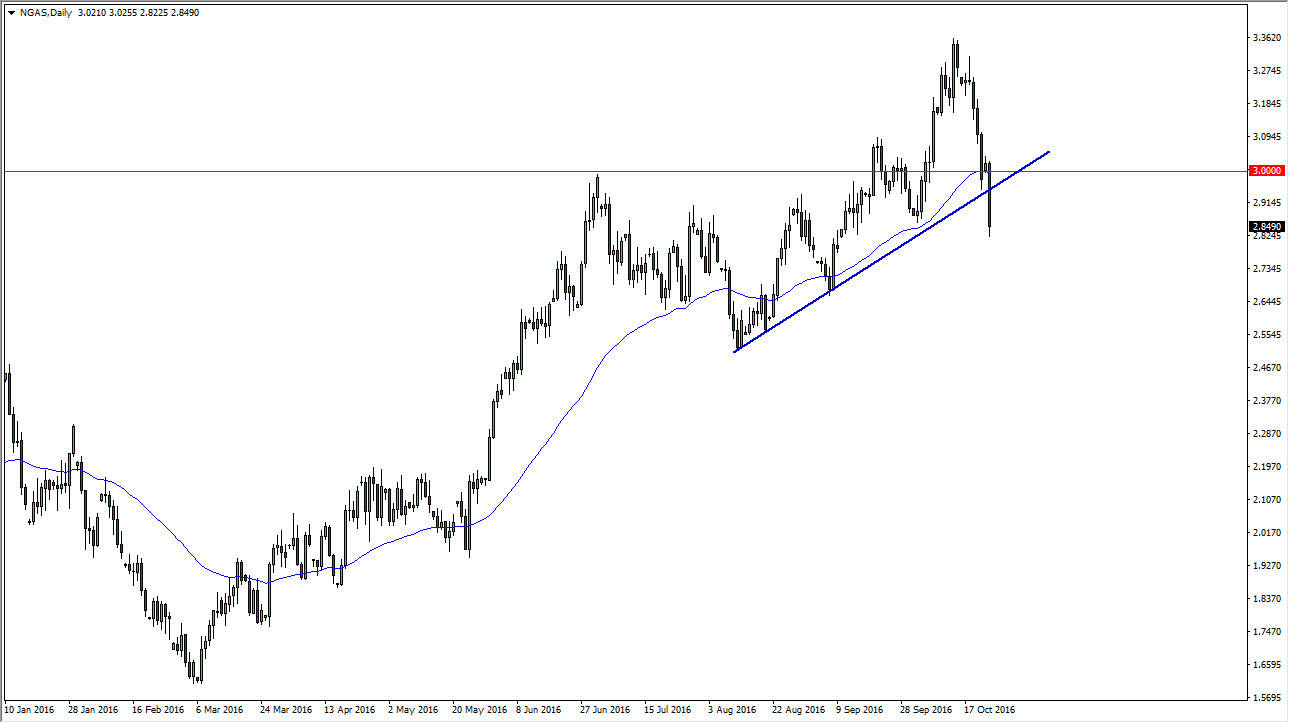

Natural Gas

The natural gas markets broke down significantly during the day on Monday, as we sliced below the 50-day exponential moving average, the $3.00 level, and then finally the uptrend line that has been so reliable over the last month. With this being the case, I feel that the natural gas markets have finally broken down and are ready to change the overall trend. After all, the natural gas markets have a lot of overhead when it comes to concern, because quite frankly it’s likely that the markets will try to rally, but at the end of the day there is so much in the way of supply in the ground that it’s difficult to imagine that we would ever be significantly supported over the longer term as the United States and Canada both could essentially power the rest of the world for several centuries. Ultimately, this is a market that I think is coming to terms with the fact that perhaps the natural gas markets have gotten way ahead of themselves. A break down below the bottom of the range for the day should send this market down to the $2.65 level. Any rally at this point in time should have quite a bit of resistance above at the $3.00 level.

?

Leave A Comment