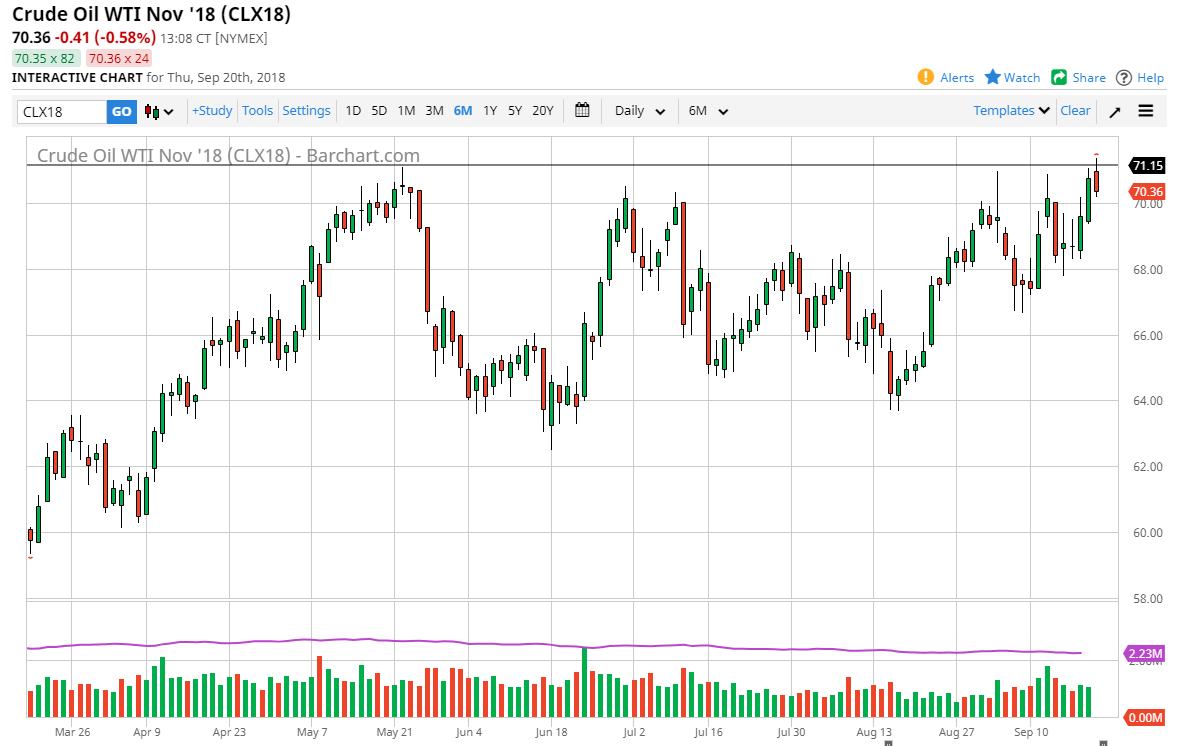

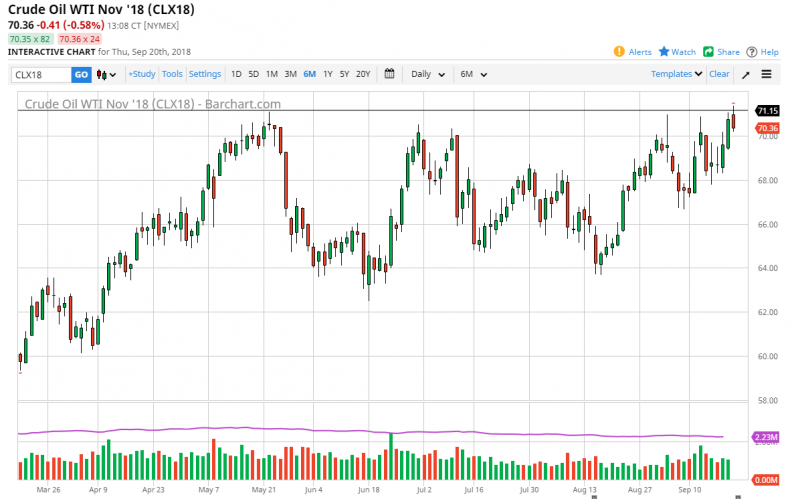

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Thursday, and even broke to a fresh, new high but then turned around to show that we still have a significant amount of resistance above. However, I believe that we are continuing to see buyers jump in on dips, and it’s likely that we will go back to that level sooner rather than later. At the first signs of support on short-term charts, I believe the buyers will continue to go back into the oil markets. I think there is massive support at not only the $70 handle, but also the $60 level. We are trying to build up enough momentum to finally break out to the upside, and then go to the $72.50 level, and then possibly the $75 level.

Natural Gas

Natural gas markets initially dipped during the day but then exploded to the upside, defying a somewhat bearish inventory number. We have gotten close to the $3.00 level, but then rolled over at the end of the day. If we can break above the $3.00 level, then I think the market could continue to go higher, but this area right here is very resistive, and I think that the market will more than likely continue to struggle to break above that region. If we do, that would be a very bullish sign and could send the market higher due to the seasonality of this market, as of course, we are getting close to trading some winter contracts, and then, of course, people will be focusing on what should be stronger demand through the next several months. However, we have exploded to the upside, so I’m still a little bit cautious about going long here. I’d rather find value.

Leave A Comment